Stimulus, policy divergence and inflation

20 July 2021

Why Currency Risk Matters (to everyone)

9 August 2021INSIGHT • 3 August 2021

Will the BoE beat the Fed in the race to raise interest rates?

Marc Cogliatti , Principal, Global Capital Markets

We have discussed inflation at length in recent months and come to the inevitable conclusion that central banks across the globe, particularly those with developed economies, will be forced to tighten monetary policy in the coming years to prevent rising prices spiralling out of control. The big question on our minds: how does this impact currencies and what does it mean for clients hedging FX risk?

Bank of England

The Bank of England’s Monetary Policy Committee (MPC) are set to announce their latest decision on the base rate (currently 0.10%) and the asset purchase target (£895bn) on Thursday this week. Unsurprisingly, the committee is widely expected to keep the base rate unchanged, but we may well see some debate over the asset purchase programme. In recent weeks, Michael Saunders and Deputy Governor, Dave Ramsden, have voiced their concerns about a rise in inflation and the risk of CPI remaining above target over the next 2-3 years. As a result, we may well see one, even or both, vote in favour of cutting the asset purchase target.

However, most of the committee are expected to maintain a cautious stance and vote to keep policy unchanged for the time being. Both Ben Broadbent and Gertjan Vlieghe have cautioned against tightening policy too quickly, particularly timely given the latest data showing a pull back in consumer spending. Whether this is the start of a shift in consumer sentiment or just a blip in what has otherwise been a strong rebound in retail sales remains to be seen, but at the very least, there is clear justification for the committee to maintain the status quo for the time being. Nevertheless, the market is currently pricing in the first rate hike from the MPC in June 2022.

Federal Reserve

During the first quarter of 2021, market chatter has centred around the timing of the Fed’s ‘lift off’ amid rising inflation. With US CPI hitting 5.4% in June, its highest reading in nearly 13 years, tighter policy may be inevitable. However, as is often the case, the question is one of timing. Broadly speaking, the Federal Reserve have talked down fears of rising prices, referring to inflation as transitionary as opposed to structural. The latest message from the Fed, last week, was inconclusive but implies that the committee is set to tolerate rising prices for a little while longer.

Consequently, the prospect of the Fed tapering its asset purchase programme this year remains remote with H1 2022 looking more likely. Meanwhile, the Fed’s forward guidance suggests that the committee will not begin raising rates until 2023 (although the markets suggest that the latter stages of 2022 should not be ruled out).

So, what can we conclude when thinking about things from a hedging perspective?

Firstly, when thinking about spot rates, conventional wisdom suggests that currencies typically benefit from expectations of higher rates. This was evident with the dollar in Q1 where the US currency outperformed its peers amid a rise in nominal rates (the yield on the US 10-year Treasury Bond rose from 90 bps to 174 bps during the first quarter). We have seen a similar scenario for sterling, where increased talk of a rate hike has kept the pound relatively firm (note: GBPEUR sits towards the top if its recent range, while the impact of a strong dollar has been nullified in GBPUSD). Longer term, whether the dollar can stand its ground amid rising inflation (resulting in a fall in real rates) remains to be seen, but we see a risk that it will weigh on the US currency (in line with our ‘market melt-up’ scenario).

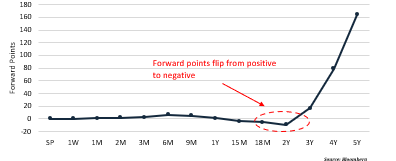

Secondly, we are seeing a notable change in the forward market with the 2-year forward adjustment in GBPUSD flipping between positive and negative as interest rate expectations shift. With the market now pricing in a hike from the Bank of England in mid-2022, but less expected from the Fed until 2023, the likelihood is we will see UK rates higher than US rates in the short term. For a dollar denominated fund hedging a sterling asset, this means there is now a small cost (excluding credit charges) as opposed to hedging having a positive impact, as in recent years. The opposite is then true for a sterling fund hedging dollar assets.

Chart 1: GBPUSD Forward Points

Source: Bloomberg

Further out, the Fed are still expected to raise rates faster and beyond where the Bank of England are likely to halt, and thus the GBPUSD forward points flip back into positive territory as we move towards the 3-year mark.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.