The UK Economy – Cooling Inflation, Labour Jitters

30 October 2025

Respite for the dollar – but will it be temporary?

12 November 2025RISK INSIGHT • 6 November 2025

Breaking Barriers in Tokyo: Takaichi's Premiership,

BOJ Policy and then Yen

Harun Thilak, Head of Global Capital Markets NA

Japan's political scene underwent a historic shift last month with the election of Sanae Takaichi as the nation's first female Prime Minister. This milestone not only breaks a long-standing glass ceiling but also signals potential changes in domestic and foreign policy. Takaichi, a staunch conservative and nationalist, assumed office on October 21, 2025, following a parliamentary vote that solidified her leadership after intense internal party wrangling.

Takaichi’s ascension comes amid political instability, including the resignation of her predecessor, Shigeru Ishiba, who stepped down after just under a year in office due to mounting pressures from electoral setbacks and divisions within the Liberal Democratic Party (LDP). The LDP, which has dominated Japanese politics for decades, suffered a disastrous showing in recent polls, leading to a coalition deal with the Japan Innovation Party (Ishin) to secure Takaichi's confirmation. The three-month vacuum after Ishiba's resignation amplified uncertainty, with public approval ratings for the LDP dipping amid scandals and economic woes.

As a longtime lawmaker and former minister under Shinzo Abe, Takaichi's platform emphasizes economic revitalization through "Abenomics"-style policies, including fiscal stimulus and structural reforms. Her immediate challenges include navigating a minority government, addressing inflation, and bolstering alliances amid simmering U.S.-China tensions. Political experts view her leadership as a trial by fire, balancing hawkish foreign policy with domestic reforms to restore public trust.

Japan's Economy in 2025: Resilient, But Tested

Amid these political shifts, Japan's economy has shown modest resilience this year. Real GDP growth accelerated to 0.3% quarter-on-quarter in the second quarter of 2025, surpassing expectations and building on an upward revision from the first quarter. This expansion was driven by stable domestic demand, robust exports—particularly from large manufacturers—and a rebound in private consumption. However, headwinds persist, including political upheaval, global economic slowdowns, and persistent inflation pressures.

The Bank of Japan (BOJ) anticipates a continued moderate recovery, with exports and production rising as overseas economies stabilize. Challenges include a shrinking workforce due to ageing demographics, mounting public debt, and external risks like U.S.-China trade tensions, which have fueled safe-haven demand for the yen, particularly in the first half of 2025.

Recent data indicates some strength: industrial production and retail sales have improved, while unemployment remains low at around 2.5%. Yet growth outlooks have been revised downward, reflecting volatility from political transitions and global uncertainties. Overall, while not in recession, the economy requires sustained policy support to achieve a virtuous cycle of growth and inflation.

BOJ Policy (In)Action

The Bank of Japan’s most recent Monetary Policy Meeting, which concluded on October 30, 2025, maintained a steady course amid the new political landscape. In its first gathering under Prime Minister Takaichi—an advocate of expansionary policies—the board voted 7-2 to keep the short-term policy rate at 0.5%, marking the sixth consecutive hold. Dissenters Naoki Tamura and Hajime Takata pushed for a hike to 0.75%, citing inflation risks, but the majority prioritized data assessment.

Governor Kazuo Ueda emphasized the need for more economic indicators before resuming hikes, while signaling a potential increase as soon as December 2025 or January 2026, contingent on wage momentum and inflation trends. No changes were made to quantitative easing tools, underscoring a gradual normalization path from ultra-loose policies.

USD/JPY – A Stretch of Potential Yen Weakness

JPY was the weakest G10 currency against the USD in October, reflecting Takaichi’s rise and her bias for expansionary fiscal policies alongside BOJ’s rate hold and dovish tilt at the recent meeting.

Chart 1: JPY weakness vs USD among G10 basket in October

Source: Bloomberg

With USD/JPY back above the 154 handle, there has been chatter from the usual official voices in Japan about the pace of the move higher over the last month. While this may curb the most frenetic price action, the upward trend could persist into year-end. Focus will be on Takaichi’s explicit fiscal plan, incoming economic and wage data, and policy cues from the BOJ’s December meeting.

Chart 2: USDJPY FX rate in 2025

Source: Bloomberg

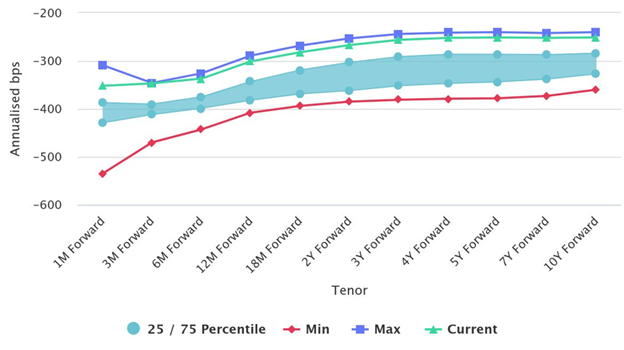

For USD-based investors, FX forward hedges remain an efficient way to guard against further yen weakness, with carry still attractive.

Source: Bloomberg, Validus