Ep 3: The Smarter Way to Manage Fund Finance

11 December 2025

Validus’ 2026 Risk Outlook

14 January 2026RISK INSIGHTS

Endgame in Ukraine: Real Progress, Real Results?

By Validus - 18 December 2025

Harry Woolman, Global Capital Markets Associate

“Over the past two days, Ukrainian-U.S. negotiations have been constructive and productive, with real progress achieved” - Rustem Umerov, secretary of the [Ukrainian] National Security and Defense Council, 15th December 2025 via X.

Where we were, where we are

On 24th February 2022, Russian forces moved into Ukraine across four fronts, one from Belarus and three from Russia, igniting the largest and bloodiest conflict on the continent since World War II. The incursion ushered in a redrawing of the European map and cast doubt on established international law and order.

Some 1,391 days later (at the time of writing), and the ensuing four years have been tumultuous to say the least. Billions of dollars of funding for Ukraine, dozens of failed peace agreements and aggressive, supply-side inflation that has been the bane of global policymakers. Early 2025 witnessed great progress to bring about peace in Ukraine – the Anchorage and Istanbul summits spring to mind – yet both yielded little success. However, Umerov’s comment in the opening gambit of this note suggests real cause for optimism. Might it really be different this time?

Security stalemate: deadlock broken?

What began as a 28-point peace plan brokered between the US and Russia at the end of November, absent Ukrainian stakeholders, has since been condensed into a 20-point doctrine, compiled with continental powerbrokers such as Friedrich Merz and, of course, Ukrainian President Volodymyr Zelenskyy.

Historical sticking points have centred around territorial concessions – whether along current battle lines, per the European position, or the broader Donbas region, per the Russian position – as well as the ceding of NATO ambitions by Ukraine. The latter appears to have been assuaged, although still firmly up for negotiation, with the US and European Union reportedly offering security guarantees akin to NATO’s Article 5 in all but name. Recent developments also suggest the US has promised Zelenskyy that any such guarantee will be subject to Congressional vote, thus becoming legally binding.

Russian Deputy Foreign Minister Sergei Ryabkov has reaffirmed his country’s territorial demands – per the above – although he was also quoted in an ABC interview that he was “very confident” the conflict was nearing its end. Clearly, there are still some critical territorial elements to be hashed out.

Financing the future

Whilst most of the recent headlines have focused on the sanguine rhetoric around security guarantees and territorial concessions, discourse will invariably pivot to financing Ukraine’s rebuilding – or, in the worst-case event of a conflict prolongation, support for its military.

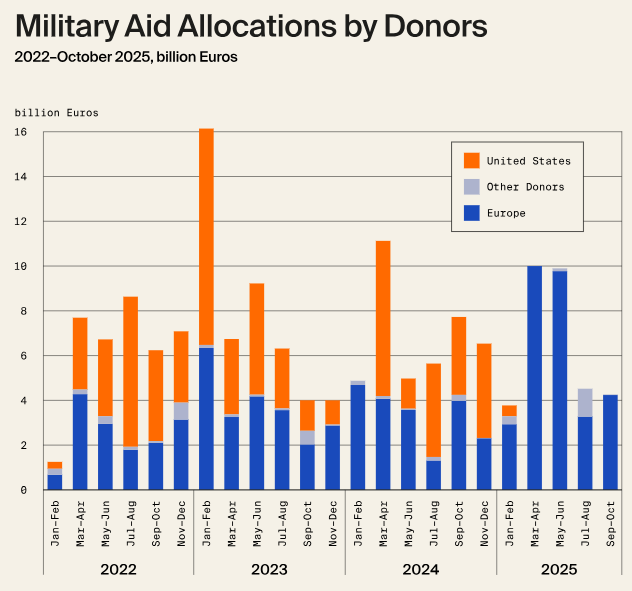

The US President’s inauguration in January correlates negatively with US donations to Ukraine in any capacity, notwithstanding the fraught tri-party White House meeting between Trump, Zelenskyy and JD Vance in February. As such, Ukraine has had to lean on alternative sources of funding from its closest neighbours – something that has fallen short in the second half of the year. More concerningly for Zelenskyy and co, if you strip out donations from the “Nordic Four” nations, the contributions from the rest of the continent are relatively minimal. All told, economic and military aid to Ukraine in 2025 is running approximately €9.1billion below the annual average from 2022-2024.

Where, then, does alternative funding come from? The provision of credit to Ukraine has been touted for months, with security for the lenders coming in the form of seized Russian assets. However, this avenue seems to have been closed in recent days, amid concern from several EU member states about legal liability in the event of any [future] peace deal. Belgium – where the largest share of frozen Russian assets are held – has been most vocal on this point, with their concern justified on 15th December after the commencement of legal action by the Bank of Russia against Euroclear. A deal between both sides, therefore, has taken on heightened precedence in recent days.

Source: Kiel Institut, Ukraine Support Tracker

Macro Matters

European and US politicians will not be the only parties scrutinising developments from the latest round of negotiations between Ukraine and Russia, as monetary policymakers wait with bated breath to ascertain whether a key inflationary risk will gradually fall away.

The onset of war saw a dramatic spike in commodity prices, with Brent oil jumping above $120/barrel for the first time in over a decade, as supply concerns rattled markets, whilst the EU had to pivot away from by far their largest supplier amid the introduction of Russian sanctions. Commensurately, the compounded effect of conflict and supply shocks saw inflation reach the highest level for several generations, topping 11% in the UK, for example.

Source: Bloomberg

Nowadays, inflation is at or nearing the much-vaunted 2% target across numerous developed market (“DM”) economies, in part aided by the fall in oil prices (reduction in supply side shocks for central bankers) over the last 18-months. A deal may give the impetus for another leg lower in oil prices, in turn assisting DM central banks – less Japan – in normalising policy; thus, kickstarting a swathe of economic growth, in the most optimistic of circumstances.

This is particularly true in Europe, whose proximity to the conflict has been a major hinderance to economic output for the preceding three years. Although myriad obstacles still remain – a French budget agreement, mobilising of German capital – there finally appears to be light at the end of what has been a particularly bleak tunnel.

As the US President has openly stated, a deal is “closer than ever” – let’s hope this time around, for everyone’s sake, he’s right.