Decoding the BoJ: what might Mr. Governor be thinking

30 April 2024

Rate Hikes, Dovish Twists: The Fed and BoE – Balancing Inflation and Growth

15 May 2024INSIGHTS • 8 MAY 2024

Correlations and Relationships are Under Fire

Ryan Brandham, Head of Global Capital Markets, North America

The trouble with economic correlations

Economic correlations are tricky little phenomena; they are not scientific or governed by the laws of nature. In physics, for example, the amount of force required to move a given object, and the distance an object will move if a known amount of force is applied to it is consistent, repeatable, and universally reliable. Economics does not offer such guarantees, as good data scientists know well – “correlation does not imply causation”. Things that are correlated do not actually cause each other to happen. Things appear to move in tandem, only until they don’t. There have been many financial calamities caused by forgetting this point.

A case in point: the Phillips Curve challenged

One such relationship coming under fire in today’s markets is the Phillips curve – the theory that inflation and unemployment have a stable and inverse relationship. If unemployment goes down, the expectation is that inflation goes up, and vice versa. However, current market conditions appear to challenge this theory. On April 25th, US Treasury Secretary (and former Fed Chair) Janet Yellen said “I don’t see any reason why unemployment needs to rise to bring inflation down”. At the most recent Fed meeting on May 1st, Jerome Powell seemed to have a similar view, saying “Remember what we saw last year; very strong growth, a really tight labour market and historically fast decline in inflation…I wouldn’t rule out something like that can continue.”

Growth slowdown, rising prices: a concerning trend

Similar to the Phillips curve, the traditional correlation between economic slowdown and falling inflation seems to be unraveling. Evidence is emerging that paints a concerning picture:

- Q1 GDP: on April 25th, the US GDP release showed surprisingly weaker growth than economists expected, yet the Price Index remained solidly higher than expectations – lower growth, higher prices.

- ISM Services Index: on May 3rd, the ISM Services Index returned activity that was surprisingly weak and signalling contractionary territory. At the same time, the Prices Paid Index came in significantly higher than expectations – again, lower growth, higher prices.

These are just two data points, but they suggest a concerning trend to keep an eye on.

