Reviving Concerns: Central Banks and Inflation Regain the Spotlight

2 June 2023

China’s Economy Roars Back to Life in 2023 After Covid-zero Policy

9 June 2023RISK INSIGHT • 6 JUNE 2023

What next for the Eurozone?

Shane O'Neill, Head of Interest Rate Trading

There has been mixed messaging from the ECB in recent weeks. While some members have been calling for further hikes, others are insisting on a pause. Though this back and forth is nothing new, the hawks were seen to be winning, with ECB President Christine Lagarde calling for additional hikes to battle inflation. However, this outlook has been challenged in recent days as inflation numbers came in weaker than expected – a novel scenario over the last few years. Let’s take a closer look at the arguments for and against further hikes from the ECB and how could this affect risk managers.

Full steam ahead

At the most recent ECB meeting, Lagarde didn’t pivot dovish like her American counterpart – instead warning that inflation risks were still “significant” and that, even if the Fed chose to pause, the ECB would remain “riveted to [its] objective” of combating inflation. She reiterated this point in recent days, claiming “there is no clear evidence that underlying inflation has peaked.”

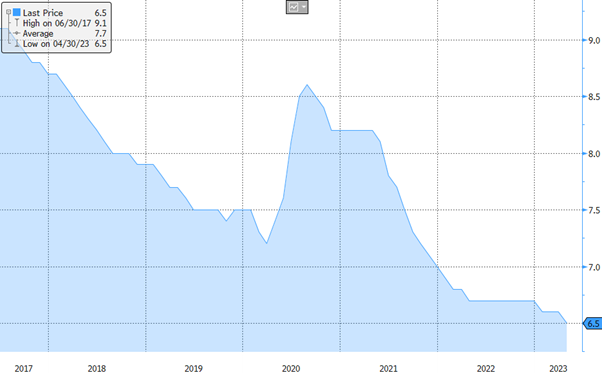

With the next ECB meeting looming (15th June), members are stating their case. Governing council member Boris Vujcic has called for more hikes as the recalibration of inflation is expected to be “gradual” and risks from a tight labour market remain high. Indeed, the latest labour market data supports his stance – the unemployment rate has fallen to 6.5%, an all-time low for the bloc. Council member Bostjan Vasle added to these calls by claiming that, despite progress, “core inflation remains high and persistent”.

Chart 1: Eurozone unemployment rate has fallen to all-time lows in recent months

Source: Bloomberg

Hit the brakes

While many members of the council are in favour of higher rates, there is an ever-present source of dissent from southern state members. Executive board member Fabio Panetta told the press that “inflation is too high, but there is no reason to worry,” suggesting that rates have not reached their peak, although they are not far off.

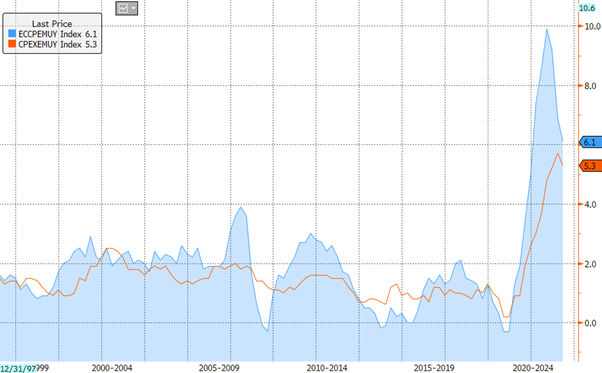

And, just like the hawks, recent data suggests he may be on to something. In the most recent print, both headline and core inflation came in lower than expected – headline fell to 6.1% vs. 6.3% expected and core inflation came in at 5.3% vs. 5.5% expected. This is the lowest headline inflation has been since February 2022, which is clearly great news for the doves at the ECB. However, although core inflation is falling, it remains sticky – much of the fall in headline inflation can be associated to stabilisation in the energy markets. High core inflation is more worrisome and may suggest inflation expectations are embedded.

Chart 2: Headline inflation is showing good progress lower but core inflation remains a concern

Source: Bloomberg

Navigating hedging

With such uncertainty around the ECB’s upcoming moves, decision making around hedging becomes increasingly important. Interest rate markets are currently pricing another two 25bps hikes from the ECB, taking the base rate to 3.75%. From here, cuts are slowly priced in, with the rate remaining above 3.5% well into 2024. This feels like a reasonable curve – inflation is clearly still an issue and there are very few calling for no further hikes at all. However, inflation is also more than 2.5% below the levels which pushed the expected terminal rate to 4% – suggesting that the ECB may indeed not need to go quite that far.

For EUR funds hedging USD exposures, we think the great risk comes from the USD curve where market pricing of cuts still seems a little too pronounced – meaning that the decreasing cost seen by pushing hedges further out may not be available in the long term. The benefit of hedging for 2y versus 3m is currently a saving of c.60bps annualised. Where it makes sense in a portfolio, some may wish to push some hedges out.

Against GBP assets, EUR hedgers are faced with a curve causing hedging costs 50-80bps annualised higher than the 10y average, with the cheapest option remaining the shortest-dated hedging strategies. As expected, terminal rates in the UK are reaching levels close to those which have previously been deemed unnecessary by the BoE. As such, we favour keeping strategies short-dated and awaiting further rhetoric from both banks.

For now, the focus will return to central bankers as we have the ECB, Fed and BoE all coming to market in June. With markets moving quickly, it helps to negotiate credit limit tenors ahead of time, as this will allow risk managers to act quickly when market opportunities present themselves.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.