Central Banks call time on rate hikes

15 November 2023

The Fed is thinking about hiking, and the market is thinking about cutting

22 November 2023RISK INSIGHT • 16 NOVEMBER 2023

Where to Next for the Single Currency?

Pierre Roke, Global Capital Markets Senior Analyst

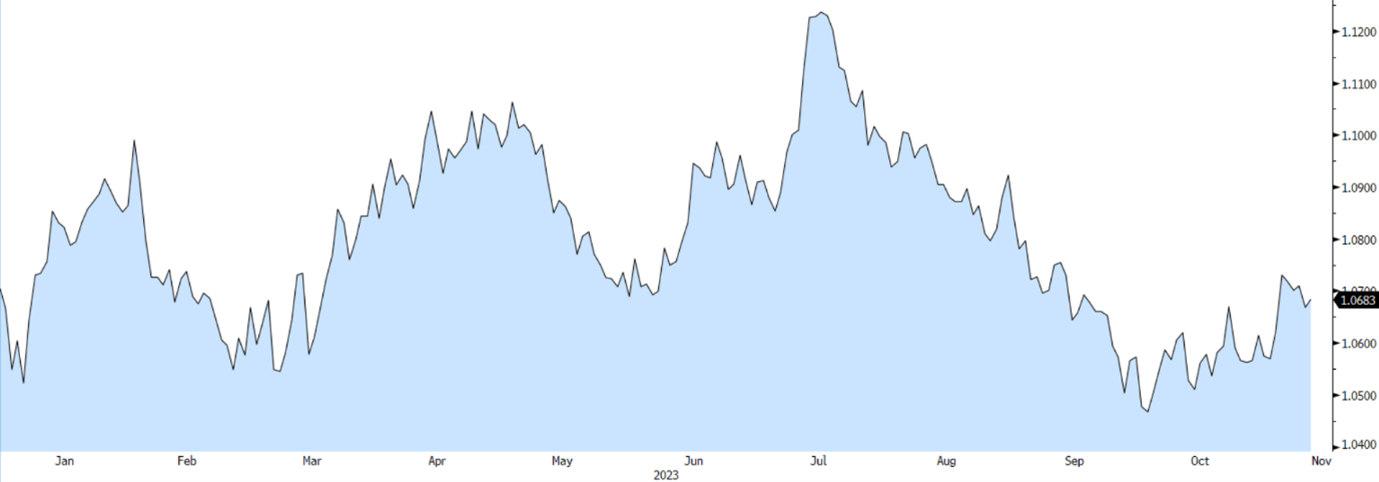

After a strong first-half rally the Euro reached its high of 1.1236 in mid-July, only to decline nearly 6% and finish the third quarter below 1.06. Was this due to the strength emanating out of the US or inherent weakness in the Euro? We think both. The US has come into the second half of 2023 displaying more economic resilience than most were expecting. The Federal Reserve commenced a historical hiking cycle, from 0.25% to 5.50% in just over 12 months and the economy held up. The ECB, not dissimilar to the US, went through its own hiking cycle, but in contrast, their economy did not fare as well. As a result of these opposing narratives, the Euro’s rally was quickly brought to an end.

Chart 1: The third quarter of 2023 has been marked by a falling EURUSD

Source: Bloomberg

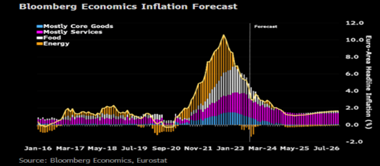

When looking at both the Eurozone as a whole and individual economies within, some trends start to emerge. Inflation has come down further than most economists were expecting, but worrying signs remain. Headline inflation is now at 2.9%, down from 4.3% which is undoubtedly proving, but core inflation remains elevated and is proving to be a bit sticker at 4.2%. A notable 11.1% decline in energy prices significantly contributed to the decrease in headline, aligning with expectations following the October 2022 peak in energy inflation. These themes are consistent across Europe. German CPI came in at 3%, beating market expectations by 0.3%, its coolest reading since June 2021 and led lower by energy. France's CPI at 4%, down from 4.9%, mostly led by energy. Then Italy, at 2.9%, down from 4.3% also led lower by Energy. Meaning that though the ECB’s attempts to bring inflation back to its 2% target have been somewhat successful, elevated services inflation are preventing one from celebrating full success.

