The “Trust Factor” in the Age of Trump’s Trade Wars

23 April 2025

Double shot of stimulus: Will a rate cut and tariff truce ignite the UK economy?

14 May 2025RISK INSIGHT • 7 May 2025

Carney’s cash play: Liberals’ surprise win and the price tag for Canada’s future

Harun Thilak, Head of Global Capital Markets NA

The federal Election held on April 28, 2025, has reshaped Canada’s political and economic landscape. The Liberal Party, led by Mark Carney, emerged with 168 seats—four short of the 172 required for a majority—forming a minority government. The result, which overturned early polls favouring the Conservatives, reflects voters’ trust in Carney’s economic credentials and his measured response to the trade tariffs imposed by US President Donald Trump. The incoming government’s programme, shaped by these external pressures and domestic priorities, will set the course for Canada’s economy and its public finances.

Turbocharging Canada’s economy

To offset the downturn threatened by US tariffs on key Canadian industries, the Liberals plan to adopt an expansionary fiscal stance. Their platform pledges substantial investment: C$25 billion for housing, a C$5 billion trade-diversification fund, and a C$2 billion strategic response fund for sectors hit by tariffs. These measures aim to reinforce domestic supply chains, safeguard manufacturing jobs and expand trade beyond the United States. They also promise to remove federal barriers to inter-provincial trade—reforms that could reinvigorate a flagging domestic economy.

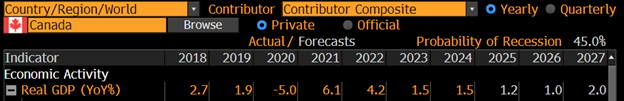

According to the Parliamentary Budget Officer, these programmes would push the federal deficit to C$62.3 billion—about 2 per cent of GDP—in 2025-26, up from the baseline projection of C$46.8 billion (1.5 per cent of GDP). While the stimulus is expected to provide a timely lift to growth, forecast to remain subdued over the next two years, fiscal discipline will be vital. Persistent and widening deficits could tarnish Canada’s standing in bond markets, inflate borrowing costs and erode investor confidence.

Source: Bloomberg

Bonds on the boil

The Liberal government’s fiscal expansion will inevitably ripple through bond markets. Funding the stimulus means issuing more debt, which is likely to push government bond yields higher—particularly at the long end of the curve. Recent experience in the United States shows how a sharp rise in long-dated yields can dent confidence in fixed-income assets and demand a higher risk premium. Investors should therefore watch Canadian long bonds closely, especially if deficits overshoot current forecasts.

Chart 1 : Canadian 10Y Generic Bond yield

Source: Bloomberg

Bank of Canada’s balancing act

While price stability remains the Bank of Canada’s core mandate, its decisions will be coloured by the government’s fiscal plans. The Bank paused in April after 200 basis points of cumulative cuts since June 2024, awaiting the election outcome. With a Liberal victory—and stimulus expected to soften the downturn—the Bank may tread carefully before delivering the further 50 basis points of easing still priced in for 2025. A less aggressive cutting cycle could, at the margin, lend support to the Canadian dollar.

Loonie on the loose

The Canadian dollar has held steady since the election, reflecting confidence in Mark Carney’s economic credentials, his measured stance towards President Trump, and the belief that a minority government will keep fiscal policy in check. If the stimulus remains balanced and helps lift growth, the Bank of Canada can stay less dovish, underpinning the currency.

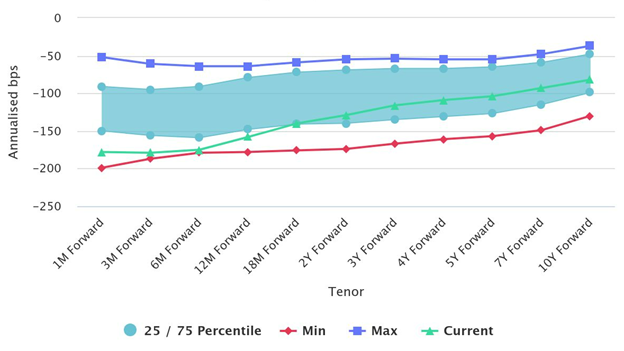

The chief risk to this narrative is a widening deficit that spooks investors and triggers capital outflows. USD-based investors worried about potential CAD weakness can hedge via FX forwards, where carry remains attractive.

Chart 2 : USDCAD FX Forwards Carry Cost (in annualized bps)

Source: Bloomberg

The stakes for Canada’s economic future

Mark Carney’s Liberal victory sets Canada on an ambitious path: using fiscal firepower to counter US tariffs and domestic headwinds. The plan should provide short-term support, but its long-term success will depend on disciplined execution—diversifying trade and containing the deficit. The government’s ability to deliver on that promise will shape Canada’s economic trajectory for years to come.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.