Warsh at the helm: restoration, not reinvention

5 February 2026RISK INSIGHTS

Sterling stutters as Starmer struggles

By Validus | 12 February 2026 | 5 min read

Marc Cogliatti, Global Capital Market Director

After a strong showing in the second half of January - aided by better-than-expected UK data - the pound came under pressure last week as political uncertainty weighed on sentiment. Keir Starmer’s future as UK Prime Minister was once again thrown into doubt following the latest release of the Epstein files, with the decision to appoint Peter Mandelson as UK Ambassador to the United States called into question given his prior relationship with the convicted paedophile.

Over the weekend, Morgan McSweeney - Starmer’s Chief of Staff - resigned, having been instrumental in Mandelson’s appointment. However, many commentators are still calling for Starmer to take ultimate responsibility.

Key takeaways:

- Sterling’s January momentum has faded as renewed political scrutiny revives the leadership debate and spooks bond markets.

- A surprisingly dovish tone to the recent BoE meeting may nudge interest cut expectations forward.

- Cross-currents still matter: a softer USD, net-short positioning leaves scope for short-covering rallies, and upcoming UK data could quickly tilt the cuts narrative more bearish.

Lurch to the left – or the centre?

The current concern for markets is who would replace the Prime Minister if he were to go. Angela Rayner and Ed Miliband are amongst the bookies’ favourites - but a lurch to the left wouldn’t go down well with bond markets. In this scenario, we would likely see further downside pressure on sterling and a steepening at the long end of the yield curve amid concerns about increased public borrowing. In contrast, Wes Streeting or Shabana Mahmood have been touted as more centrist options. This may prompt a positive impact on the pound, even if it’s just a relief rally.

For now, at least, Starmer’s “not prepared to walk away”. His stance - accompanied by support from senior members of the Labour party – has provided some reassurance to markets. While it’s not beyond the realms of possibility, it seems unlikely that we’ll see a challenge from one of the sitting MPs – particularly given >20% of MPs are in support. Equally, Starmer standing down also appears remote. That said, given the recent precedent of UK Prime Ministers standing down, it should not be ruled out.

BoE surprise: a tighter vote nudges cut expectations forward

If political instability wasn’t enough for sterling to bear, last week’s Bank of England decision had a surprisingly dovish tilt to it. Holding rates at 3.75% was widely expected, but the 5-4 split vote was notably tighter than the 7-2 split economists expected, suggesting that the next cut could come sooner than previously anticipated. Prior to the meeting, markets had ~38bps of cuts priced in for the remainder of 2026 (effectively 1.5 x 25bps cuts). Fast forward to today, the market is pricing ~45bps of cuts (i.e. much closer to 2 x 25bps) with the first coming in either March or April and a second most likely in Q4.

Cross-currents to watch

Given the factors above, the near-term risks to sterling appear tilted to the downside. However, a few additional points matter:

- USD matters too. While sterling has come under pressure against the euro, it has recovered well against the dollar, reminding us that there’s two sides to the coin when it comes to currencies. The dollar has its own issues stemming from capricious politics and an uncertain monetary policy outlook, which may continue to dominate for now.

