The Golden Age

16 October 2025

The UK Economy – Cooling Inflation, Labour Jitters

30 October 2025INSIGHTS • 22 October 2025

Calm Markets – Time To Hedge?

Marc Cogliatti, Global Capital Markets Director

Thirty-eight years ago, almost to the day, an estimated $1.7trn was wiped off global stock markets in what became known as Black Monday. There wasn’t an obvious catalyst for the sell off, but a combination of overvalued stocks, widening US deficits and rising interest rates were all deemed contributing factors and added to the snowball effect.

Fast forward to today and, and although markets appear calm, a growing number of risk factors that could easily derail sentiment. Trade tensions, ongoing conflict in both Europe and the Middle East, sticky inflation preventing central banks from cutting rates as aggressively as they’d like, and widening government deficits (to name a few) have markets on edge. Nevertheless, for now at least, risk assets continue to perform well: global indices remain close to record highs, and the sharp sell-off we saw in April is a distant memory.

Warning lights in a quiet market

There are a couple of warning signals that we shouldn’t ignore. First, the recent failures of Tricolor Holdings and First Brands raise questions about whether other issues might yet surface. That was then followed by news that Zions Bancorp and Western Alliance Bancorp said they were exposed to alleged fraud, triggering a sharp sell-off in their share prices and weighed heavily on broader financial stocks. Sentiment has since recovered, but the price action suggests markets are nervous.

Secondly, the rally in gold. Traditionally sought after for its safe-haven appeal and as a hedge against inflation, the precious metal has more than doubled in value since the beginning of 2024. Many analysts argue the move reflects a world awash with liquidity, hence both global equities and gold rallying in tandem. However, it could also signal concern about persistent price pressures and the destabilising of fiat currencies.

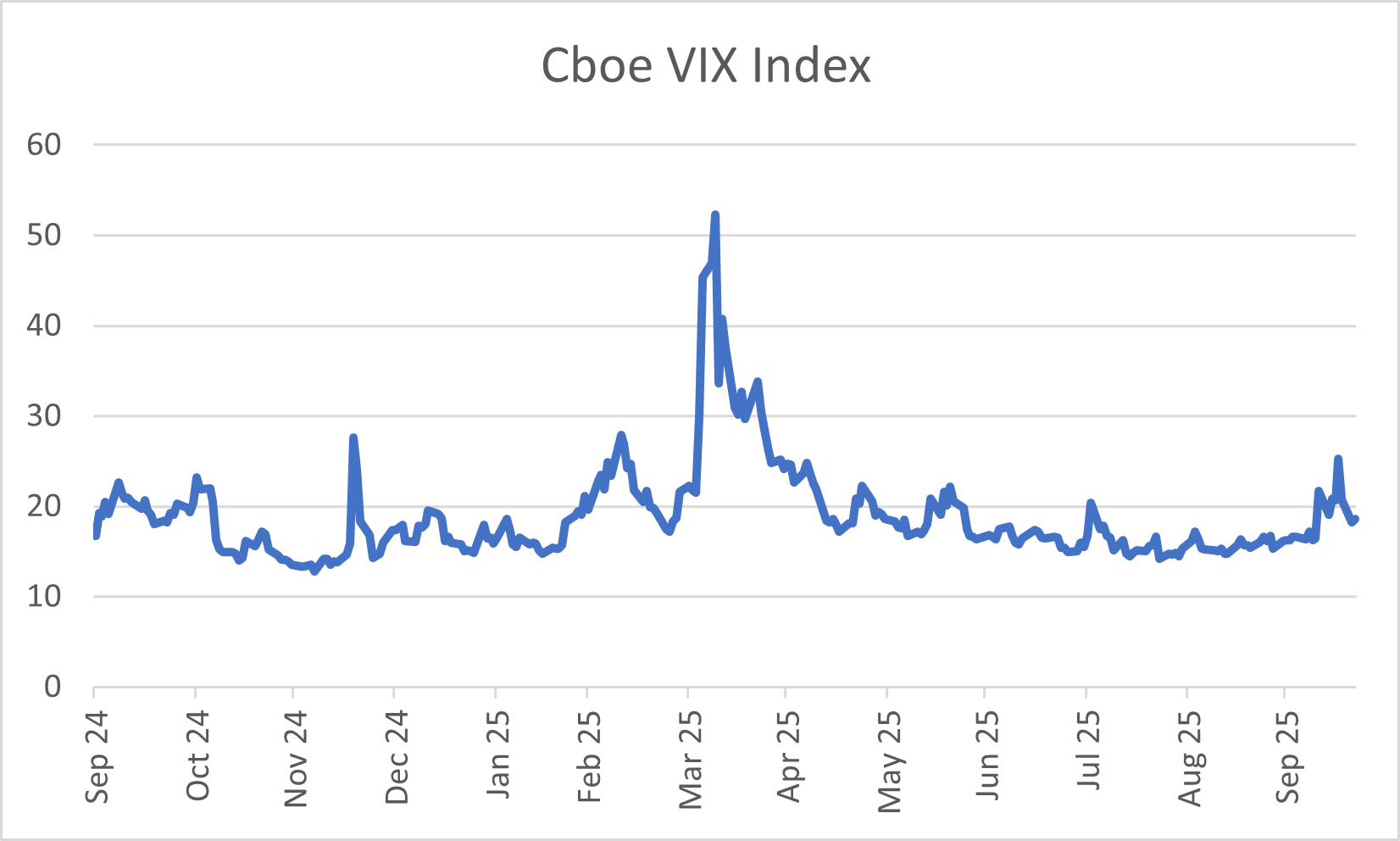

Finally, derivative markets are starting to show signs of stress. The VIX index (often described as the market’s fear index) spiked last week to its highest level since April. Granted, it’s a long way from the dizzying heights reached in April post Liberation Day, but a jump in option volatility is reminder that the market remains on tenterhooks.

Chart 1: Cboe VIX Index

Source: Validus / Bloomberg

Hedge while vol is low

Fortunately for our clients, FX and IR volatility remains low and, hence, hedging these risks remains worthy of consideration. In practice, very few clients use options to hedge FX risk, but volatility is still a factor in determining credit charges, particularly for longer tenors. Euro-denominated vehicles hedging dollar assets also benefit from a significant narrowing of the interest rate differential between EUR and USD over the past three months (-228bps in July vs -166bps today when using a 1 year forward). Given the uncertainty surrounding US politics, this feels attractive, even if EURUSD spot is considerably higher than it was at the start of the year.

On the rates side, the market is still pricing additional cuts from both the Fed and, to a lesser extent, the BoE. While the ECB are less likely to cut further, there is little scope for it to start hiking again before H2 2027. As a result, we’re seeing clients lock in the current curves using swaps, or take advantage of relatively cheap caps given low volatility and inverted curves at the short end.

The quiet is the time to act

The point here isn’t to suggest that we’re about to see a big sell-off in risk assets, or even that heightened volatility is inevitable in the months ahead. Instead, the message is that when markets are calm, volatility is low and risks appear suppressed, it’s the exactly the right time to think about taking risk off the table as the cost of doing so is relatively cheap.

As always, please reach out to your regular Validus contact if you would like to discuss specific exposures in more detail.