A Fragile Backdrop for a Critical Budget

25 November 2025

Kevin Hassett: A Potential Shift in Federal Reserve Leadership

10 December 2025RISK INSIGHTS • 4 DECEMBER

The waiting (for 2026) game

Kambiz Kazemi, Chief Investment Officer

After a record breaking 43-day shutdown, the government is back to business and the publication of economic data has finally resumed. Unfortunately, as we suspected, some important data points - such as the October inflation data - will be permanently forgone. Nonetheless, investors are once again able to rely on key data to formulate their expectations.

Back in October, Fed Chair Jerome Powell’s suggestion at the FOMC meeting press conference that the Fed might be on pause took investors by surprise. The market promptly priced out nearly half a percentage point of rate cuts which had been expected by the end of 2026, and equities weakened. Once the data flow resumed, it generally highlighted a softening employment picture and an inflation rate that seems to be hitting a floor in the vicinity of 3%, remaining stubbornly higher than the Fed’s target 2% rate. This, in turn, prompted another leg down in assets past mid-November.

As always, risk assets remain very reactive to expectations of further rate cuts. While the AI hype seems to have somewhat faded, and equity markets debate the economic scale and viability of AI, the December FOMC meeting has become a near obsessive focal point. But the relationship between asset prices and expectations of rate cuts is a two-way street. Investors are conditioned to expect that the Fed will react to any widespread market weakness or sell-off episode by adopting a dovish stance. This feedback loop has made for a volatile fourth quarter so far. In just over a month, we saw expectations going from pricing 0.50% of cuts, to zero, and then back to 0.25%.

Figure 1: Number of 0.25% cuts expected for the December 2025 FOMC meeting since October (-1 means a single 0.25% cut)

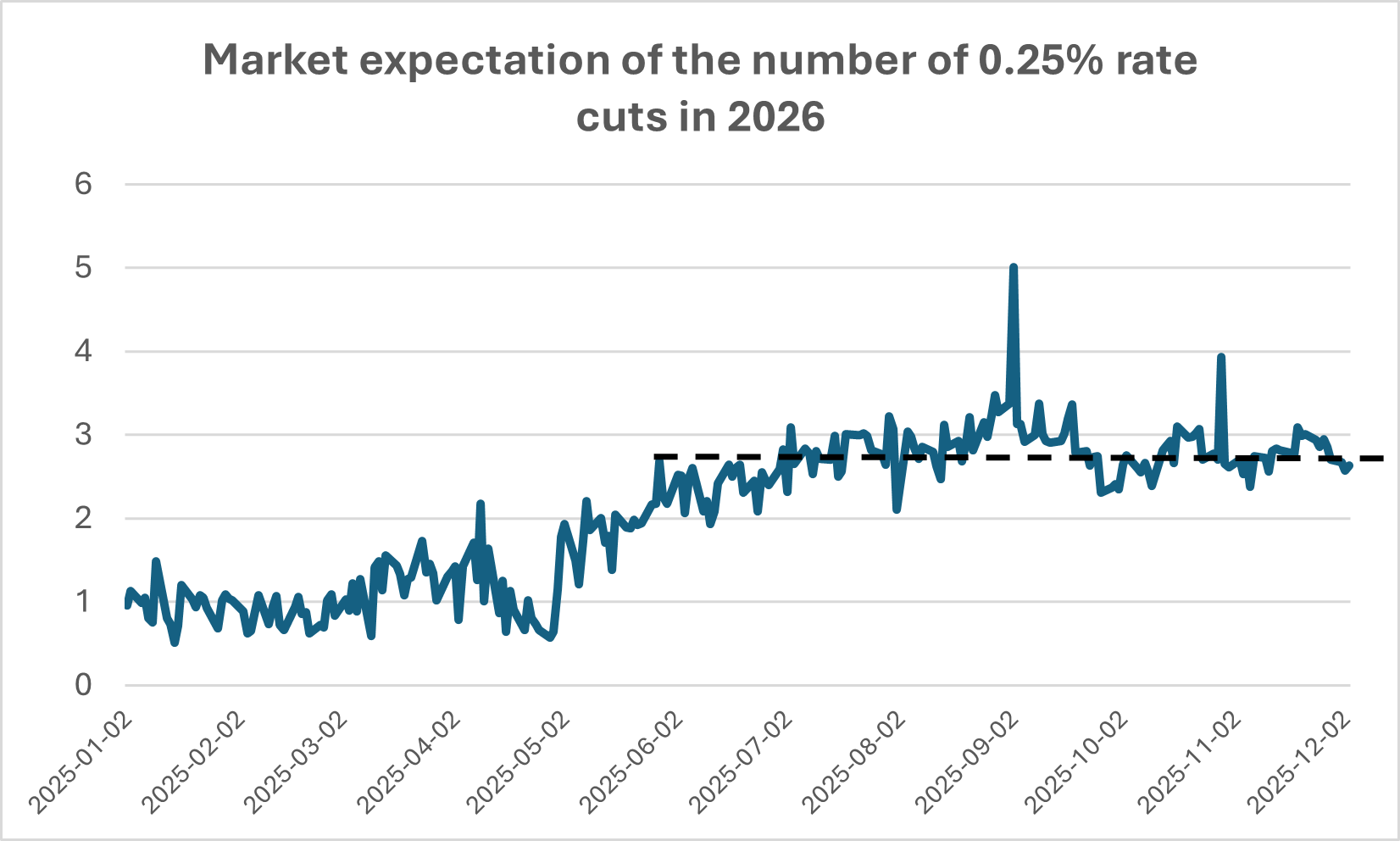

However, in our view, there is little attention paid to a determining factor for markets in 2026. The salient observation is that, over the last year, the market expectation for where the rates will end by end of 2026 has been astonishingly stable.

As figure 2 highlights, since mid-2025 the market has continuously priced three rate cuts for 2026, no matter what happened in the short-term. This stability of 2026 expectations is not only quite impressive, but also historically rare if not without precedent. Why? Because all the volatility and abrupt swings in expectation that have occurred in the short term – particularly regarding the upcoming meeting in December - have not affected where the market sees the Fed Funds rate ending up at the end of December 2026.

In other words, 2026 expectations seem to be immune and have been fully dissociated from what happens here and now.

Figure 2: Market expectation of the number of 0.25% rate cuts in 2026

Nonetheless, it is precisely those medium-term expectations for 2026 that are a particularly defining factor and will soon become the focus of all investors. It is important to remember that Mr. Powell’s term is coming to an end and whoever replaces him is likely to be more amenable to assuaging the US administration’s bias towards a looser monetary policy.

What would this mean for the markets?

As we head into 2026 and start looking into the post-Powell era, any perceived dovish tone by investors will likely provide important tailwinds to risk asset prices on the one hand and help soften the US dollar on the other. This scenario would be relevant in the first half the year until the new Fed Chair takes over the seat.

But if a deteriorating employment picture and sustained inflation persist in the months to come, the reality of the challenge facing policy makers could be catching up with investors in the second part of 2026.

As always, our framework is built in term of scenarios, but we see the one described above as having a higher probability than both a more benign scenario – healthy growth and employment - and more dire outcomes, for instance, a steep bout of stagflation.

As a result, preparing for the first half of 2026 using optionality that benefits from healthy price action for risk assets, and taking a closer look at - and thoughtful hedging - the USD exposure of one’s portfolio can be rewarding.