The Tipping Point

14 June 2023

The Bank of England surprises

27 June 2023RISK INSIGHT • 20 JUNE 2023

The Dance Continues: Fed Projections Stay Just Out of Reach of Market Pricing

Ryan Brandham, Head of Global Capital Markets, North America

On June 14th, the FOMC announced that it would be keeping interest rates constant in the US – the first pause following 10 consecutive hikes and totaling 500 bps of tightening in an aggressive hiking cycle to fight inflation. Indeed, while the FOMC clung to the theme of “transitory inflation” for far too long, it made up for it with its unprecedented pace of rate increases.

Heading into the meeting, the overnight target rate at 5-5.25% was in line with the peak of the prevailing dot plot (5.125%), so this seemed like a logical place to pause, as we previously highlighted in our note: Shifting Focus: From Regional Banks to Central Banks.

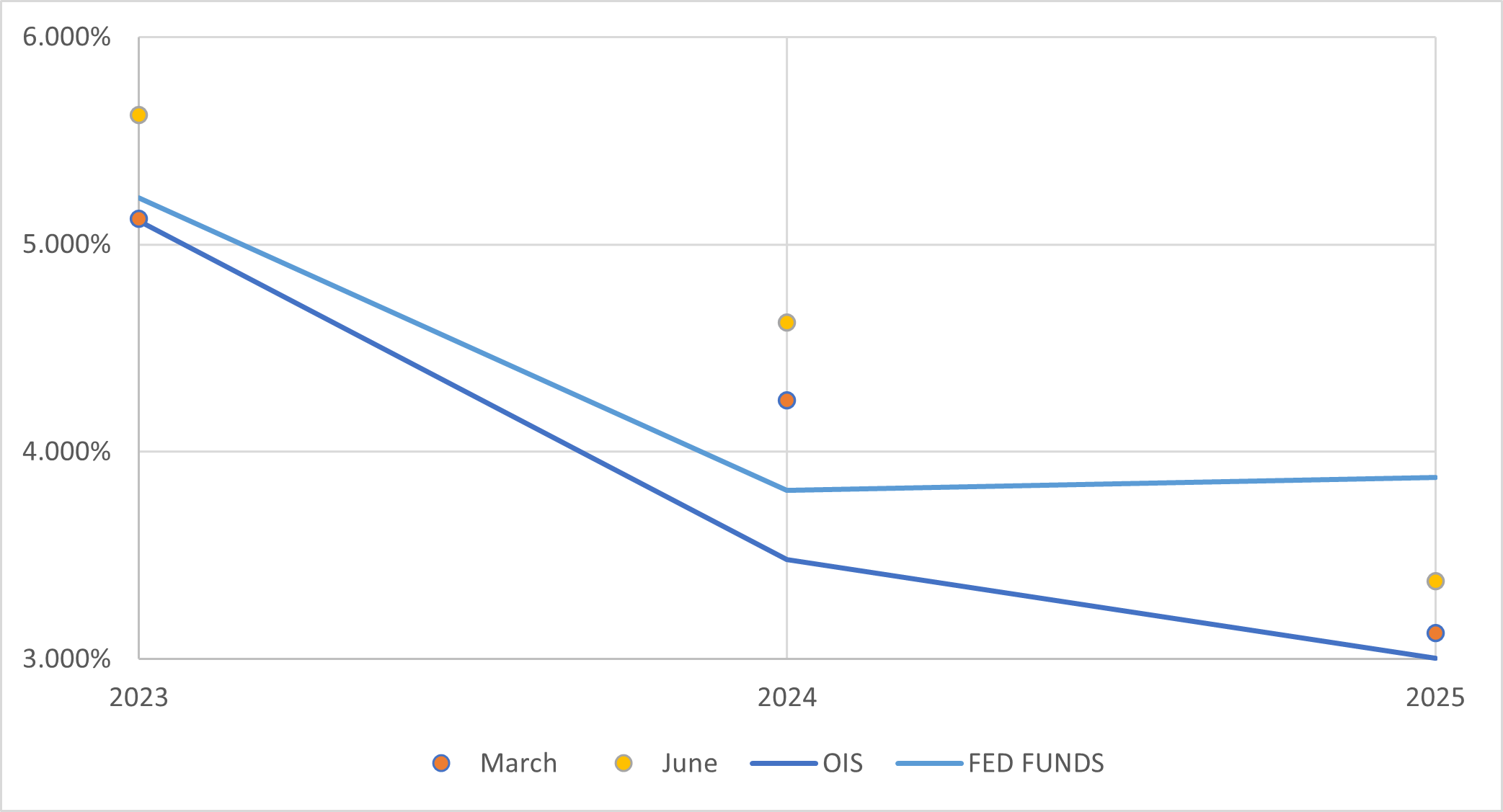

However, while the Committee decided to pause, it also released a Summary of Economic Projections (SEP) that was quite bullish on the US economy in 2023 – with upwards revisions to real GDP from 0.4% to 1.0% and a reduction in the anticipated unemployment rate from 4.5% down to 4.1%. These projections contributed to a new dot plot that was materially higher than the one released at the March 22nd FOMC meeting, with the median dot forecasting a peak rate at the end of 2023 up to 5.625% from 5.125% and a similar lift in 2024 and 2025 before falling to the long-term rate of 2.5% beyond that point.

This was perceived as an incongruency of sorts by market participants. After all, if the Fed is suddenly forecasting two more rate hikes, why not just hike now? In other words, if the new SEP impacted the dot plot in a material way, why did it not impact the current rate decision?

While this appears to be a fair question, Fed Chair Jerome Powell explained, to the dissatisfaction of some, that while the economic projections had changed, the Fed was still nearing the end of a 500 bps+ rate hiking cycle – and one does not hike as aggressively at the end of the cycle as one does at the beginning. As such, the pace of tightening has slowed to the point where it will not occur at every meeting – and while not committing to a July hike, he pointed out that this was a “live meeting”.

Although he did not draw this analogy, it may be useful to think of a running water tap being shut off – as it goes from flowing freely to completely off, it might drip intermittently for the last few drops. Although the market did not necessarily agree, we find no major reason to argue with this explanation. We also noted improvements in the Fed’s credibility with the market in an earlier note: The Market Meets (the Fed’s) Expectations.

