Watch the $ step

11 June 2025INSIGHTS • 18 June 2025

Could Middle East strife hand the dollar a lifeline?

Marc Cogliatti, Global Capital Markets Director

Israel has grabbed the headlines striking Iran’s nuclear facilities and killing several senior military figures. The attack has sharply raised geopolitical tensions and carries the potential to snowball - locally if Iran’s allies retaliate, and globally should Russia, China or the United States be pulled in.

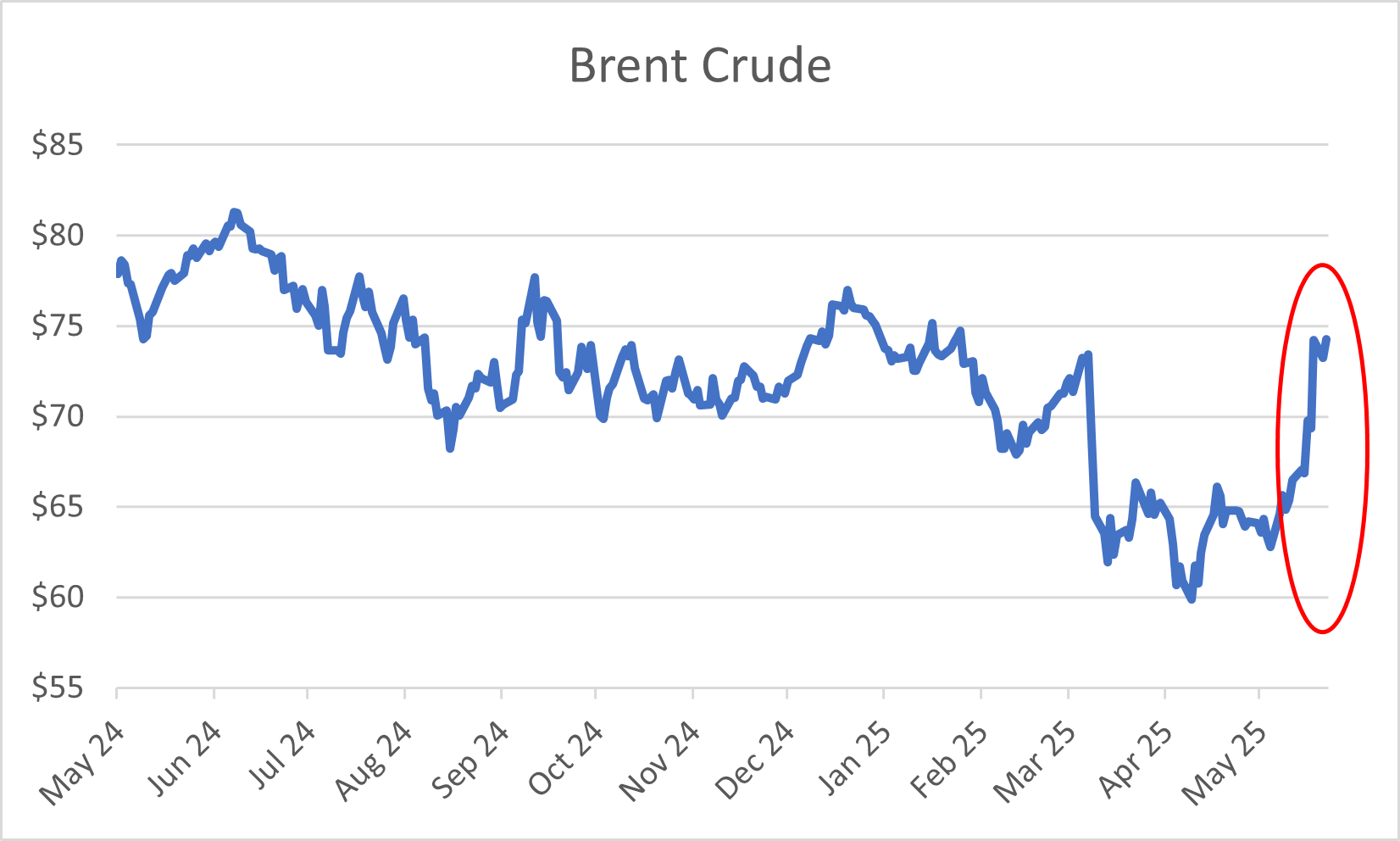

Chart 1: Brent Crude Prices Over the Past Year

Source: Validus / Bloomberg

Greenback appears unfazed

Commodity and equity markets reacted exactly as the playbook suggests. Brent crude spiked more than 11 per cent at one point on Friday, while the S&P 500 closed 1.13 per cent lower. Foreign exchange moves, however, were conspicuously muted. In the past, a clear “risk-off” mood would have sparked a dash for US Treasuries and a stronger dollar. Instead, although Treasury yields dipped slightly, the dollar index (DXY) is still within half a per cent of its lowest level since March 2022 - a world away from the rallies of yesteryear.

Two forces appear to be keeping the greenback in check. First, investors may believe that, despite the headlines, hostilities will remain contained. Monday’s market action backed that view: oil fell roughly 4 per cent and the S&P erased Friday’s loss. Second, the long-standing link between risk sentiment and the dollar has weakened. Since Donald Trump’s presidency, uncertainty over US trade policy has driven many investors to trim exposure to US assets, diluting the dollar’s haven status.

Both factors are probably at work. It is also telling that the traditional safe-haven currencies - the Japanese yen and Swiss franc - barely twitched last week. Even so, now is hardly the moment for complacency. We see immediate risks.

Escalation

Although Iran has signalled a desire to de-escalate, exchanges continue: Iran has launched multiple waves of drones and missiles, while Israel’s strikes killed another senior commander.

For now, traffic flows normally, but if Iran blocks the Strait of Hormuz and Europe’s oil supplies are disrupted, inflation could flare and force central banks to raise rates just when they would prefer to cut them to revive sluggish growth.

Crowded short-dollar positioning

Virtually every currency strategist now seems to predict further dollar weakness. While that aligns with our long-held view, a one-sided consensus can be a contrarian warning that leaves the market vulnerable to a squeeze.

Our bias remains for a weaker dollar, yet a dose of caution is prudent. EUR/USD still struggles to sustain rallies above 1.16, and GBP/USD feels heavy north of 1.36, although CFTC data show positioning is far from extreme, leaving room on the upside for both pairs.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.