Going it alone: central banks and the dawning of divergence

14 November 2022

What does UK gilt volatility mean for pensions governance?

22 November 2022RISK INSIGHT • 16 NOVEMBER 2022

Is the US Dollar still Royal?

Kambiz Kazemi, Chief Investment Officer

The US dollar’s relentless rally seems to have slowed since September, as talk of the “pivot” fuelled by prospects of a recession and a potential lower pace of rate hikes took centre stage. An additional factor behind the pause in the dollar’s rally is likely the prospect of other central banks playing catch-up.

Compared to other developed markets, the US has been aggressively raising rates since early 2021, with 2-year rate differentials massively widening in a very short period. But on November 10th, October CPI numbers came in lower than expected, signaling that inflation might be slowing.

Chart 1: US Dollar index’ rally slowed starting in September 2022

Source: Bloomberg

In our note, “The (inflation) shock is over, back to normal” (July 2022), we took the view that inflation numbers would likely soften by end of the summer. Though it came about a month too early, our projection highlighted that if investors were to price out aggressive hikes we would likely see:

- Constructive setting for risk assets and, in particular, equities which after having suffered a rout would welcome less aggressive tightening policy. Interest rate-sensitive (growth) stocks will likely be the main beneficiaries.

- A weakening of the US dollar as hikes are priced out, though some jurisdictions such as the ECB will still be playing catch-up.

- A stabilization of longer-term rates. Ongoing Quantitative Tightening (QT), however, will continue to provide upside pressure to long-term rates.

Upon the release of the CPI last week, the market promptly priced out some rate hikes and:

- The S&P 500 had its biggest one-day rally (+5.54%) since the lows of March 2020.

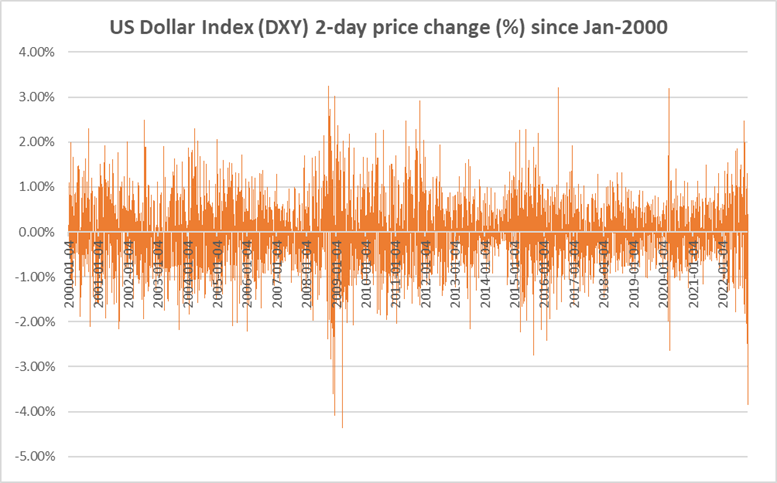

- The US dollar had its 3rd biggest two-day sell-off since January 2000.

- US 10-year rates were down 30bps on the day.

Chart 2: US Dollar index has its 3 biggest 2-day drop since 2000

Source: Bloomberg

Coming off the release of the CPI, the Fed seems to be keeping the door open for a less aggressive hiking agenda. On November 14th, for example, the Fed Vice Chair Ms. Bairnard said: “The inflation data was reassuring, preliminarily … It will probably be appropriate, soon, to move to a slower pace of rate increases.”

So, where does this leave the US dollar? Are we witnessing the start of a fundamental and lasting correction in the price of the US dollar? Or, is this steep drop a result of a technical move due to those long USD unwinding and changing positions?

Fundamentals

From a Purchasing Power Parity (PPP), the US dollar remains overvalued relative to many developed currencies—with the exception of the British pound. While this would generally constitute a headwind for the US dollar, PPP is not a strong driver of short-term currency price behaviour; rather, it defines long-term trends.

Compared to many developed countries, US interest rate differentials have consistently widened. For instance, the difference (i.e., spread) between the Fed Fund rates and the ECB overnight refinancing rates is at its highest since the Global Financial Crisis of 2008. Therefore, a reduction in the pace of US rate hikes combined with other central banks potentially playing catch-up constitutes a headwind for the dollar.

Flows and positioning

Among macro investors, long USD has been a widespread—and attractive—trade for the last two years. At Validus, we have continuously helped many USD-based investors astutely and aggressively hedge their foreign exposure. Anecdotally, many non-US investors with exposure to USD were under-hedged and benefited from the tailwind of the USD rally.

At this juncture it seems only rationale for investors to trim their long USD exposure and take profit and/or hedge their long USD exposure to lock in the benefits of past tailwinds.Conclusion

While the aforementioned forces point to a weakening of the USD’s rally or even a possible reversal, we have only witnessed one weak CPI print so far; continual softening in inflation numbers in the US is necessary to confirm the trend. Combined with other fundamentals (and barring increased geopolitical tensions or unforeseen flight to quality type events), such decrease points to the likely end of the seminal USD rally in this cycle. It is therefore wise for investors to consider an at least partial adjustment of their hedges and exposures by reducing their USD exposure in aggregate.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.