FX Hedging in China – Risks are Rising for Private Equity Investors

12 October 2021

Is inflation out of control?

26 October 2021INSIGHT • 19 October 2021

Volatile markets are just beginning

Shane O'Neill, Head of Interest Rate Trading

We have spoken numerous times about the risks embedded in the rates markets as we come out of the COVID-induced recession, but this cycle is without modern historical reference, and appears to be moving very fast, giving rise to a huge increase in market volatility and all the concerns which accompany it.

The speed of the recovery and the, well documented, increase in global inflation figures have put central bankers in a difficult position – do they tighten immediately, and if so, by how much?

The UK sits in the eye of the storm with inflation expectations at generational highs, driven by pent up demand and, increasingly, from supply side constraints. The market reaction has been a huge repricing at the front end of the curve, with the base rate now expected to be over 1% by September 2022. This has led to the largest quarterly move in 2-year GBP rates for a decade, a decade that included huge events for GBP markets – most notably, Brexit.

It’s not over yet

Though a huge move, there’s plenty of reason to believe it is far from over. This large repricing comes amid significant fiscal tightening – furlough schemes recently ended, tax hikes are on the horizon and, universal credit is being reduced. The Bank of England has yet to receive a single post-furlough employment data point, and should it be determined that the economy isn’t ready for hikes, the move could be retraced even quicker than it was established.

Or worse, the Bank of England hikes into an unready economy and a double dip recession becomes a real possibility – the market certainly thinks there is a chance. The difference between 2-year swaps and 10-year swaps is often watched as a bellwether for growth expectations, and, historically, a negative “2s10s curve” has preceded times of little to no growth, even recession. The 2s10s curve in the UK had one of its most volatile weeks of the decade over the last week – falling over 40bps and now hovering only 10bps above the important 0% barrier.

Chart 1: GBP 2s10s Curve

Source: Bloomberg

Of course, it may also come to pass that the UK economy is ready and in need of higher rates – the terminal rate in the UK could end up considerably above the 1% predicted for September 2022. In this scenario we can expect far higher long-term yields. If the difference between 10y swaps and the base rate remains where it is today, then by September 2022 we can expect 10y swaps at no less than 2.5%.

Cost of hedging remains favourabl

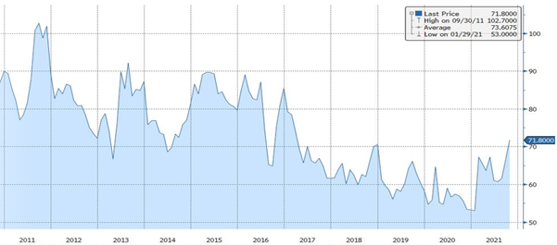

With the prospect of sustained volatility ahead, it is only natural to assume the cost of hedging should increase – and though it has, the increase is less than one would expect. Looking at implied volatility, or the cost of an option, as a proxy for the cost of hedging – we can see that although it is climbing, it is still comfortably lower than it was for the first 5 years of this decade – for both 10-year and 2-year swaps.

Chart 2: Implied volatility for a 1-year option on a 10-year swap

Source: Bloomberg

Significant stress stretches from UK to US

The volatility discussed here won’t be localised to one country or one product over the coming months. In the US there are already signs of significant stress – last month we watched 2-year rates more than double and the hiking cycle is only just beginning. During the cycle from 2016 – 2018, 2-year rates more than quadrupled. Similarly, the FX market is not going to be immune. GBPEUR has appreciated over 2% in less than a month and central bank policy continues to diverge.

As risk managers our primary job is not to call a direction of travel for rates or FX, but rather to identify the risks and manage them in a cost-effective way. Unprecedented markets will lead to unprecedented volatility – late movers will be caught out and the costs will be significant. The options market indicates that significant hedging is already under way but there is plenty more to be done. The macro risks are there for all to see, now is the time to be an early mover and to hedge your macro exposures.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.