Turbulent treasuries: why America’s IOUs are rocking the boat

21 May 2025

Validus Risk Management expands APAC presence with new leadership hire and Singapore office

10 June 2025RISK INSIGHT • 06 June 2025

ECB in focus: Change on the horizon?

Harun Thilak, Head of Global Capital Markets NA

As the European Central Bank (ECB) prepares for its upcoming monetary policy meeting on June 5, 2025, the outlook for the Euro remains a focal point for investors and policymakers. The interplay of recent macroeconomic data, trade policy uncertainties and the ECB’s cautious approach to monetary policy will shape the trajectory of the Euro in the near term. We examine these dynamics, incorporating insights from recent ECB projections, macroeconomic indicators and the evolving EU-US trade landscape.

Cautious approach remains

The ECB has adopted a cautious approach to monetary policy, reflecting heightened uncertainty driven by global trade tensions and a shifting macroeconomic environment. At its April 2025 meeting, the ECB lowered its key interest rates by 25 basis points, bringing the deposit facility rate to 2.25%. This marked the seventh consecutive rate cut since June 2024, reducing rates from a 2023 peak of 4%. The ECB’s rationale hinges on a disinflationary trend, with headline inflation declining to 2.2% in March 2025 and core inflation falling to 2.4%, the lowest since early 2022. ECB staff project headline inflation to average 2.3% in 2025, 1.9% in 2026, and 2.0% in 2027, aligning closely with the ECB’s 2% target.

Figure 1: ECB Deposit facility rate

Source: Bloomberg

Trade tensions could see aggressive monetary easing

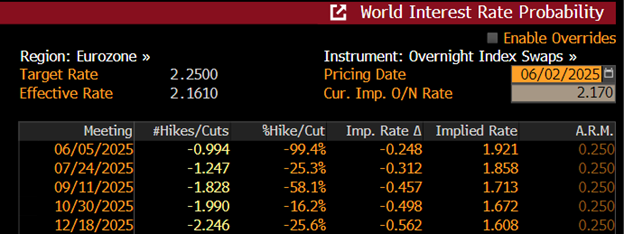

With regards to forward guidance, while the ECB has maintained a data-dependant approach, its recent decision to remove references to restrictive monetary policy suggests a shift toward a less contractionary stance. Current market expectations, based on OIS pricing, indicate roughly 50 basis points of additional rates cuts for the remainder of 2025. However, sluggish economic growth amidst a backdrop of persistent EU-US trade tensions could alter this trajectory and embolden the ECB into aggressive monetary easing to support domestic growth.

Figure 2: EU Policy Rate Projection

Source: Bloomberg

Impending economic slowdown

Recent data paints a mixed picture for the Eurozone. Real GDP is projected to grow at around 1% over the next two years, revised downward from December 2024 forecasts due to weaker exports and investment amid trade uncertainties. The Eurozone economy showed resilience in Q1 2025, driven by robust government consumption and private consumption fueled by rising real incomes. However, recent survey indicators suggest an impending slowdown, with manufacturing contracting and services growth decelerating especially if EU-US trade tensions continue to linger for the remainder of 2025 and impact export driven economies in the EU such as Germany.

Trade tensions ahead of inaugural meeting

Trade talks between the European Union and the US are at a delicate point. While many tariffs were paused for 90 days, ongoing volatility has already tightened financial conditions and dampened business confidence. Tensions resurfaced recently when the US administration threatened to impose 50% tariffs on EU imports as of June 1, only to move the deadline back to July 9 after a productive phone call with the European Commission. The EU has said it’s willing to negotiate with the White House but will retaliate if a satisfactory solution can’t be found.

Amidst this backdrop, recently elected German Chancellor Friedrich Merz will meet with the US President at the White House this week for the first time. The meeting presents a crucial opportunity for Merz to discuss key issues such as tensions pertaining to Germany and EU’s persistent trade surplus with the US and hopefully soften the stance on both sides of the Atlantic.

Euro’s strong performance at risk

The EUR has been one of the strongest performing currencies in 2025 and has risen by almost 11% YTD vs the USD. This strength stems mainly from capital inflows into the bloc on the back of expected fiscal policy expansion and increased government spending while trade policy uncertainties have so far weighed on the USD. A stronger EUR is a challenge for the export-driven economies in the EU especially amidst a backdrop of heightened volatility from persistent trade uncertainties which affect EU business outlook and confidence. While current macroeconomic data shows resilience in consumption and labor markets, growth projections remain modest, clouded by export and investment weaknesses.

The Euro’s recent strength therefore faces risks from potential trade disruptions, sluggish growth and a subsequent aggressive accommodative policy from the ECB to support the domestic economy.

Figure 3: EURUSD YTD Chart

Source: Bloomberg

Attractive hedge against future weakness

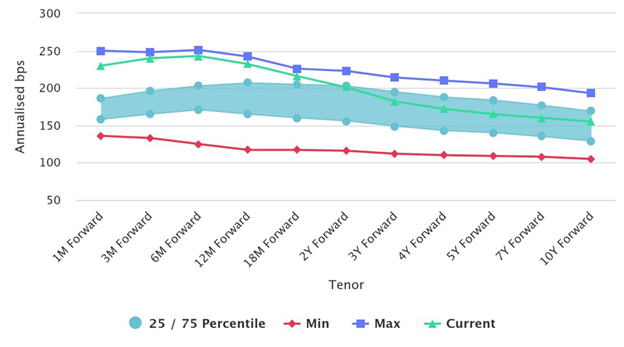

USD based investors can hedge for EUR weakness via FX forwards with FX forwards carry at extremely attractive levels.

Figure 4: EURUSD FX Forwards Carry (in annualized bps)

Source: Bloomberg, Validus

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.