Artificially Intelligent Markets

14 August 2025

Divisions at the Bank of England: A Balancing Act

27 August 2025RISK INSIGHT • 21 August 2025

Jackson Hole: What to Expect from Powell and the Fed

Marc Cogliatti, Global Capital Markets Director

What to Expect from Powell and the Fed

The outcome of Trump’s talks with European leaders and Putin aside, the focus this week will be on the Fed’s symposium at Jackson Hole on Friday, where this year’s theme is “Labour Markets In Transition: Demographics, Productivity and Macroeconomic Policy.” Fed Chair Jerome Powell is scheduled to deliver a speech entitled “Economic Outlook and Framework Review” at 10am ET. After a relatively quiet August (the last FOMC rate decision was on 30th July and the next isn’t scheduled until 17th September), markets are eagerly awaiting any insight into what the Fed is thinking as we head into the remainder of the year.

At this stage, markets are pricing in an 83% chance of a 25bps cut for September’s meeting and a further 25bps reduction before year-end (most likely in December). That follows a very disappointing Non-Farm Payroll report earlier this month, which not only undershot expectations for July, but also included sharp downward revisions to the readings for both May and June. As usual, there were some seasonality effects to be considered and the labour market may recover somewhat as the full extent of tariffs becomes clearer, but from a growth perspective, a reduction in borrowing costs looks justified.

However, we shouldn’t forget the other half of the Fed’s dual mandate, which is to ensure price stability (i.e. control inflation). After July’s meeting, Powell noted that “inflation is still above target and even if you look through tariff effects, it’s still above target” (headline CPI rose 2.7% y/y in July while core CPI rose 3.1% y/y). We are yet to see the impact of tariffs – it’s unlikely to be fully evidenced for a number of months as businesses delay passing it through to consumers for as long as possible – but inflation expectations are for CPI to rise back above 4% in the months ahead, which will give the Fed cause for concern.

The final dynamic to include into the mix is the US administration and its view that interest rates should be ~1.5% lower than they currently are. Of course, the Fed is independent and should not be swayed by politics, yet the administration tends to push hard for what it wants. For now, it seems that Powell will not succumb to the administration’s wishes and his term as Fed Chair runs until May 2026, but markets are already looking beyond that and speculating who will take his place. In the words of the US President: “Whoever’s in there will lower rates. If I think someone is going to keep rates where they are, I’m not going to put them in.”

Why it matters for markets

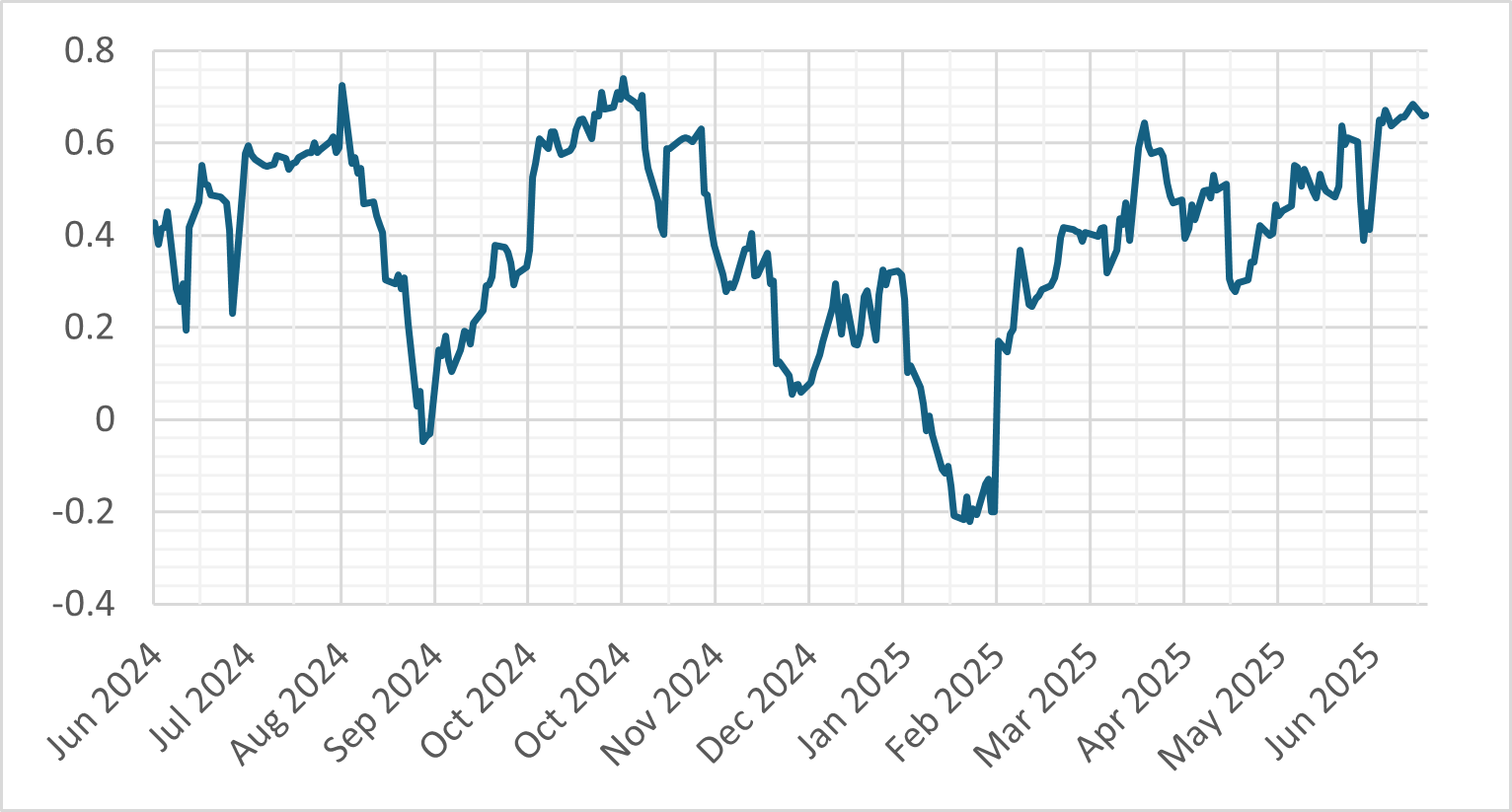

As the chart below shows, the outlook for US interest rates is once again the key influence on USD FX. The relationship broke down during H1 2025 when uncertainty over Trump’s tariff regime triggered large capital outflows from the US, but as confidence returns, interest rates look set to become the main driver for USD FX once again. Consequently, any indication from Powell that the Fed may look to be more accommodating than currently anticipated will almost certainly weigh on the dollar.

Chart 1 : 25 day rolling correlation between EURUSD spot and 3m SOFR futures

Source: Bloomberg, Validus

As risk managers, we identify key events that could trigger increased volatility and risk. While some may expect Friday to be a volatile day in the markets, while there is a risk, history suggests otherwise. Only once in the past decade has the 2-year US Treasury moved more than two standard deviations following a speech at Jackson Hole, and that was back in 2009, with the world steeped in a financial crisis.

Uncertainty around Fed policy can create major risks for global portfolios. Speak to our team to explore tailored hedging strategies

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.