A new world order: can the dollar defend its global reserve currency crown?

6 May 2022

Treading the inflation tight rope: can the BoE keep its balance?

17 May 2022INSIGHT • 10 MAY 2022

Hawkish Peak to Thread the Needle?

Phillip Pearce, Associate Global Capital Markets

“The FOMC is not actively considering 75 bps hikes”

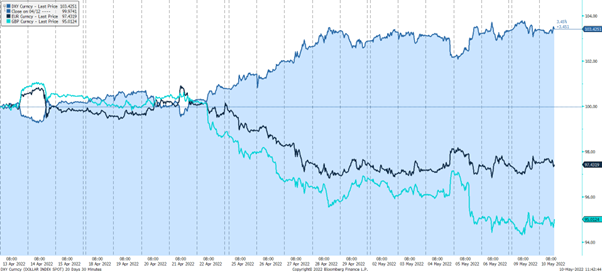

Now to the BoE and the striking forecasts that came out of the meeting were that inflation was expected to hit 10% this year and a 1% contraction was expected in Q4. What was interesting though was that some members thought forward guidance of further rate hikes was no longer appropriate, essentially trying to taper the market’s expectations and attempt to “thread the needle” once again. Cable (GBPUSD) came off heavily after the negative outlook and the dollar has benefitted through its status as a haven, which ultimately hurt the Euro as well.

The relative performance of the Dollar Index, EURUSD, and GBPUSD over the past month

Source: Bloomberg

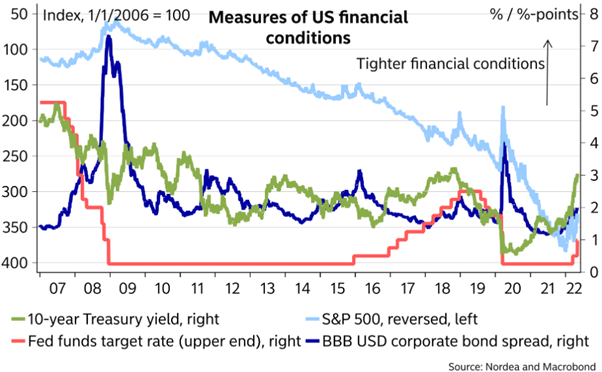

Ultimately, the remarks from both the Fed and BoE have resulted in markets repricing the expected target rates for the end of the year with the market now expecting US rates to reach 2.75% and UK rates to reach 2% vs. 3% and 2.25% respectively prior the meetings. The ECB is forecasted to reach a positive deposit facility rate of 0.25%. The terms dovish and hawkish are all relative, the BoE and Fed are far more hawkish than the ECB if the time horizon is the past 6 months, but if you look at the comments over the past week, it’s the ECB that is more hawkish (albeit they are a bit late to the party). I think what’s unfolded over the last week is more of a “pause and assess” how conditions unfold than a definite “hawkish peak”. Central banks are guiding us to believe that they are delicately engineering a soft landing but it’s heavily dependent on how conditions evolve, making the eye of the needle exceptionally small.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.