Chart 1: Updated Dot Plot – Economic Optimism Abounds at the Fed

Source: Bloomberg

We have highlighted for some time that the US rates market was underpricing the Fed’s rate expectations. Indeed, as recently as early May, the market was pricing in 100 bps of cuts by January 2024 despite the Fed’s insistence to the contrary. However, these were priced out over the course of a couple weeks towards the end of May as the market finally caved and recognized the improved credibility of the Fed’s commitment to fighting inflation. Accordingly, the USD rallied across the board as expected, in tandem with the rate moves.

Ahead of the latest meeting, the market had finally caught up to the Fed – at least until the end of the year. However, the Fed has now pushed the dots higher to keep the dance going and re-establish a divergence. Will the market cave again? Will the market be right this time? One way or another, closing this gap for good is likely a necessary precursor to seeing any meaningful correction lower in a broadly overvalued USD.

What does it mean for markets?

Several global central banks are dealing with persistent, sticky core inflation and resilient economies led by tight labor markets. As such, we have a relatively hawkish global backdrop, with recent interest rate hikes delivered by the ECB (as expected), the BOC (surprise hike) and the RBA (surprise hike) – and most expected to implement further hikes.

In North America, we have very recently seen a few weaker than expected employment data points, with Canadian jobs printing a negative number on June 9th, and back-to-back elevated initial jobless claims prints in the US on June 8th and June 15th – which admittedly came on the heels of a very strong non-farm payroll report on June 2nd.

Like the Fed, we must remain data dependent. These small cracks in the labor story could grow over time into early signals of a turn in North American labor markets that have, to date, been very resilient in the face of robust interest rate hikes. This could lead to a situation whereby the lagged impacts will be felt initially by those economies where central banks started hiking rates first. If this were to develop, it would be supportive of our overall bias for a weaker USD in the medium term.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.