Canada and the US – diverging policies, diverging economies

2 December 2022

The mirror of the error – The road ahead for the Fed

14 December 2022RISK INSIGHT • 7 DECEMBER 2022

Impacts of the Chinese economic slowdown on the global economy

Ali Jaffari, Head of Capital Markets, North America

China’s zero-COVID policy regime and resulting political unrest has raised ongoing concerns about the state of its economy and potential widespread economic impacts. Domestic activity in China is undergoing significant challenges, resulting in weak economic data. The Chinese Renminbi (CNY), for example, has been one of the weakest performing Asian currencies this year, depreciating approximately 10% versus the USD. The spillover effect this may have on the global economy is a key risk to consider.

China’s economic outlook remains vulnerable as the state continues to experience lacklustre growth: the property market is in a slump, manufacturing and production levels are coming in below estimates, and export demand is fading. Headwinds persist, despite the PBOC’s efforts to boost economic activity via fiscal measures and looser monetary policy, leaving risk to the CNY slated to the downside.

Last week’s protests in China and, more specifically, President Xi Jinping’s indication that the state will loosen its zero-COVID policy, were met with positive market sentiment. The change in policy signaled further economic support, easing of supply chains restrictions, and a pickup for global growth. As a result, equity markets rallied, and the risk-on tone led to further USD depreciation. However, there remains a considerable amount of pressure with a lengthy recovery process; volatility in the region is likely to persist.

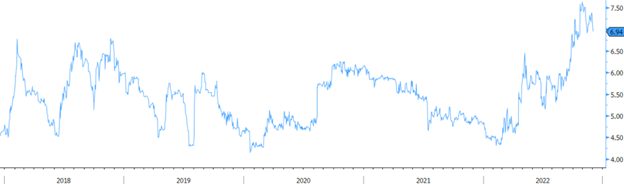

CNY volatility has historically been low compared to other emerging market pairs. Over the last year, however, there has been a steep rise in CNY volatility driven by ongoing uncertainty in the region (see Chart 1). Despite the PBOC’s intervention efforts, there has been little reprieve.

Chart 1: USD/CNY 1Y Implied Volatility

Source: Bloomberg

October’s trade data saw an import decline of 0.7%, with the market expecting a further 6.7% decline in November, signalling the extent of the negative impact of China’s zero-COVID policy on the economy. Deteriorating growth out of China will put pressure on nations reliant on export flows to the region. Economies where Chinese demand constitutes a significant element of their overall trade balance include the US, Germany, Japan, Australia, and Canada. Asian nations proximal to China are also facing a considerable slowdown.

European exports to China are significantly lower this year. In Germany—Europe’s largest economy—waning Chinese demand is having a detrimental effect on the state’s industrial production. China is Germany’s second largest export market after the US; a slowdown in trade flows adds to deteriorating economic conditions in Germany, where the state already on the brink of a recession.

Furthermore, commodity markets reliant on Chinese demand are volatile, with iron ore, oil, coal, copper, and other agriculture-based commodities significantly reacting to shifts in Chinese GDP. Recent calls for a move away from a zero-COVID policy saw select commodities surge, with iron ore closing at its highest level in three months. With global recessionary fears underway, a boost in export revenue will certainly support respective commodity-backed currencies in the near term.

Broad USD strength served as a catalyst to the appreciation seen in the USD/CNY pair in recent months. Despite the USD paring back from its rampant run, a weak economic outlook for China and persistent capital outflows will maintain pressure on the currency pair. Consequently, added stress on the Chinese economy will see a cut back in development funding from China’s Belt and Road Initiative which, in part, supports infrastructure development in developing markets. The cut back will further impact global growth, as several nations rely on this steady stream of cash.

Markets remain susceptible to headline risk as we receive further clarity on China’s economic and zero-COVID policies. Stay tuned for next week’s events in which we may learn more from local health authorities on what reopening measures could look like. This will be a key driver in assessing near-term risk for the domestic economy, its trade partners, and a return to peak levels of economic activity.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.