The Fed’s next move

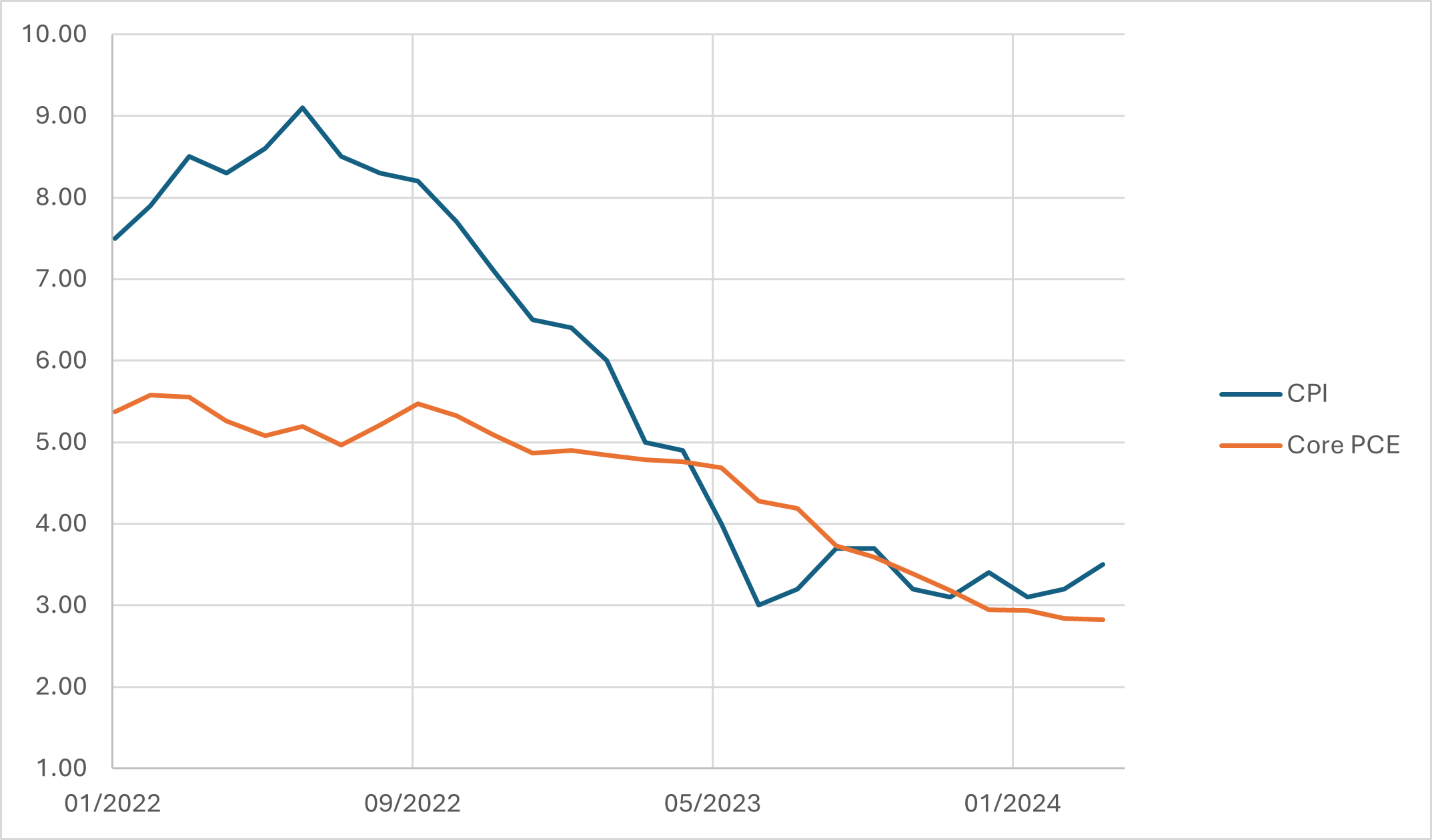

Another potentially concerning relationship emerged after the FOMC meeting on May 1st. If the Fed says the next move in interest rates is a cut, will the next move really be a cut? Given US inflation has been much stickier than anticipated in late 2023 / early 2024 (see Chart below), Jerome Powell could have taken a more balanced approach to the outlook, emphasized data dependence, and kept his options open. He was directly questioned on the potential that the next move is a hike, and he responded saying it’s unlikely, emphasizing focus on how long to keep policy restrictive before cutting. The market took notice of this easing bias, as yields went lower by 25-30 bps and the US dollar sold off by 1-1.5% to close out the week.

Chart 1: US Inflation Trajectory

Source: Bloomberg

Powell was asked multiple times and seemed clear he wanted to avoid discussing the specific bar for a further hike, and that the Fed is confident that maintaining the current level of interest rates for long enough, inflation will come back down to target. Is it completely within the Fed’s control though?

The situation is complicated by external factors beyond the Fed’s control.

- Exogenous shocks: supply side disruptions, geopolitical tensions, tariffs, etc. can stoke inflation at home.

- Fiscal policy: the US government’s perpetual, growing deficits and mounting federal debt pile add fuel to the inflationary fire – and in an election year, moving in the direction of fiscal restraint seems unlikely. This is beyond the control of the Fed. Debt forgiveness, without treading into the moral, ethical, or political right or wrong on such government policies, is inflationary, for example.

These factors highlight the limitations of monetary policy alone in controlling inflation. If these forces do lead to a pickup in US inflation, and in the future the Fed loses its confidence that rates are restrictive enough and so puts hikes back on the table, it could likely lead to an outsize market reaction in US yield volatility and US dollar volatility because of the market expectations set by the FOMC on May 1st.

Inflationary impact is uncertain

After five consecutive stronger than expected monthly results, the US employment report on May 3rd broke this trend. Headline jobs were below expectations, and the unemployment rate unexpectedly ticked up from 3.8% to 3.9%. This change raises some questions:

- Maybe this newfound labour market softness will help inflation move all the way back to 2%.

- Maybe the correlations will hold.

- Maybe the Fed is right, and rates are restrictive enough.

- Maybe Yellen is right, and the job market doesn't have to be hurt to bring down inflation.

- Maybe the US will achieve a soft landing, which would be a welcome outcome for all.

Only time will tell. But a potential risk emerges here – the Fed’s recent dovish stance, limiting its flexibility in terms of hikes, could lead to an outsized and volatile market reaction if it needs to tighten policy later.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.