UK Macro Update: Sticky Prices, Sluggish Growth

23 July 2025

Fund Finance: In the Strategic Spotlight

7 August 2025INSIGHTS • 30 July 2025

Japan’s Power Shift: What the Ballot Means for Yen & Yields

Harun Thilak, Head of Global Capital Markets NA

Japan’s upper house election of 20 July has upended the political landscape. Prime Minister Shigeru Ishiba’s Liberal Democratic Party (LDP)–Komeito coalition lost its majority, inviting fresh uncertainty for policy, the yen and the domestic rates market. The vote came just days before the Bank of Japan’s (BoJ) 31 July meeting and in the same week as a new US-Japan trade deal, knitting politics, policy and markets ever more tightly.

Ballot Box Blow for Ishiba: Policy Paralysis Ahead?

Having already surrendered control of the lower house last year, the coalition’s upper house defeat weakens Ishiba further and raises the spectre of legislative gridlock. Opposition parties, notably Sanseito, have gained ground on platforms of tax cuts and looser monetary settings. Their calls for a larger fiscal package - including scrapping the 10 per cent consumption tax - could swell public debt, already near 230 per cent of GDP. A minority LDP government would need ad hoc deals with small parties or a grand coalition, either way limiting its scope for long-term reform.

Roller-Coaster Year for the Yen

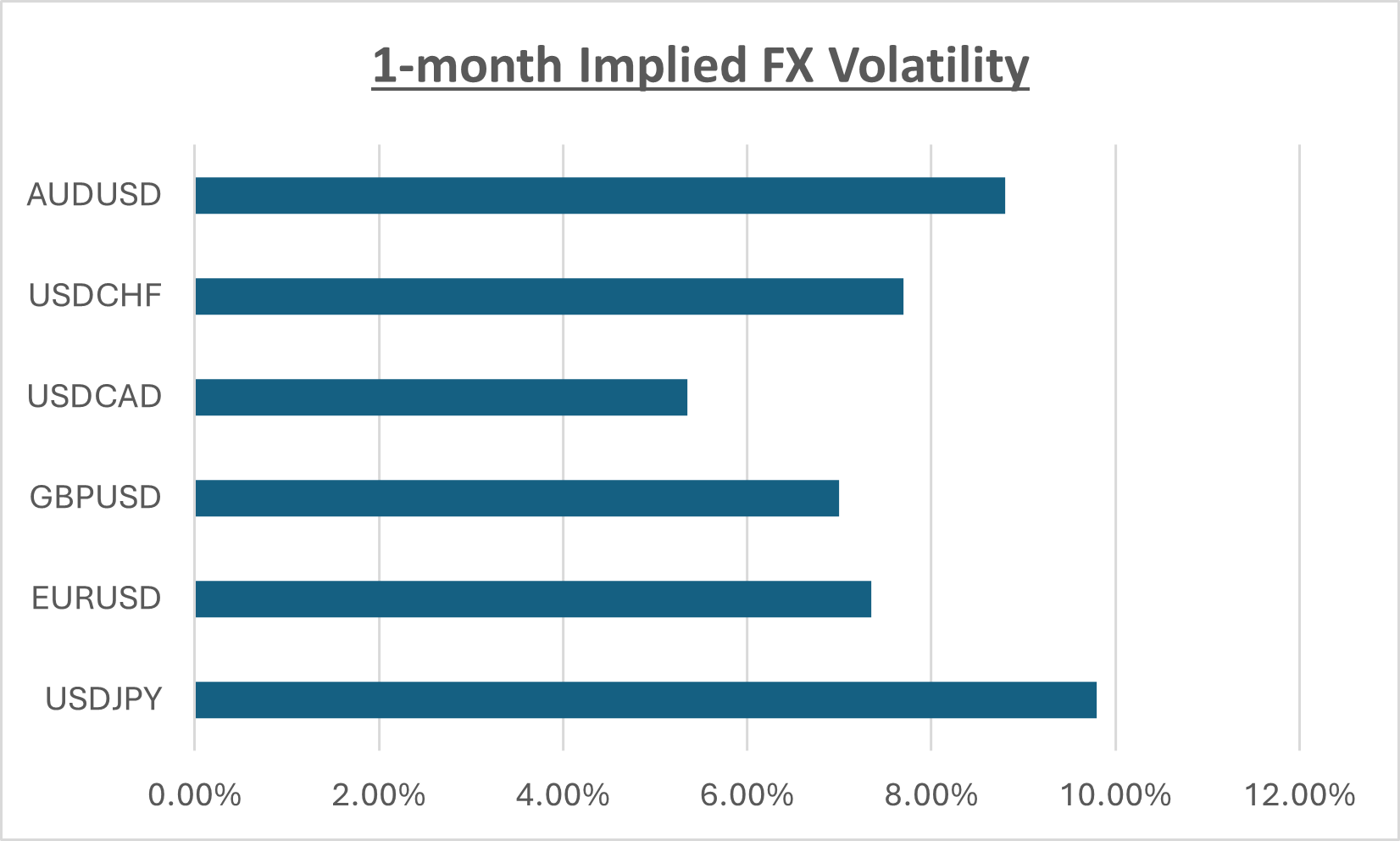

The yen (JPY), traditionally a safe-haven currency, has swung sharply this year. It firmed against the US dollar in Q1 as the greenback sagged, but fresh political uncertainty and trade friction have since sent it lower. Markets now fear bigger deficits and softer policy, both potential headwinds for the currency. One month USD/JPY implied volatility sits at the top of the G7 league, hinting at a lively summer.

Chart 1: USD JPY Historical FX rate

Chart 2: G10 Implied FX Volatility (1M tenor)

Source: Bloomberg

Bonds Feel the Heat

