Opportunity and Obstacle: Can Europe handle a stronger euro?

16 April 2025

Carney’s cash play: Liberals’ surprise win and the price tag for Canada’s future

7 May 2025RISK INSIGHT • 23 April 2025

The “Trust Factor” in the Age of Trump’s Trade Wars

Kambiz Kazemi, Chief Investment Officer

Two weeks after President Trump unleashed a blitz of global tariffs, the markets are still dealing with its aftershocks. Trump’s style, which favors showmanship, has been creating an environment of relentless uncertainty, inundating investors with fluctuating tariff rates, reversals, temporary pauses, exemptions or speculative bilateral deals.

Distinguishing signals from noise requires being able to step back and digest the information, but the relentlessness of the incoming information makes this virtually impossible. Questions can be raised about the administration’s own capacity for thorough assessment of the impact of these policy changes.

Many market indicators show signs of stress, echoing patterns seen in the COVID-19 and Global Financial Crisis (2008). It is likely that the fear of a potential disruption of the Treasuries market might have prompted the announcement of a 90-day delay by the administration.

The common denominator of periods of stress and crisis in financial markets is the notion of trust.

- The 2008 Global Financial Crisis saw a collapse of investors’ trust in the financial system, especially once Lehman Brothers declared bankruptcy. Trust was restored by the swift, coordinated actions of the Fed, the Treasury Department and Congress, culminating in the rapid implementation of the Troubled Asset Relief Program (TARP).

- The 2010 European Debt Crisis centered on investors’ trust in the viability of the euro currency and the Eurozone. It was met by the infamous “whatever it takes” statement of then President of the ECB Mario Draghi, whose credibility re-established calm and confidence.

- The 2020 COVID-19 Crisis eroded both society’s trust in its future, as well as the ability of governments to contain the pandemic and promote future economic growth. It took globally coordinated responses by both central banks and governments to dissipate fears and restore trust.

However, the 2025 tariff-induced market turmoil differs profoundly from these past crises in three major ways: (1) its cause(s), (2) its potential effects and (2) the remedy.

1. Cause

Past crises typically stemmed from exogenous or unintended actions, ranging from a lack of understanding of interactions in the financial markets to poor regulatory supervision. However, the present situation is the result of intended policies, the long-term ramifications of which may not have been fully considered.

More importantly, in past crises most, if not all, stakeholders’ interests were aligned in resolving the crisis and bringing about stability. Today’s “Tariff Wars”, however, are inherently non-cooperative, designed to prioritize certain stakeholders over others.

It would be wishful thinking to expect constructive cooperation among parties and a swift resolution to the situation. This suggests that a rapid restoration of trust is unlikely. Unfortunately, prolonged uncertainty and a lack of trust can breed deeper doubts, potentially culminating in widespread fear.

2. Effects

Trump’s trade policies are dismantling over six decades of global commercial and financial system integration at an unprecedented pace.

This abrupt disruption of intricately interconnected systems carries the risk of unforeseen consequences. Analogous to the destabilizing effect of minor disturbances on complex natural systems, such as small movements triggering avalanches, rapid alterations to global economic structures can lead to unpredictable outcomes.

While we tend to think that economic and financial systems can be “explained” exactly, planned and controlled, they are inherently complex systems which represent the aggregate actions of many participants. These participants may react unpredictably to disruptions, steering markets down unforeseen paths.

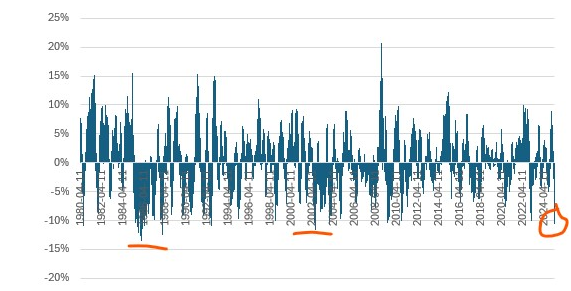

Although an immediate crisis in Treasury markets has been avoided and the VIX has receded somewhat, the US dollar continues its descent, with its biggest three month drop since July 2002, while gold’s rally is unstoppable.

Chart 1: 3 month return of Dollar Index since 1980

The path ahead is very uncertain and investors should expect volatility across asset classes both to the upside and downside.

3. Remedy

The most concerning aspect of the current crisis is the administration’s apparent lack of recognition or stated desire to remedy it, beyond increasingly pressuring the Fed for rate cuts.

Furthermore, this crisis is fundamentally one of eroded trust. The damage to investors’ (as well as foreign states) confidence is not fully reversible. Why? Because Trump’s administration has consistently shown that it can change its position. The USMCA, initially lauded as a landmark trade deal (negotiated under Trump 1.0), was subsequently disparaged as poorly negotiated. Trust is predicated on the respect of contractual agreements, which have been repeatedly undermined.

Even if the administration was to rescind all tariffs and attempt a return to pre-existing conditions, will markets’ trust be restored 100% to the pre-Liberation Day level? Would investors confidently dismiss the possibility of future policy surprises or poorly thought-out strategies? We believe the answer is no.

Conclusion: The Trust Factor

Where we are heading in the weeks and months to come is everyone’s guess. However, in the absence of certainty and in light of the “broken trust”, investors may find it useful to incorporate a “Trust Factor” in their investment process.

Price = (fair) Value x Trust Factor

Buying and selling decisions are inherently based on the perceived undervaluation or overvaluation of an asset, with each investor having their own framework and approach to valuation.

Historically, investors compared their valuation of an asset to its market price to see if it was a buy or sell. We suggest now applying a Trust Factor, which would take a value between 0 and 100% to one’s estimated fair value before comparing it to market price and taking an investment decision.

In the past, one trusted the US legal, contractual and financial system as the home of capitalism and assigned a 100% trust factor. Now, whether an investor thinks there are legal risks (e.g. tariffs, pharmaceutical regulations) or contractual risks (e.g. potential future taxation of foreign-held assets in the US), or other unforeseen regulations, that trust factor is not 100% anymore and unlikely to be restored anytime soon.

The outflows from US equities, the rise in US yields and other observed price behaviors are, to some extent, a function of this repricing of trust, and likely not over.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.