Validus Launches Tech Solution to Streamline Fund Finance Operations for Private Capital Managers

17 September 2025

Sterling’s Squeeze: Public Finances in the Frame

1 October 2025INSIGHTS • 24 September 2025

France: Vive la révolution or vive la stabilité?

Harry Woolman, Global Capital Markets Analyst

"Après moi, le déluge" – attributed to Louis XV (Louis the Beloved)

When then Prime Minister Jean Castex resigned in May 2022, one can only imagine he did not envisage the tumult that would ensue in the prevailing three years. However, Sebastien Lecornu’s appointment on 9th September – Emmanuel Macron’s seventh PM and fifth in the last two years – confirmed, if any doubt remained, that the deluge was well and truly upon us.

From snap poll to stalemate

Macron’s ill-fated decision to call snap legislative elections in the summer of 2024 ushered in a period of political volatility that is extreme even by French standards. Last July brought a deep partisan split in the National Assembly (as we have discussed previously, here), which claimed another victim earlier this month when Francois Bayrou boldly called for a vote of no confidence against his own government in an attempt to break the impasse over his fiscal austerity proposals.

Lecornu’s tightrope

To today, and Lecornu has the unenviable task of uniting a divided coalition while, in the same breath, reducing the nation’s fiscal deficit – the largest among EU member states. Clearly, it will take another ‘beloved’ leader to unite the legislature once more. There are, nonetheless, early hints of green shoots: late last week the far-right’s Marine Le Pen was quoted as praising Lecornu’s cordial approach to his political counterparts, as he took the unorthodox approach of galvanising support behind his fiscal plans prior to forming a coalition government.

Ratings pain, spreads strain

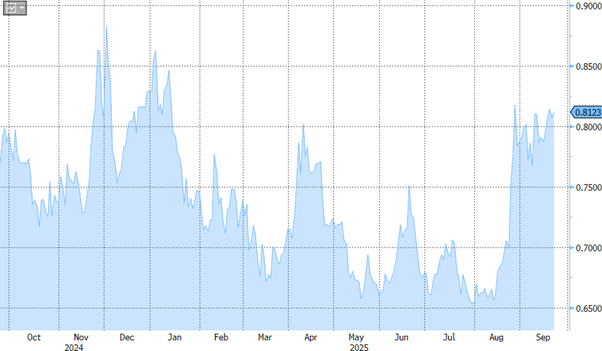

The challenge remains arduous. The recent downgrade of France’s credit rating has cemented the recent price action for French debt, where yield premium versus the German equivalent remains close to year-to-date highs. According to the French Ministry of Finance, should the fiscal gridlock continue, France’s deficit could jump to 6.1% of GDP – substantially above the 3% EU rule, the 5.4% forecast this year and the 4.6% target submitted to the bloc’s powerbrokers under Bayrou’s plans.

Chart 1: OAT/Bund spreads have widened to levels not seen since late 2024.

Source: Bloomberg

First domino falls

Fitch’s decision on 12 September made it the first major agency to remove the country’s AA-rated status, citing “increased fragmentation and polarisation of domestic politics”. With ratings due in the coming months from Moody’s (24 October) and Standard & Poor’s (28

November), concern over debt sustainability looks set to continue. Perhaps more worryingly for French investors is the convergence of OAT yields with peripheral nations. Greece – historically a pariah state in EU fiscal terms – actually has a lower yield on its 10-year bonds than France, indicative of the persistent uncertainty around the French budget, despite a worse credit rating for the peripheral nation.

|

Nation |

Fitch Credit Rating |

Fitch Outlook |

10-Year Yield |

|

Greece |

BBB- |

Positive |

3.398% |

|

France |

A+ |

Stable |

3.558% |

|

Italy |

BBB |

Positive |

3.541% |

Source: Bloomberg and Validus analysis, as of 22nd September 2025

A further downgrade from either / both of Moody’s and S&P could exacerbate the institutional sell-off of French debt, compounding fiscal woes that the fragile government is striving to address. Meanwhile, fiscal consolidation continues to be an uphill battle: France’s tax-to-GDP is already the highest in the EU at 45.6%, while unemployment fears are at 10-year highs - suggesting austerity must fall elsewhere in the economy.

Resilience – up to a point

The outlook is clearly bleak for the French consumer and French assets. However, contagion has so far been limited to France. The National Institute of Statistics and Economic Studies (INSEE) has even increased its 2025 GDP estimates to 0.8% from June forecasts of 0.6%, suggesting a degree of underlying economic resilience, although French outperformance vis-à-vis the bloc is likely to end this year.

Euro on a knife-edge

Should Lecornu both form a united government and pass fiscal legislation, further upside to the euro is likely; in recent days it has reached levels against the dollar not seen since 2021. In the more likely event that the legislative impasse continues, and credit rating downgrades are issued, spillover into European assets is a clear risk, alongside higher debt-servicing costs. Furthermore, any presidential election outcome that jeopardises Macron’s position—not presently our base case—would add further downside risk to the common currency. As it stands, the next French presidential election is not expected until Q2 2027.

Prepare for both paths

For risk managers, the French political saga underscores the difficulty of navigating markets when policy outcomes are binary and volatility is elevated. The potential paths ahead are stark: either a breakthrough in coalition-building that restores confidence, anchors French debt spreads, and lends fresh support to the euro — or a continued stalemate that invites rating downgrades, widens spreads, and triggers broader European contagion.

In such an environment, agility is key. Portfolio positioning must remain flexible enough to capture potential EUR upside if fiscal clarity emerges, while staying hedged against an adverse spiral in spreads and risk assets should the impasse deepen. The coming months will test the market’s faith in European unity; risk managers would do well to prepare for both revolution and stability in equal measure.