From Big Ships to Black Swans

30 March 2021

Beware The Right Tail

6 April 2021INSIGHT • 4 May 2021

Not out of the woods: Covid risk subsides but the foundations of a ‘market melt-up’ scenario remain

Kevin Lester, CEO

Every month, Bank of America publishes its Global Fund Manager Survey (FMS), asking over 200 institutional investors, who collectively manage over half a trillion dollars in assets, to provide their views on the global markets. Since April of last year, until now, the biggest ‘tail risk’ that these fund managers have highlighted has been, unsurprisingly, the coronavirus (before that it was the risks around the US presidential election which dominated investor’s thoughts).

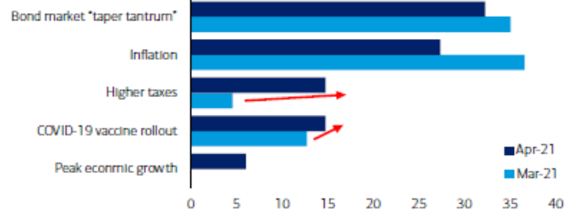

However, the recently published April 2021 survey has shown that, perhaps buoyed by the success of vaccine roll-outs in the US, investors are now less concerned about the impact of the virus on markets, relegating COVID to fourth place in their list of potential ‘tail risks’. Investors are now more worried about interest rates / the bond market (32% ranked this as the number one tail risk), inflation (27%), and even higher taxes (15%).

Chart I: What do you consider the biggest ‘tail risk’?

Source: BofA Global Fund Manager Survey, April 2021

We covered the issue of tax rises last week, and while it is clear that the prospect of big increases in US taxes will create a headwind for equity prices, I would not classify it as the biggest risk currently facing financial markets. This view seemed to be reflected in the markets themselves – while the S&P 500 declined following Biden’s announcement, equity markets quickly clawed back their losses and the overall market impact was minimal.

However, I would be inclined to agree that some combination of the first two factors - rising inflation and bond market turmoil – is the biggest risk facing financial market participants. Technically speaking, I would not even classify this as a ‘tail risk’, which is often taken to mean a three standard deviation move (or a risk with a 0.3% chance of occurring).

Rather, I would see this as a manifestation of our ‘market melt-up’ scenario, which we recently upgraded to our ‘expected’ market outcome with a 60% probability.

So, what would be the be the likely implications for these risks on FX markets? First of all, it is important to emphasize the fact that these risks are not mutually exclusive. In fact, the opposite is true – they are likely to occur together, with rising inflationary pressure leading to a bond market exodus which pushes interest rates higher, as described in the market melt-up scenario.

According to the April FMS, inflation expectations are now at all-time highs, with 93% of fund managers expecting higher inflation over the next 12 months. As a matter of fact, the April survey represented a shift from investors expecting ‘above-trend growth and below-trend inflation’ to now expecting above-trend growth and above-trend inflation (see chart).

Chart: Fund Manager’s expectations on growth and inflation

Source: BofA Global Fund Manager Survey April 2021

In the above chart, the dark blue line can be seen as a proxy for our ‘market melt-up’ scenario, while the light blue line can be seen to represent our ‘benign inflation’ scenario. Currently, 57% of fund managers expect the first outcome, compared to only 28% who now expect the ‘goldilocks’ outcome of high growth and low / stable inflation. It is also worth highlighting that this expectation is quite rare; on only two previous occasions (March 2011 and December 2016) have fund managers been expecting a high growth / high inflation scenario.

Over time, we expect this to evolve into a situation where inflation moves / stays higher while interest rates do not, as rates become increasingly subject to Fed intervention (e.g. yield curve control). This outcome would be bearish for the US dollar in the medium to long term, although in the very short term we would likely see some dollar resilience due to higher US yields. So far in 2021, this scenario has been playing out largely as we expected it would.

It is also possible to envision a bond market ‘taper tantrum’ without higher inflation. This would occur if inflationary pressures proved transient (as both Powell and Yellen have claimed), but markets became spooked by the scale of US fiscal largesse. This scenario is harder to read from an FX perspective – on the one hand, you would expect the dollar to decline if investors are becoming nervous about the sustainability of US fiscal policy. On the other hand, this is classic ‘Risk Off’ territory, which tends to be good for the dollar.

So, what do fund managers think about the FX markets themselves? Well, the bearish dollar thesis seems to be losing support, with only net 17% of respondents seeing the dollar as ‘overvalued’, which is the lowest level since August 2018, and down from over 50% last year. The view on the euro is even more balanced, with the same proportion viewing the single currency as overvalued as those who think it is undervalued (net 0%). In other words, which ever way the markets move, there will be a lot of surprised investors! In a market like this, with building macroeconomic risks and a lack of FX market consensus, it is more important than ever to carefully monitor (and, where appropriate, hedge) the FX risk exposure in your portfolio!

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.