Is this the Rachel Reeves Rally?

17 July 2024

Low FX vols – exploring the opportunities

31 July 2024RISK INSIGHT • 25 JULY 2024

Bipartisan markets also hold risks

Kambiz Kazemi, Chief Investment Officer

Equity markets’ reaction to the failed assassination attempt on President Trump seemed to confirm that they perceived a Trump presidency as market-friendly. Markets fondly recall the S&P500 rally - despite the Covid pandemic - of over 65% during Mr. Trump’s presidency (compared to nearly 47% since the start of the Biden presidency).

Similarly, President Biden’s withdrawal from the race and his endorsement of Vice President Harris, also saw equity markets rally.

It seems that in a politically divided US, bullish equity markets are solidly bipartisan!

The strength of the continued rally of equity markets over the last couple of years has been quite impressive. They have defied traditional gauges and indicators of potential reversal and weakness, such as the inversion of the interest rate curve. They have also been agnostic to both high and low inflation prints. Traditional measures of fair valuation seem to be of little relevance, with the S&P 500 Price-to-Earning ratio standing solidly above 28.

While this constructive bullish trend in the equity market seems undeterred, it is important to identify and be cognizant of potential sources of risk specific to these markets, or those in other asset classes that could affect the equity markets by their ripple effect.

At Validus, as market risk specialists and practitioners, we look at and monitor a wide range of risk metrics, while also keeping abreast of shifts in the structure of markets across asset classes. Here are a few thoughts and observations that are worth considering at this juncture:

- Implied risks are near multi-decade lows across asset classes

Market participants often look at the VIX or other measures of option implied volatility as a gauge of expectations of future volatility or risk.

A similar measure exists for currency markets, the CVIX. Yet, while we are likely at the beginning of an easing cycle – already kick-started by the BoC and ECB – that will likely not be fully synchronized, neither among developed markets nor between developed and emerging markets, with some uncertainty lingering about long-term rates as some jurisdictions might be facing recessions, the CVIX is sitting near its historic lows since 2001.

Admittedly, as markets have been calm and orderly, the cost of carrying long options positions could have deterred investors from owning them. However, markets now imply less than a 5% move - in either direction - over a one-year horizon for some currency pairs such as EURUSD and USDCAD. Given the uncertainties ahead, a 5% move both historically and in our view seems far from unlikely, pointing to some level of complacency in pricing expectations.

Chart 1: Deutsche Bank FX Volatility Indicator (2001-2024)

Source: Bloomberg

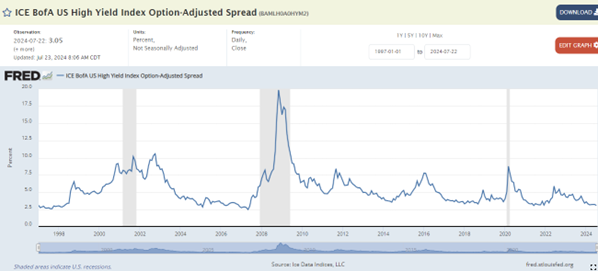

Similarly, a closer look at high-yield credit spreads – additional return investors seek over holding US treasuries to hold risky corporate bonds – shows that they are near all-time lows. While higher Treasury rates have a tendency to compress the spread, being at historic lows remains nonetheless impressive and indicative of investor appetite to own high-yield instruments.

Chart 2: ICE BofA US High Yield Index Option-Adjusted Spread (1997-2024)

Source: Bloomberg

- The equity options markets: a source of risk?

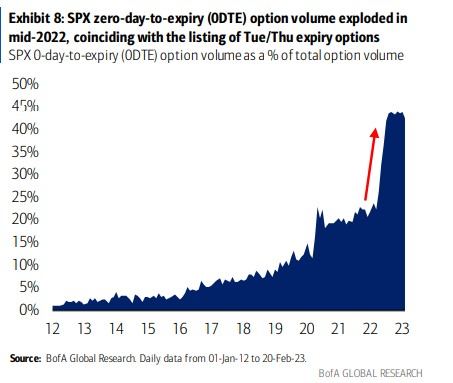

The last few years have seen tremendous changes in equity derivatives markets. In particular, the advent of daily options – with expiry dates across various days of the week for a number of subsequent weeks versus a single expiry day per month which prevailed until 2016 – has seen a massive rise both in the trading volume of options (both on widely held indices but also single stock and in particular “hot” technology stocks) and a staggering increase in the share of options with zero days to expiry (i.e. expiring on the same day they are traded) as highlighted by the chart below.

Chart 3: SPX zero-day-to-expiry (0DTE) options volume as % of total S&P500 daily volume

Source: Bloomberg

Why this is important?

Options are financial instruments whose pricing (and hedging) are very sensitive to (and use) the underlying security. This sensitivity can increase drastically in some scenarios when the option has very little time to expire. As a result, these 0DTE instruments can present – under some conditions – expanding risks that could be difficult to hedge and manage for dealers and market makers. In fact, since the massive growth in 0DTEs in 2023, the markets have not been really “tested”. While some believe that the market is well-balanced and could handle shocks, others point out that these underlying risks could result in some undesirable outcomes and negative feedback loops.

In essence, our view is that the 2024 US options markets have a new landscape, and should they be tested by an extreme event, it is likely that we will witness unforeseen extreme effects and potential ripple effects. For example, the effects of a “flash crash” in this new landscape – should one occur - will likely be very different than the one in 2010 and will surprise many.

Conclusion

Our goal in highlighting the above is not to suggest that there is an impending catastrophe ahead of us. In fact, markets could be resilient for long periods of time. However, what we like to underscore is that should we witness a disruptive event in the markets – an unknown – there are some increasingly embedded fragilities in the structure of (equity option) markets and underappreciation of risk, as well as potential lack of preparedness by investors that could take many by surprise. An appropriate analogy is the kind of surprising widespread disruption (still ongoing) and fragilities the world suddenly witnessed due to a single software security patch glitch last week.

On the bright side, the low expectations of risk by markets (i.e. low implied volatilities) offer opportunities to be prepared and nimble.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.