Can anything save sterling?

23 August 2022

Hiking risks: the unintended consequences of taming inflation

6 September 2022INSIGHT • 30 AUG 2022

Breaking parity: near-term risks weigh on the euro

Ali Jaffari, Head of North American Capital Markets

After a 20-year period, the Euro broke parity vs the dollar, a mark which has long served as a strong support and psychological level. Euro weakness is hardly a surprise in the current environment. With a break below parity levels, is there momentum for a continued downward spiral? Significant uncertainty is still on the horizon for the euro and the near-term outlook remains dim.

The ongoing structural issues in the Eurozone continue to highlight downside risk. Recent data related to manufacturing and production has been bleak and points to a significant slowdown in economic activity. Furthermore, the worsening energy crises have led to a deterioration in the Eurozone’s external account, sending the trade balance into a deficit for the first time in a decade. The ECB is cognizant and vocal of these issues, however, its lack of firm action is leading to waning credibility amongst consumers.

Let’s consider some near-term risks that could weigh on the Euro:

Energy crises continues to deteriorate amidst an ongoing supply squeeze from Russia

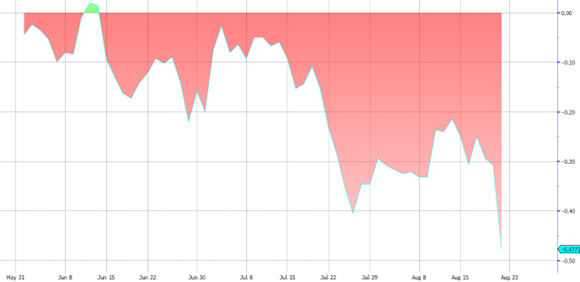

Gas and electricity prices extend their surge across the continent as further supply tightening from Russia exacerbates the situation. With the winter months approaching, demand for gas storage is on the rise, however, coupled with a decline in output, prices are approaching astronomical highs and weighing on the Euro. German power prices, 1-year forward, rose over 5% last week representing a 500% gain over the last year. The move lower in the euro is strongly correlated (see Chart 1) to the recent price action in the energy space, which was likely a catalyst for the break below parity.

Chart 1: Rolling 30-day Correlation on EUR/USD vs 1-year forward German electricity prices

Source: Bloomberg

Eurozone inflation prints see no reprieve, leaving real yields deeply in the negative

Despite the recent 50bps hike by the ECB, which pushed the policy rate into positive territory, market sentiment was fairly dovish and the currency’s reaction was muted. USD, being the strong outperformer in recent months, largely offset any upward momentum for the currency pair. Furthermore, with Eurozone real yields (accounting for inflation) deeply in the negative, coupled with central bank inaction, the exodus of capital flows in the Eurozone is high and will weigh on the pair.

At last week’s Jackson Hole symposium, ECB members harped on about the requirement to act swiftly to slow price pressures, to avoid “unnecessarily brutal” moves. Delayed reaction from the ECB, in an environment where yearly inflation is trending to 10% and higher, will result in further divergence in yield spreads between Europe and the rest of the developed world.

Peripheral spreads continue to widen across EU nations as the bloc fragmentation crisis deteriorates

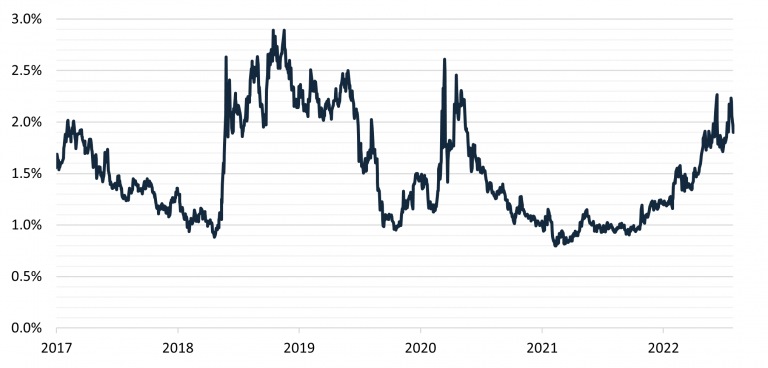

While the ECB released a tool aimed at tackling divergences between bloc nations, the implementation of the tool and its mechanism are vague. As an indicator, German to Italian 10-year yield spreads have widened to Covid crisis highs (see Chart 2). With the fragmentation issue deteriorating, the ECB’s toolkit grows less effective in tackling inflation in an orderly fashion across EU nations and increases the risk of falling into a deeper recession.

Chart 2: 10-year German-Italian Yield Spread

Source: Bloomberg

With uncertainty surrounding Italian elections (coming up the fall), further volatility could ensue

A number of key issues are at stake with the Eurozone’s third largest economy, as its upcoming general election will determine a path forward on Italy’s future EU integration, access to EU fiscal support and addressing the bloc fragmentation concern. The 2018 political turmoil had a significant impact on financial markets with a steep sell-off of Italian debt followed by a depreciating euro. It is unlikely that we will see a repeat to that extent, however, expect greater volatility leading up to the election and further capital outflows which could weaken the currency.

Ongoing USD strength exacerbates the move lower in EUR/USD. Given the looming risk on the horizon for the euro, it seems any support for the currency pair has a higher likelihood of coming from a reversal in USD strength – opposed to a topside move in the euro. With a spike in FX volatility, larger swings could be on the horizon which would create unanticipated portfolio risk. Having a sound approach to risk management is critical to navigate the current environment and ensure protection of capital.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.