US Tariffs on India: Catalyzing an India-China-Russia Alliance?

3 September 2025

Validus Launches Tech Solution to Streamline Fund Finance Operations for Private Capital Managers

17 September 2025RISK INSIGHT • 16 September 2025

Canada's Economy Brakes

Kambiz Kazemi, Chief Investment Officer

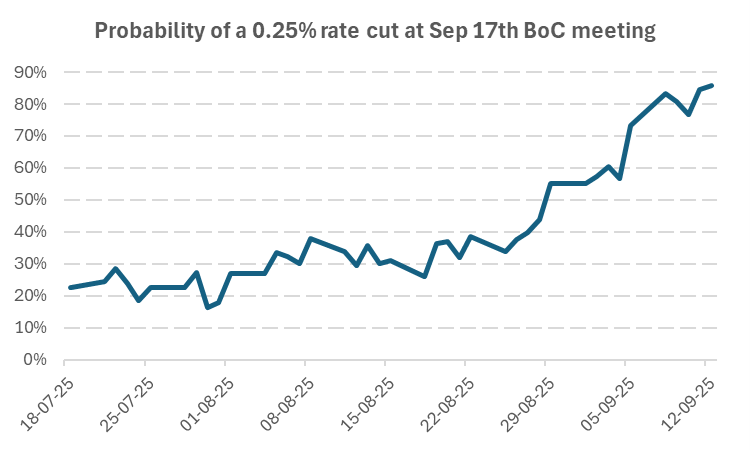

Only a couple of weeks ago the market was divided – placing around a 40% probability - on whether the Bank of Canada would be cutting rates at their September 17 meeting.

The Federal Reserve is due to meet the same date and expected to cut the overnight rate in the US for the first time since September 2024.

But the recent negative surprise on the unemployment front in both the US and Canada have quickly shifted expectations. Canada’s unemployment rate was revised up to 7.1%, a level not seen since 2016, excluding the pandemic era.

Chart 1:

Under strain

However, the deterioration of employment is far from the only sign of strain on households and the economy at large. Signs of stress are increasingly apparent in many parts of the system. For instance:

- Debt delinquency rates (excluding mortgages) in Q2/2025 were up 14% versus Q2/2024 and over 20% in both Ontario and Toronto, reflecting the effects of the slowdown of Canada’s most populous province’s economy which depends on the housing industry as well as the auto and steel sector, both affected by the US tariff saga and uncertainty.

- Credit demand generally slowed down with new credit card origination decreasing by 4.5% in Canada, while outstanding balances grew.

- Meanwhile, lenders continue tightening lending standards on auto-loans with about 21% of new applications going through multiple rounds of reviews.

- First-time home buyer activity - as measured by number of buyers - in Canada’s major markets such Alberta, British Columbia and Ontario, dropped below 2024 levels.

Foundations shaking

In Canada, national statistics can hide different stories beneath the surface. In our view, it is important to gain a more granular understanding of these sub-trends.

Much of the weakness seems to be increasingly visible in Ontario which represents 38% of Canada’s GDP and is a main engine of its economy.

Aside from the issues on credit and debt delinquency mentioned above, CMHC’s recent report highlights a bleak picture of the housing sector in Ontario.

- Condominium starts plummeted, driving the new housing starts number down 44% year-over-year to levels not seen post-GFC in 2009.

- Land prices in the Toronto region are down 30%.

- According to Urbanation, the number of condo construction projects cancelled so far this year has matched 2024 cancellations, and there is an expectation of additional cancellations and projects entering receivership.

It is the degradation of the situation housing sector in Ontario (the one in British Columbia has many similarities), that is cause for concern. Why? Nearly one in six jobs in Ontario relate to the housing and real-estate sector at large.

Such an abrupt slowdown in the sector canhave an important effect on employment, which is the Achilles heel of an economy with highly levered households.

The combination of a slowdown in the construction sector and important land and real-estate price adjustment makes up for a dangerous mix that could result in a negative feedback loop fueled by lower employment resulting in an inability to meet financial/debt obligations by households.

BoC too focused on the US and Global picture

The BoC wisely started an aggressive series of rate cuts back in July 2024, as it was well aware of the risk mortgage re-financings posed in late 2024 and early 2025.

Yet, it took the view that inflation might not be fully tamed and potentially a problem, thus pausing the rate cuts earlier this year. The BoC might have overlooked some important specific parameters for Canada and instead was too focused on the evolution of US monetary policy. If taken into account, these elements pointed to the necessity and/or appropriateness of further cuts earlier this summer.

a) While US inflation seemed stickier in the US, Canadian inflation continued a tranquil downward move, providing the BoC an option for further rate cuts earlier in the year. Such pre-emptive action could have helped avoid smoothen the deterioration of the housing sector.

b) Since the re-emergence of inflation in 2021 – and costly delay in central bank reaction – the housing market and mortgage refinancing risk have been a very distinctive risk for the Canadian economy. While the BoC has clearly acted to contain this risk, in our view a more aggressive stance would have been warranted, barring which the slowdown effect we witness get underway today.

Clouds on the horizon

It is important to remember that credit and debt deterioration are neither smooth nor progressive processes. They can accelerate abruptly past a certain threshold.

We have advocated for the last 2 years that the main indicator to watch to gauge the economic risk in Canada is employment. We see a high probability of the current deterioration to accelerate, putting in motion an undesirable and marked economic slowdown.

This will likely push the BoC to engage in further cuts in the next nine to twelve months, albeit with little room to do so, as the starting point is only 2.75%.

Should this be the case, where both the Fed and BoC engage in a loosening of monetary policy, the USDCAD exchange rate might be generally stable in the comings months, while both will likely depreciate versus other currencies.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.