Carney’s cash play: Liberals’ surprise win and the price tag for Canada’s future

7 May 2025INSIGHTS • 14 May 2025

Double shot of stimulus: Will a rate cut and tariff truce ignite the UK economy?

Marc Cogliatti, Global Capital Markets Director

MPC slashes Bank Rate - but the vote is far from unanimous

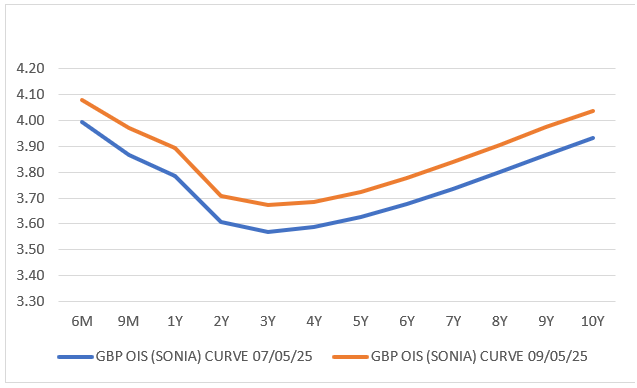

The Monetary Policy Committee has clipped the Bank of England Base Rate by 25 bps to 4.25 per cent. The minutes, however, revealed an unusually fractured committee. Governor Andrew Bailey was joined by Breeden, Greene, Lombardelli and Ramsden in favour of the quarter-point cut, while Dhingra and Taylor argued for a larger 50-point reduction and Catherine Mann and Huw Pill preferred to keep rates unchanged at 4.50 per cent. Because markets had expected a more dovish tilt, the OIS curve now discounts just over two additional cuts this year - rather than nearly three before the decision - despite the Bank’s own forecasts pointing to weaker GDP growth, slower wage rises, softer CPI and higher unemployment. For households and businesses, though, any move towards cheaper credit should, in theory, kindle activity over the coming months.

Tariff thaw: a lifeline for steel and autos

Just hours later the UK received a second boost when President Trump announced a UK–US trade deal rolling back parts of last month’s sweeping tariff package. The 25 per cent duty on British steel disappears entirely, while levies on UK-built cars drop from 27.5 per cent to 10 per cent on the first 100,000 vehicles shipped stateside - covering virtually all car exports last year. Although a 10 per cent charge still applies to aluminium and most other goods, further talks are scheduled, and the rollback should save thousands of jobs in both industries. It is hardly the full-scale free-trade agreement the UK once enjoyed with the EU, yet it still goes further than concessions granted to any other nation so far.

Market take-away: sterling steady, cuts still priced

Gilt yields ticked higher after the MPC news, with traders now pricing 57 basis points of further easing - likely 25-point moves in August and November - compared with 69 points beforehand. In ‘normal’ market conditions that shift would normally support the pound, but sterling’s modest climb appeared instead to draw strength from optimism surrounding the tariff deal, which had been well signposted and therefore produced limited fireworks.

Figure 1: GBP OIS Curve Pre (Blue) and Post (Orange) MPC

Source: Bloomberg / Validus

Outlook: cautious on cuts, constructive on the pound

Our stance on rates remains largely unchanged. We still suspect markets are over-estimating the scale of BoE easing while service-sector inflation remains stubborn, though the MPC must weigh that against mounting growth risks. For sterling, a “higher-for-longer” profile should be supportive, yet near-term moves will depend chiefly on how the dollar responds to President Trump’s ongoing global negotiations. We therefore keep our bearish USD view, which underpins a bullish outlook for GBP-USD and a moderately positive bias towards GBP-EUR, unless Washington extends similar tariff relief to Brussels - an outcome that still looks improbable.