Chart 2: Bloomberg Economics Inflation Forecast

Source: Bloomberg

The European economy is exhibiting clear signs of weakness. PMI data for Europe, coming in at 46.5, reflects contraction (below 50). This is driven in particular by weakness in manufacturing, where PMI is coming in at 43.1. Third-quarter GDP contracted by 0.1% after only 0.1% growth in the second quarter. The biggest drag (for now) is coming out of Europe's largest economy, Germany, which contributes approximately 25% to the Eurozone GDP. Their most recent GDP number also slowed by 0.1% and is expected to be down 0.4% on the year. Because of Germany's disproportionate reliance on the manufacturing sector, it is falling behind. Slowing demand, partly attributed to China's slowdown is holding them back. Italy, grappling with debt, recorded no growth in Q3, prompting the government to revise deficit targets for 2023 and 2024 to 5.3% and 4.3% of GDP from 4.5% and 3.7%. As a result, the Italian administration is pulling back its fiscal stimulus. France experienced a 0.1% GDP growth in Q3, down from 0.6% in Q2, driven by robust household savings and consumer demand. This positions France with a comparatively more optimistic growth outlook than Italy and Germany heading into Q4 2023 and 2024, but they are far from setting the world alight.

The US economy is looking much healthier than its European counterparts. Headline inflation is at 3.7% and core also holds higher at 4.1%. Although they have also been through an aggressive hiking cycle, their GDP growth is 4.5% annualised, its fastest pace in nearly 2 years. Employment remains tight, with only 3.9% unemployed and job openings above pre-pandemic levels. All in all, this gives the Federal Reserve plenty of flexibility to hold rates higher for longer to bring CPI back down to its 2% target.

What does all this mean for the Euro? Currently, both the Fed and the ECB have no more hikes priced in, keeping rates at 5.50% and 4.0% respectively. When committee members are questioned on rate cuts, there is no guidance, with ECB President Christine Lagarde deeming it is “premature” to discuss. The market, however, has priced the first cuts from the ECB and the Fed around the second half of 2024. What is unknown is how severe the economic downturn needs to become to shift the focus away from inflation.

Despite the stark contrast in economic outlook, on some measures the Euro looks cheap. From a PPP (Purchasing Price Parity) perspective, it is valued at 1.24 well above current levels. We believe that much of the “bad news” discussed above is already in the price and has been a driver of the fall we’ve seen recently, meaning that the marginal buyers may well come from Euro side and not the USD, this move is aided by a relatively light market positioning in the Euro. The risk to this view is a global slowdown of significant size, kicking off USD buying for safe haven reasons – currently, though economies are faltering, a huge recession doesn’t seem imminent – leading up to be cautious bullish EUR.

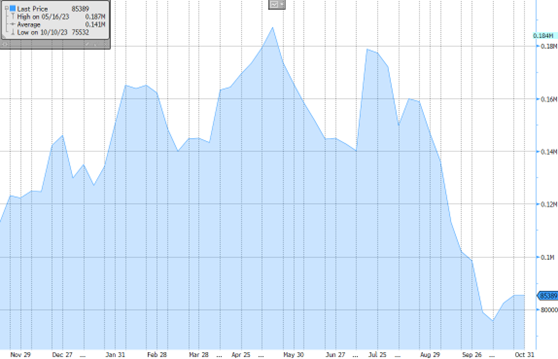

Chart 3: Positioning in EUR has fallen significantly over the last quarter, opening room for potential marginal buyers

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.