US Government Shutdown: Causes, Consequences and the Road to a Deal

8 October 2025

Calm Markets – Time To Hedge?

22 October 2025INSIGHTS • 16 October 2025

The Golden Age

Kambiz Kazemi, Chief Investment Officer

"Gold is a treasure, and he who possesses it does all he wishes to in this world and succeeds in helping souls into paradise."

Christopher Columbus (Letter to the Sovereigns, Fourth Voyage, 1503)

Another day and another all-time high for gold (and silver). So far in 2025, gold has made a new all time high 46 times.

A relentless rally that started in February 2024 is unabated, as gold has set record after record and more than doubled in price. As the momentum continues to both impress and surprise many investors, two core questions remain: why the rally, and where is the gold price heading?

Demand Goes Global – and Circular

For the better part of 2024 we often heard about the “Chinese buying” as a justification of the run-up in prices. As gold imports is controlled by the People’s Bank Of China (PBOC), which also regulates markets to a great extent, statistics reflecting purchases by PBOC were attributed to action meant to meet “retail” demand for gold.

But in reality, the PBOC is a buyer of gold along with many other central banks (CBs) globally. Both developed-market and emerging-markets CBs have purchased gold relentlessly over the last few years, with the notable exception of Switzerland, which has been a seller.

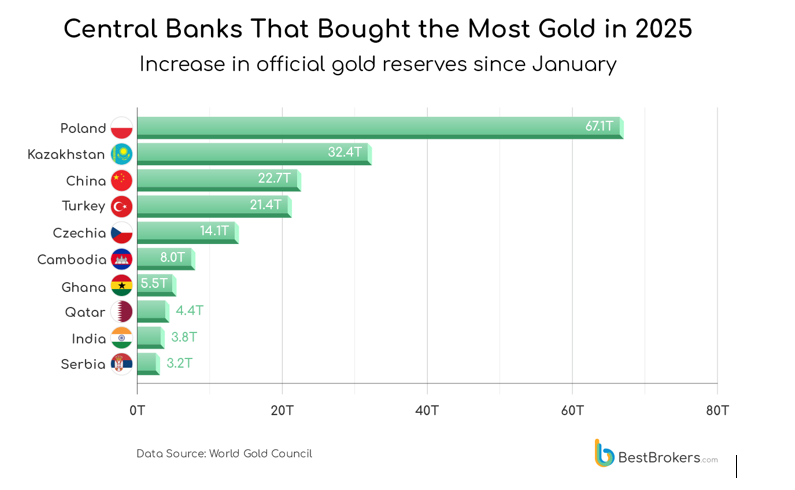

While 2023 and 2024 were marked by purchases from China and a number of emerging countries, 2025 has seen purchases by a wider range of countries – such as Poland - aggressively buying gold despite not being traditional top buyers. This signals a trend that has taken hold globally and, more importantly, highlights that CB demand is unlikely to abate any time soon.

Chart1: Central Banks that bought the most gold in 2025

Source: World Gold Council

Why Now? Diversification, Geopolitics, Inflation

As for the causes of this frenzy, the usual explanations are in play: a desire by CBs to diversify away from the US dollar as a reserve, the geopolitical uncertainty (for instance, justifying the aggressive buying by Poland given its proximity to the Russia-Ukraine conflict), and concerns around a potential cyclical resurgence of inflation.

In our view, the data undoubtedly supports the idea that many decision-makers are looking to diversify reserves away from the USD, in particular:

- The World Gold Council survey of 71 central Banks (Q2 2025) indicated that 73% of respondents expected the share of the USD in their reserves to decrease over the next 5 years, while 76% expected the share of gold reserves to increase.

- The data in unequivocal: by August 2025, for the first time since 1996, the share of US Treasuries held as reserves by central banks (ex-US) had dropped below that of gold reserves - 23% versus 24%, respectively.

- Furthermore, 81% of respondents cited inflation concerns as the second most relevant reason for their reserve management decisions, just after interest rates, which were cited by 93% of them.

A clear picture emerges: the traditional arguments for holding gold – which were absent or weakened for the better part of four decades - are resurgent and top of mind for investors across the spectrum.

Momentum begets momentum

We therefore see this trend to have a high potential of being sustained by a positive feedback loop and the late bloomers who will join the fray.

This, in turn, can have important ramifications. Gold remains a physical commodity and production has its limits (projected at approximately 3,200 tonnes in 2025), and proven reserves are finite. Therefore, scarcity can become relevant – especially as CB demand is complemented by financial instruments backed by it.

It is no surprise that we have seen a lift-off in prices of other precious metals as investors become more aware of the sector and the intricacies of the physical versus financial markets. The price of silver has made a new 43-year high and is up nearly 30% since early September.

We expect a high probability that the tide lifts other precious metals such as palladium and platinum, as investors see relative underperformance.

For those who find comfort in statistics and history: the highest appreciation of the price of gold in a 21-month period (106% presently) post-Bretton-Woods (1971) was nearly 300% in 1976-1980 - admittedly a period marked by tremendous levels of inflation. History might not repeat itself, but it does seem to rhyme.