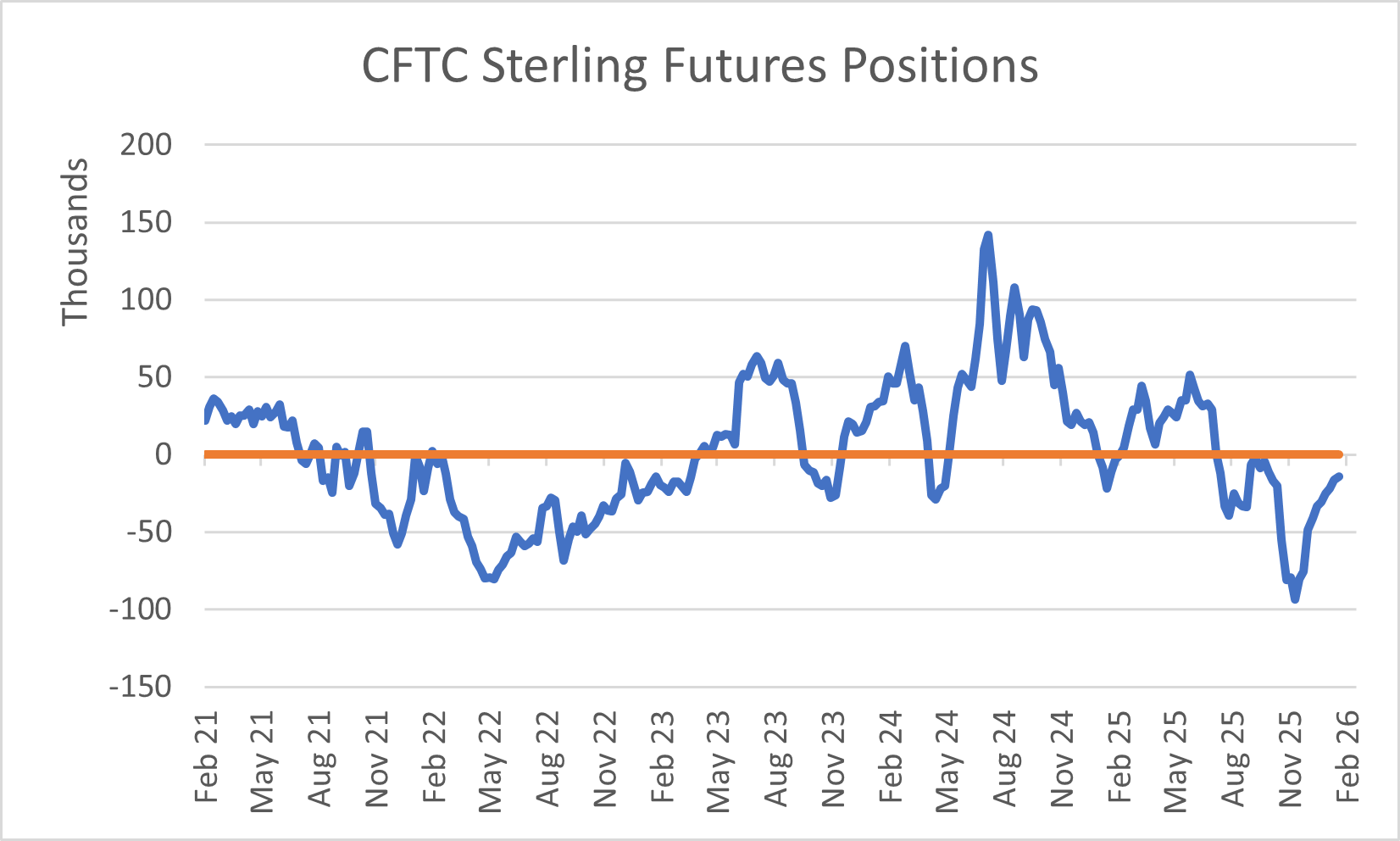

- Positioning is still a swing factor. Recent data from the CFTC (see chart below) is still net short GBP - although not as extreme as we were in December. While it’s entirely possible for a larger short position to build again, if fears fail to materialise, there is scope for GBP to rally as shorts are covered.

- Upcoming data could complicate the cut narrative. As mentioned above, UK data was surprisingly good in January, suggesting that the need for additional rate cuts may not be as pressing as previously thought. Whether it’s stickier than expected inflation or potential green shoots of growth, it probably wouldn’t take much to tilt the BoE committee back towards keeping rates unchanged for longer.

Overall, we see no reason to change our forecast at this stage and continue to expect sterling to outperform the dollar but remain sluggish against the euro.

Chart 1: CFTC Sterling Futures Positions

Source: Bloomberg / Validus