Hawks Gather in February

24 February 2023

What next for Central Banks?

7 March 2023INSIGHT • 1 MARCH 2023

Adopting the Higher for Longer

Kambiz Kazemi, Chief Investment Officer

What a difference a few weeks make…

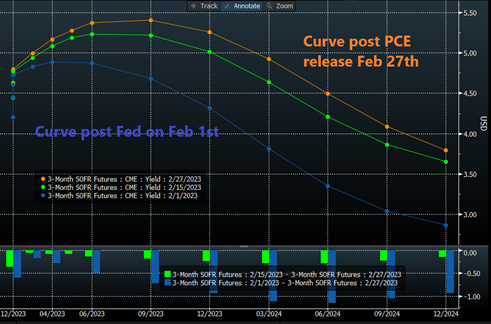

On February 1st, Fed Chair Jerome Powell used the word ‘disinflation’ 11 times in his post-FOMC press conference. Risk assets duly obliged with the S&P500 moving up 2.5% in the following two trading sessions, continuing its impressive new year rally and erasing nearly a third of its 2022 losses in just one month. Market participants were comforted in their view of peak Fed Funds at around 4.8% by summer 2023.

Then came the PCE data release on February 23rd, which surprised the market by its strength at 5.4% versus expectations of 5%. Suddenly, the projected peak rate was below the Fed’s preferred measure of inflation. Short-term rates had to make a massive and abrupt move higher to reflect expectations for a peak Fed Fund rate of 5.3%.

The possibility of a 0.50% rate hike at the Fed’s March meeting is now back on the table, denting the Fed’s credibility. As seen in Chart 1, the markets are now pricing in a “higher for longer” scenario as opposed to the year-old scenario of massive hikes immediately followed by rate cuts.

Chart 1: The PCE data jolted short-term rates: “higher for longer”

Source: Bloomberg

In the aftermath of this abrupt change in expectations, we turn our attention to the underlying data and what insights we can gather from it for the weeks and months ahead.

The data is (and will continue to be) volatile

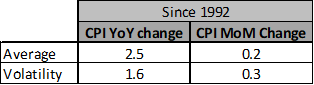

As always, the Fed has designed its messaging around the fact that its decisions are data dependent. Yet the volatility of the data—particularly in the pandemic and post-pandemic era—will remain a critical challenge. To highlight this, we analysed the YoY and MoM change in CPI data since 1992. As seen in Table 1, the average changes have been 2.5% and 0.2% on a yearly and monthly basis with a volatility of 1.6% and 0.3%, respectively.

Table 1: CPI since 1992

Source: Bloomberg

CPI data at the time of publication, however, is not a fully random variable; estimates are based on observable prices which have already materialised. Using its calculation methodology, an estimate can be produced by, for example, using the December price data to calculate an estimate ahead of the January data release. This helps explain why we don’t see wild surprises when CPI data is published.

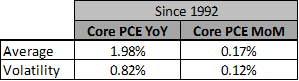

But predicting upcoming data before prices have been observed (e.g., predicting March CPI in February), significantly raises the level of uncertainty. A drop in CPI does not guarantee a continuing trend. By comparison, this uncertainty is lower for PCE data (see Table 2), which helps explain why the Fed prefers it as a measure of inflation.

Table 2: Core PCE since 1992

Source: Bloomberg

Unless a strong trend emerges, we can expect volatility in short-term rates to remain high in the months to come. This in turn will likely sustain FX and commodity volatility. Directional trades and views will need be sized accordingly. For those whose mandate is to hedge, it is wise to reduce any directional exposure by increasing their hedge ratio. For those seeking performance, it is wise to focus on relative value trading.

Short-term rates are back in the seat and driving the US dollar

Prospects of cooling inflation led to a reversal and a weakness of the US dollar late in 2022, despite the high level of US short-term rates. This is likely because investors expected other central banks to play catch-up by hiking rates. As seen in Chart 2, this latest increase in expectations of US short-term rates has driven once again the Dollar Index (DXY) higher by about 0.50% for every 10bps of higher rate expectations on a one-year horizon, in line with its recent historic relationship.

Chart 2: Dollar Index (red) driven again by short-term rate expectations (blue)

Source: Bloomberg

Unless inflation data continues to surprise to the upside, the most likely scenario is that the US dollar rally will moderate or pause around these levels, in line with our Outlook published earlier this year.

“Higher for longer” is not fully discounted

“Higher for longer” is a very recent phenomenon; indeed, markets only began pricing it in last week. As such, its consequences do not seem to be fully reflected in asset prices and investors will be assessing its potential impact on both the supply and demand side of credit, consumption and consumer spending, corporate strategy repositioning and corporate results, among other considerations. While equity markets have been quite resilient so far, one can expect some level of “choppiness” as investors tackle this new reality.

Considering the above elements, cash could increasingly become an “asset” with increasing allocation and outflows from other risk assets and repatriation flows by non-US investors as they benefit from attractive levels of interest in their own jurisdiction. While we expect this to occur in an orderly fashion—barring the unknown—volatility is unlikely to subside from current levels in the short term.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.