ECB’s Pivot in Stance and What it Could mean for the EUR

26 April 2022

A new world order: can the dollar defend its global reserve currency crown?

6 May 2022INSIGHT • 3 MAY 2022

How low can the euro go?

Marc Cogliatti, Principal, Global Capital Markets

Chart 1: US Dollar Index 2000 – 2022

Source: Bloomberg

Arguably the dominant theme driving the dollar higher is risk aversion, not only from the crisis in Ukraine and nervousness about Putin’s next move, but also China’s response to its latest COVID outbreak. The economic impact continues to be felt across the globe, but particularly in Europe and surrounding countries which are highly dependent on Russian energy. As the war over control of the Donbas region intensifies, Putin’s threat to target those who are supporting Ukraine is keeping everyone nervous.

While risk sentiment is undoubtedly the main driver for the dollar right now, interest rate expectations are still a key consideration. Last week, a number of FOMC members sounded a hawkish tone – Daly stated that a couple of 50bps hikes are likely, Bullard wouldn’t rule out a 75bps hike and Powell reiterated that many in the FOMC are in favour of one or more 50bps hikes. The net effect was a repricing of the curve, with even more hikes priced in and as highlighted last week in our Rates Insight piece, we are now expecting 50bps in each of the next 3 meetings (beginning tomorrow) with a total of 270bps priced in for 2022.

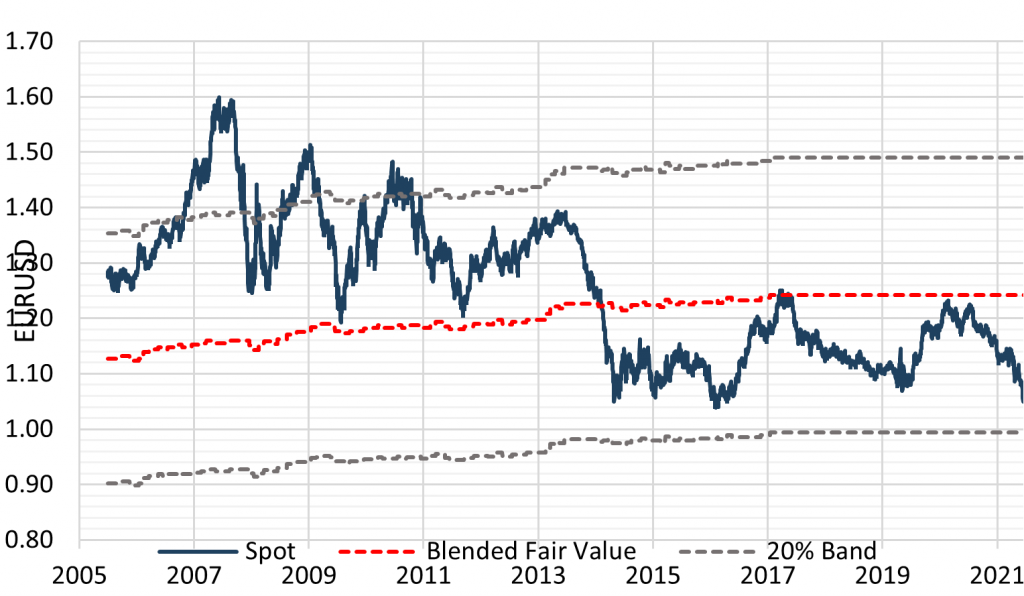

At this stage, given recent momentum, it’s hard to envisage a swift recovery any time soon, especially with tensions in Ukraine showing no sign of abating. However, with the euro now 17% undervalued (or the dollar being 17% overvalued) we’re fast approaching a level of deviation from fair value that is rarely sustained for long. In fact, last time the pair was +/- 20% from fair value was back in 2010 and when the market was ~22-25% overvalued for a few months before it corrected back lower (see chart below).

Chart 2: EURUSD Purchasing Power Parity Valuation

Source: Bloomberg

With this in mind, we still see downside risk to EUR/USD in the short term, but over the medium to longer term, we see plenty of scope for a recovery and a move back towards fair value later this year. Clearly the obvious risk for now is that tensions between Russia and Ukraine escalate and other nations are brought into the fold.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.