How low can the euro go?

3 May 2022

Hawkish Peak to Thread the Needle?

10 May 2022INSIGHT • 6 MAY 2022

A new world order: can the dollar defend its global reserve currency crown?

Jesús Cabra Guisasola, Senior Associate, Global Capital Markets

“Gold is money everything else is credit.”

“Having a reserve currency is one of the greatest powers a country can have because, it gives the country enormous buying power and geopolitical power”

Source: Bloomberg

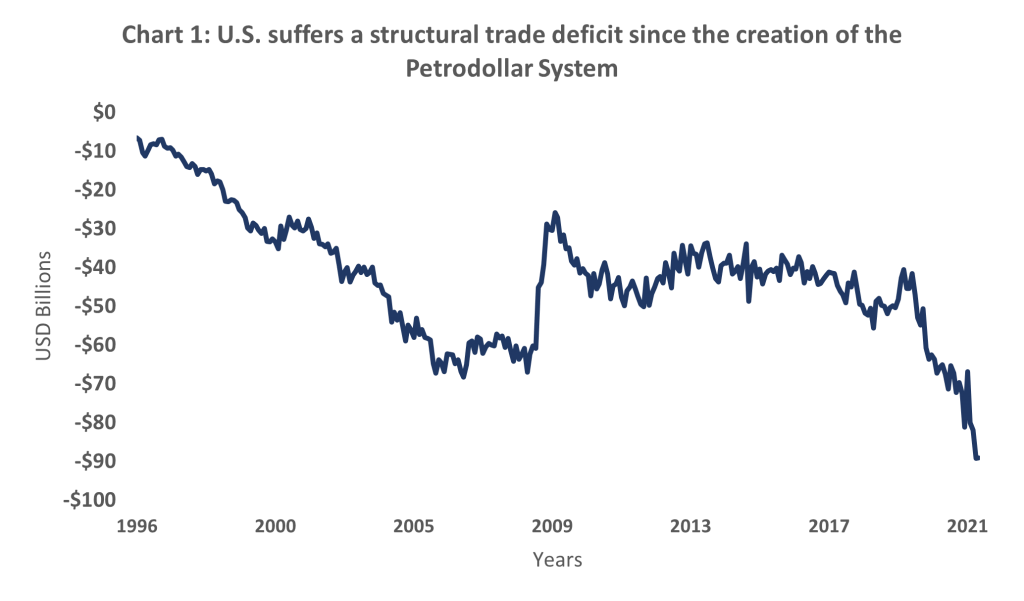

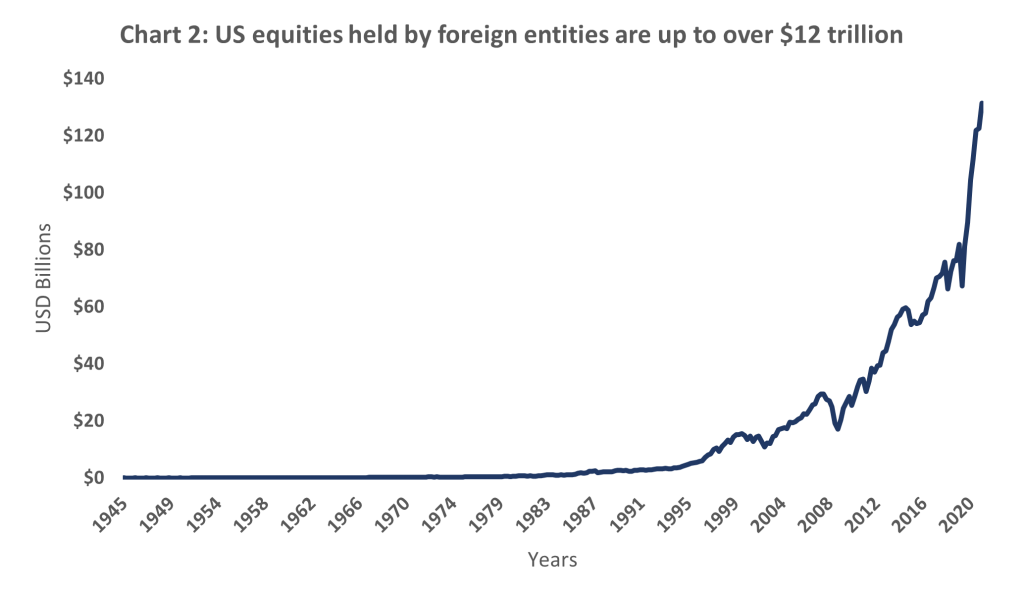

Trillions of Dollars in accumulated trade deficit have become surplus for other countries that first started investing in US treasuries but have now shifted to other asset classes (i.e., US equities, real estate, etc.). This means that the United States, which used to be the world’s largest creditor, has now become the world’s largest debtor. Chart below shows the value of US equities in hands of foreign countries.

Source: Bloomberg

On the back of the conflict between Russia and Ukraine, we are now witnessing a shift in the current status quo with countries like Saudi Arabia pushing to start using other currencies for its oil sales. Recently, a report from the WSJ flagged that Saudi Arabia was in active talks with Beijing to start accepting Yuan, a drastic move that would put China, the biggest importer of oil, in a position where it would not need to continue building its dollar reserves to buy oil from foreign countries.

