Hawkish Fed steps on the gas

22 June 2021

A turning point for the dollar?

7 July 2021INSIGHT • 29 June 2021

Forecast: Sunny Markets with a Risk of Delta Clouds

Kambiz Kazemi, Chief Investment Officer

Over the last few months, the successful progress of vaccination campaigns has been welcome news to all of us who have the privilege to benefit from them (in the US, UK, Canada, and EU).

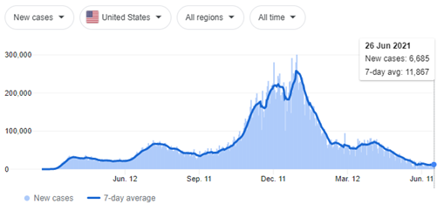

The economic recovery is solidifying, with strong incoming data and indicators. From a healthcare perspective, the US (46.4% of its population fully vaccinated) has seen a massive drop in the number of new cases, with life starting to have a pre-pandemic flavour in some parts of the country.

Number of new daily Covid cases in the United States

Source: New York Times

In fact, the strength of the recovery and the performance of risk assets is such that the Federal Reserve, to the surprise of some, changed its very accommodative tone and signaled that it is “time to start thinking about thinking” about tapering, in its June meeting. While we all hope for brighter days, and a continuation of this constructive trend after nearly 18 months of hardship (which has taken a toll on economies, individuals, and nations alike), it is important to remain alert – without being alarmist – and abreast of new developments.

The continuous global spread of the Delta variant, which first appeared in in India during October 2020, is 40%-80% more transmissible than the Alpha variant and is worth monitoring closely as we move through the summer.

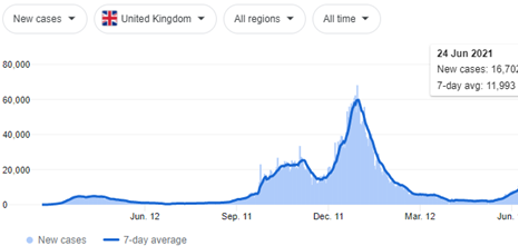

The UK, despite being at 48.4% of total vaccination, has decided to delay the lifting of its remaining restrictions in light of the spread of this Delta variant. New infections reached a daily high not seen since February 2021, on June 26th, and weekly cases have increased ~50% over the previous.

Number of new daily Covid cases in the UK

Source: John’s Hopkins University

Israel, the world leader with a ~57% vaccination rate, just a few days ago reported an outbreak believed to be due to the Delta variant, which has also infected vaccinated adults. The country has reimposed mandatory masks indoors and reconvened its “coronavirus cabinet”.

In Portugal, the Delta variant has recently become an issue in the Lisbon area and, despite travel restrictions imposed for those who wanted to exit the city, the variant seems to continue spreading and some are concerned about a further spread into EU.

Here are four points that may be helpful in framing where we are and how to think about the potential impacts of the Delta variant:

- It is not all bad news but will be challenging. Various studies show that vaccines remain effective against the Delta variant albeit less than on the Alpha variant. The Pfizer-BioNTech vaccine remains ~88% effective and the AstraZeneca at ~60%, with hospitalization avoided in over ~90% of cases. On the flip side, a single dose vaccine has roughly a 30% level of effectiveness. This means that vaccine roll-out methodology and speed are key. Jurisdictions that have increased the delay between the two doses (UK, Canada, and EU) have already reacted by accelerating the administration of the second doses. They risk an outbreak within both the non-vaccinated and single dose vaccination populations.

- To avoid new waves, a high rate of vaccination is required. Given the transmissibility and virulence of this new strain, high vaccination rates will be needed to avoid massive outbreaks which could saturate, once again, the healthcare system and hinder normal society wide activity.

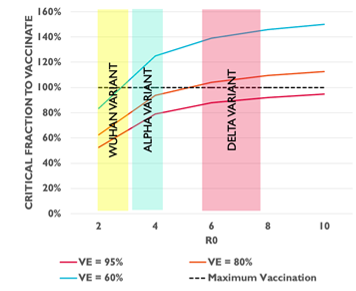

The chart below (courtesy of Dr. Fisman from the University of Toronto) shows the mathematical relationship between vaccination effectiveness (VE) and the % of a population which need to be vaccinated to stop the spread of the virus (i.e. herd immunity). With the original strain and highly effective vaccines, such as mRNA vaccines, a ~70% vaccination rate could have achieved herd immunity. But given the high transmissibility of the Delta variant (R0 of 6 to 8):

a. Herd immunity can not be achieved by using a vaccine with low effectiveness in any case (as we can not vaccinate more than 100%)

b. Even with a highly effective vaccine, nearly 90% of population needs to be vaccinated to reach herd immunity.

Vaccination rate needed for heard immunity, as a function of vaccine effectiveness & Covid19 variant

Source: Twitter - DFisman

3. Return to work and return to “normal” just got very complicated.

While the high vaccination rates have allowed many corporations and institutions to contemplate and engage in plans for a return to some new version of pre-pandemic normal, those plans will be very much affected by the advent of this new variant.

In particular, its high transmissibility and the fact that it can potentially infect vaccinated people (as data unravels over the next few weeks) means that:

Indoor settings and activities in a new “normal” will require restrictions on density and are likely to be limited. Think: back to work, back to school and the many types of challenges we had with the original strain: entertainment industry, sports, etc. are not likely to resume “same as before”.

4. Tolerance function of societies has likely changed.

Generally speaking, the masses are likely to be less receptive to the type of restrictions which were imposed on them in 2020 and early 2021. Additionally, the economic costs of such restrictions would be too high for both governments and societies.

This means that policy makers are well advised to think about what is ahead of them in the months to come, within a new framework: that of the simultaneous optimization of economic activity, the management of any strain on their healthcare system, and social obedience/harmony.

Using the same tools and methods that have been used so far will prove insufficient and likely to be less efficient at best and may create upheavals in compliance and social discontent at worse.

Conclusion

Financial markets proved particularly resilient post-pandemic and once the prospects of a strong recovery started materializing, risk assets continued to perform handsomely.

The Delta variant will result in a number of challenges, some of which were mentioned above.

For developed countries, the spread of the new variant will likely not alter the recovery narrative albeit it is very likely that it will be tamed in many regards as the return to normal will either be slowed or halted. In turn, this means that some of the economic progress and the constructive price action of markets in recent months, could be stopped or even reversed. In such a scenario, central banks would likely reaffirm their accommodative stance, with the Fed potentially backtracking on its recent change of tone.

It is also important to remember that only a limited number of developed countries are well advanced in their vaccination campaigns and many emerging markets have used vaccines that have lower effectiveness and will be vulnerable to outbreaks of the Delta variant, bringing them back to the difficult situation of the past and the challenges that come with facing new waves. This would likely once again affect, to some extent, the global supply chain networks and geography sensitive industries such as tourism.

One should follow closely how the Delta variant evolves in the next 6 to 8 weeks, as it will provide key insights as to how things might look for economies and societies in Q4/2021. We live in an ever-changing world where positive developments, like a fast Covid test with high reliability, could be a game changer, while a new deadlier variant would have the opposite effect.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.