The tale of two central banks – a new dynamic with UK and US rates

25 September 2024

Has Sterling’s Bull Run Come to an End?

9 October 2024INSIGHTS • 2 OCTOBER 2024

Dealmaking and volatility are on the rise, PE firms must manage risks to seize opportunity

Ron Pathak, Event Driven Sales Lead

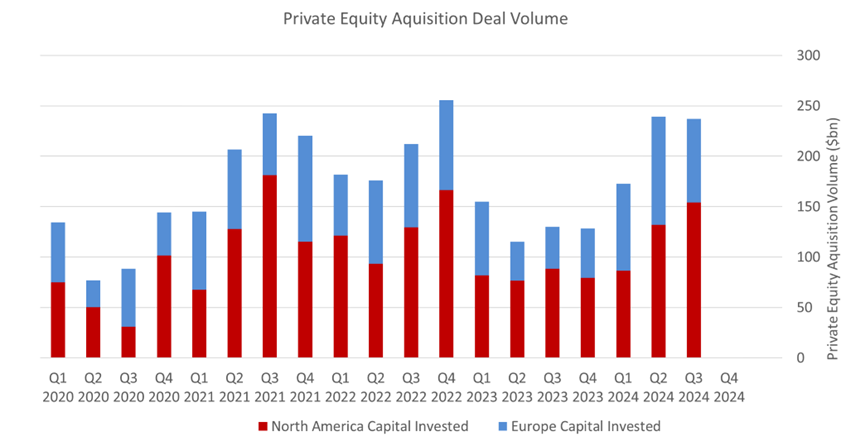

All change: a new economic environment is boosting M&A but stirring volatility, proceed with caution. Private equity dealmaking is making a roaring comeback in 2024. In recent reports, CVC disclosed a significant uptick in acquisitions and investments in H1 2024 (a 63% rise in deployments compared to H1 2023): This is a reflection on a broad return of confidence to the sector. Additionally, secondary market activity is also up considerably, providing much needed liquidity to the primary. Blackrock expects secondary deal volume to surpass the previous record set in 2021 with circa $140bn closing in 2024.

This resurgence comes after a period of relative stagnation, with market uncertainty, rising interest rates and limited exit liquidity over the recent years putting the brakes on many large new deals. Now, renewed activity in the sector points to a revitalized appetite for risk and opportunity. This is further supported across the broader market by LSEG data stating that there has been more than $200bn of private equity cross-border M&A transactions announced in 2024 YTD which is a significant increase on 2023.

However, this resurgence in private equity comes alongside growing volatility in foreign exchange. The GBP/USD and EUR/USD currency pairs have experienced pronounced fluctuations in recent months, exacerbated by global economic instability, changing central bank policies, and geopolitical tensions.

Adding to the uncertainty, interest rate volatility has swung back into sharp focus. As central banks, including the Federal Reserve, The Bank of England and the European Central Bank, navigate the transition from managing inflation to managing economic stability. This has placed significant pressure on borrowers and financial institutions that rely on stable interest rates for long-term planning.

These wild swings have made FX and IR risk management a top priority for companies and investors alike, who are subsequently exposed to deteriorating deal economics and potential losses. Not surprisingly, the renaissance in private equity mergers and acquisitions (M&A) has led to a notable increase in the use of deal-contingent hedging as firms seek to mitigate these market risks: The ‘go-to’ hedging instrument for private equity allows deal makers to hedge against currency and interest rate fluctuations without incurring costs if the deal falls through.

As liquidity and fixed income markets recalibrate, Validus is here to assist clients manage their risks effectively and seamlessly. As private equity, FX, and interest rate markets all experience a revival in activity, prudence and preparation remain the watchwords.

Chart 1: Private Equity Acquisition Deal Volume

Source: Pitchbook Data Inc, Sep 2024

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.