This decision from the Saudis comes after years of growing increasingly unhappy with the U.S. given their lack of support in intervening in certain conflicts such as the Yemen civil war, the U.S. withdrawal from Afghanistan last year, and from the Biden administration’s attempt at an Iranian nuclear deal.

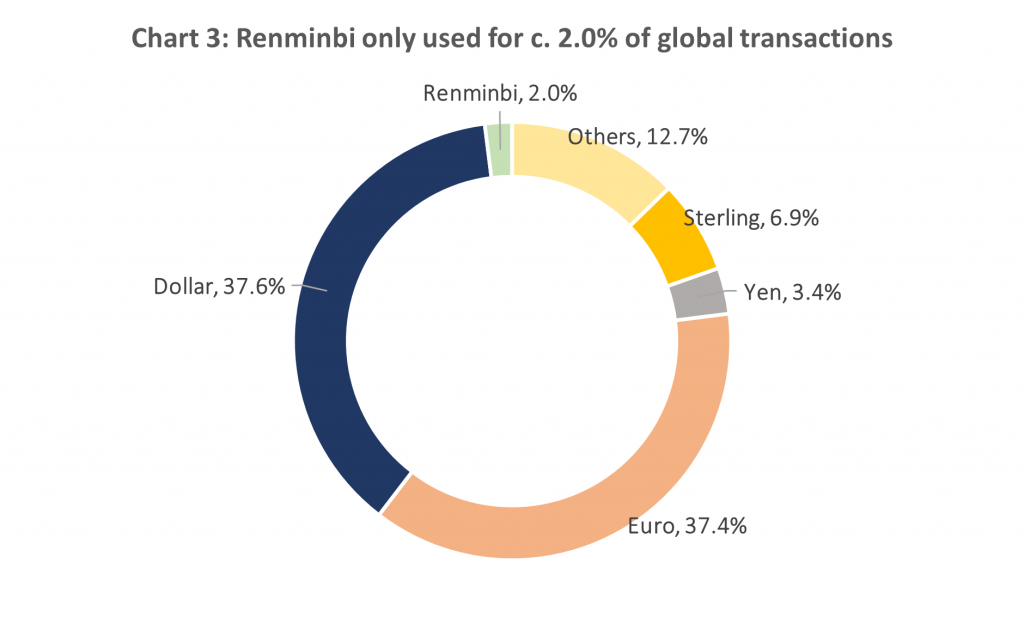

Some people have argued that yuan could become the new global currency reserve, but could the Chinese Renminbi dethrone the US dollar?

We have seen some countries like Russia unwinding its US dollar reserves and moving towards Chinese renminbi and gold. Perhaps, anticipating a scenario with sanctions from Western countries resulting from a geopolitical escalation between both blocs. However, looking at the numbers, only 2.7% of international transactions are completed in yuan, and not even commodity producers in China use the Renminbi.

Source: Bloomberg

In recent years, China has been opening its stock and bond markets to foreign investors. However, it does it through cross-border exchange programs that link the Chinese onshore market with those in Hong Kong, which are specifically designed to receive foreign investments while maintaining a limit on the amount of China’s currency which can flow oversees. These investments from foreign investors can be withdrawn easily, but Chinese investors are subject to strict capital controls. This allows Beijing and the central bank to maintain control over the renminbi’s exchange rates and limit the amount of renminbi that other countries can hold as reserves.

In 2015, China appeared willing to internationalize the renminbi. However, this was difficult when the greenback surged and the renminbi appreciated, making Chinese exports less competitive. That prompted the People’s Bank of China (PBoC) to devalue the renminbi and keep a soft peg of the currency to the US dollar which has worsened over the years pushing the government to impose strict capital controls.

Therefore, if China wants the renminbi to dethrone the US dollar as the global reserve currency, it will need to open its economy, loosen capital controls, and leave the renminbi to float freely.

What next?

Former Governor of the Bank of England, Mark Carney, raised this concern back in 2019 during the Jackson Hole Symposium and in front of the US Federal Reserve, when he highlighted that the US dollar as a global reserve was too risky for the current financial system and proposed a digital currency based on a global basket of goods to replace it.

Some have proposed different alternatives to the current system (i.e., bitcoin, or other digital currencies or even the return to the gold standard).

It is clear that the US dollar will lose its privileged position as a global reserve currency in the long term and be replaced by a more decentralized system in which not all transactions are tied to a specific country’s currency but instead to the euro, yuan, and perhaps a few others, or alternatively a neutral reserve currency is used. This is already gradually emerging throughout Eurasia with countries using other currencies for energy and commodities transactions.

However, a more abrupt shift could happen if there are further escalations in the conflict between Russia and western countries. This could accelerate the gradual change that we are witnessing, with countries like China and India growing sceptical of the U.S. and following Russia’s steps to start using its own currencies for international transactions. This would lead to a sell-off in US treasuries, pushing interest rates higher, and the US dollar lower. An uncharted scenario, which when coupled with the Fed’s readiness to halt active bond purchases could cause further disruptions and dislocations in the market and put the Federal Reserve in the uncomfortable position of pulling back from its decision of tightening to curb inflation.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.