Japanese government bonds have also wobbled. The 30-year JGB yield is about 80 basis points higher year-to-date‑ and the curve is the steepest in years. If a looser budget demands more long-dated issuance, yields could climb further. The BoJ’s policy rate has been pinned at 0.5 per cent since January, yet rising bond yields and political pressure to keep borrowing costs low leave the central bank in a tight spot.

Chart 3: 30Y Japanese Government Bond (JGB) yields

Source: Bloomberg

Tariff Truce with Washington

The trade front offers mixed relief. On 23 July, the US administration and Prime Minister Ishiba unveiled a deal cutting tariffs on Japanese car imports to 15 per cent from 27.5 per cent and trimming levies on other goods to the same 15 per cent, averting a threatened 25 per cent hike due 1 August. Tokyo, in turn, pledged a USD 550 billion investment in the United States. Japanese equities cheered the news, handing the BoJ a brief respite amid sluggish growth and sticky inflation.

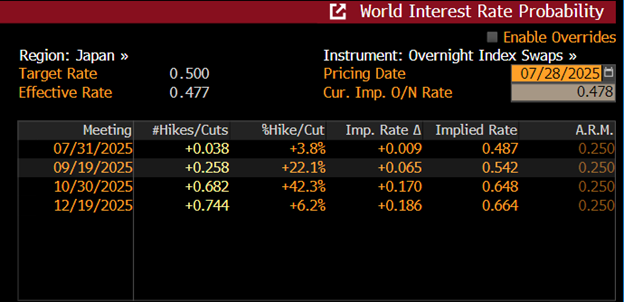

BoJ's Tightrope

The Bank of Japan faces a delicate balancing act: inflation has sat above the BoJ’s 2 % goal for more than two years, pushed up by a tight labour market and stronger wages, while overall activity remains lacklustre. After the election, demands for fiscal expansion will only grow, and political voices will keep urging the BoJ to hold rates down. The Bank of Japan (BoJ) upcoming meeting on 31st July will be closely watched for indications of its response to these challenges. Markets still expect the bank to stay on hold through yearend, but if prices and pay keep climbing it may be forced to tighten sooner - risking volatility just as public debt comes under greater scrutiny.

Chart 4: policy rate trajectory implied from OIS pricing

Source: Bloomberg

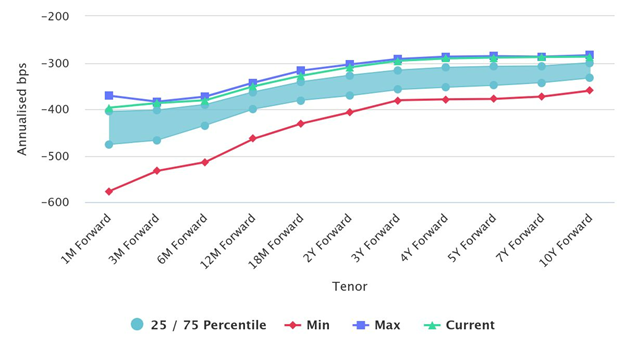

For USD-based investors, FX forward hedges remain an efficient way to guard against further yen weakness, with carry still attractive.

Chart 5: USDJPY FX Forwards Carry Cost (in annualized bps)

Source: Bloomberg, Validus