The 49th Parallel Divide

7 February 2023

Beware the Sleeping Giant

21 February 2023RISK INSIGHT • 15 FEBRUARY 2023

It’s grim, but not as bad as we were told it would be…

Marc Cogliatti, Principal, Global Capital Markets

Last week’s first look at 2022 Q4 gross domestic product (GDP) revealed that the UK narrowly avoided recession—defined by two quarters of negative GDP—after its economy saw zero growth between October and December. While this is not the sort of figure that would get anyone particularly excited, especially with inflation running above 10%, it does help ease fears of the dreaded “R” word—even if it is only a short-term reprieve.

Following the Bank of England’s November meeting, Governor Andrew Bailey warned that the UK was facing its longest recession since records began and expected the economic contraction to extend well into 2024. This week, we take a look at why the economy is faring better than expected and consider what this might mean for UK rates and sterling in the months ahead.

First and foremost, consumer spending grew 1.3% in nominal terms, helping to offset a fall in production and a stagnant services sector. When adjusted for inflation, consumer volumes increased by 0.1%— a meagre figure, but an increase nonetheless. Meanwhile, business investment grew 4.8% over the quarter, meaning it is finally back above its pre-pandemic level.

Consumer spending has undoubtedly been helped by a tight labour market where most people who want a job are able to find one. According to the Office of National Statistics, the unemployment rate currently stands at 3.7%— a level which is hardly associated with a recession. With wages rising 6.7% year on year, people have more money to spend, even if rampant inflation means that money is buying considerably less that it did a year ago. While there is no question that the rising number of economically inactive people will prevent a dramatic recovery as it weighs on productivity, it doesn’t have to result in economic contraction if they still have money to spend.

What does it mean for UK rates and the outlook for sterling?

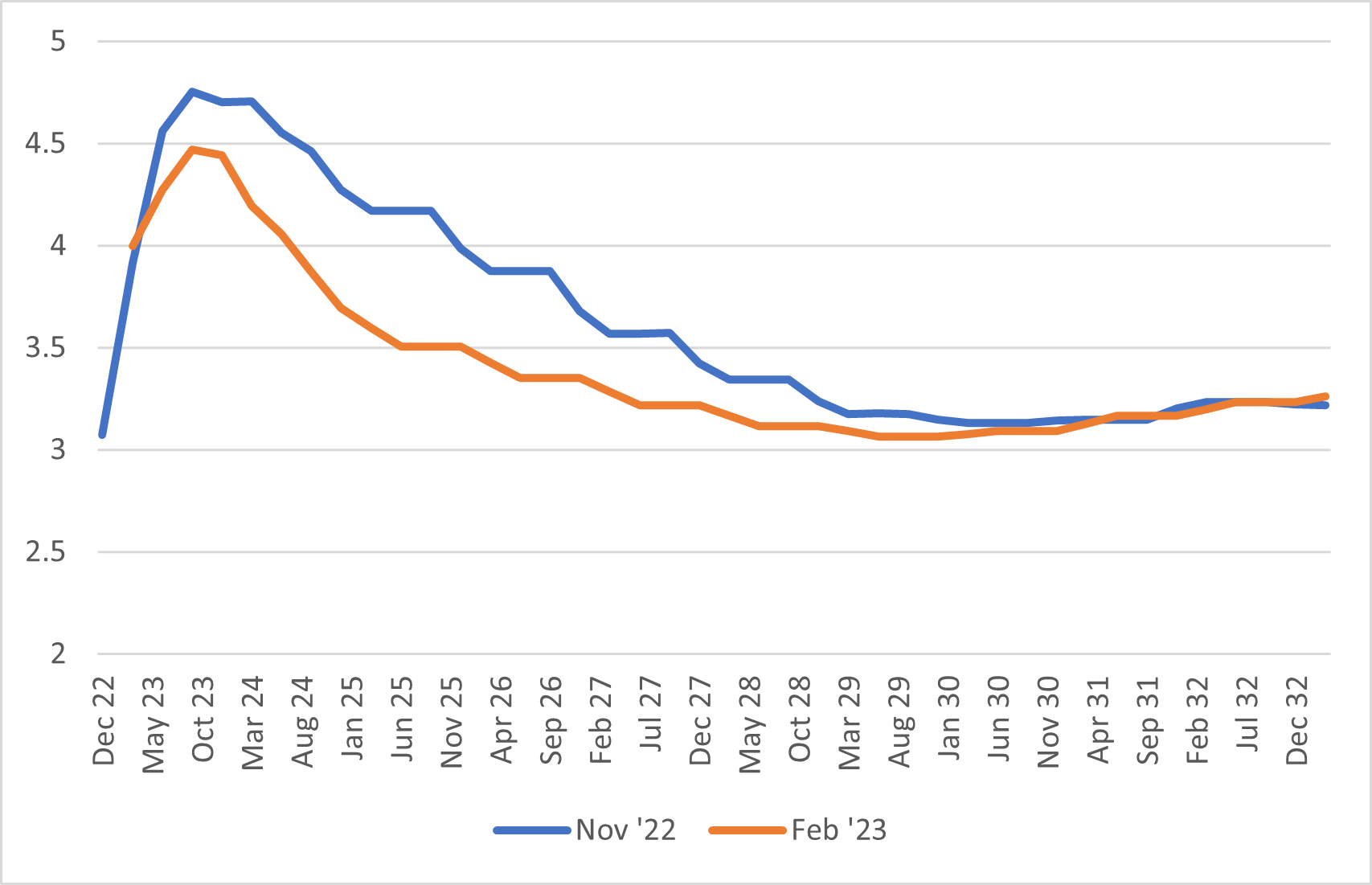

UK rates have already seen a notable move lower in recent months, as shown in the chart below. Back in November, the market had UK rates peaking at 4.75% in the third quarter of this year. Current forecasts, however, expect rates to peak around 4.5%.

Chart 1: UK SONIA Curve

Source: Bloomberg

This reflects what we are seeing across the globe and follows a notable drop in energy prices—which is one reason why central banks may not need to be as aggressive as previously envisaged. However, the counter argument—particularly for the UK—is that if growth is more robust than previously thought, the Bank of England may be more comfortable keeping rates higher for longer. This could easily be justified given the secondary risks of higher wages and increasingly embedded inflation expectations. Either way, risks appear two-way again, having previously skewed higher and then lower again in recent months.

Two-way risk in rates likely means increased volatility in FX. Intuitively, the prospect of higher rates in the UK should provide a boost for sterling. However, given that FX is one currency measured against another, it might not be that simple. For example, sterling has been under pressure against the dollar during the past few weeks, not because of expectations of lower UK rates, but due to a shift higher in US rates. Nevertheless, at the very least, based on recent correlations, the prospect of higher rates in the UK shouldn’t hinder the pound.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.