UK GDP – good news or bad? It depends on who’s asking.

16 August 2023

Economic Woes Compound Sticky Inflation

4 September 2023INSIGHT • 23 AUGUST 2023

September's Clues: Unveiling the data on the Fed's next moves

Ryan Brandham, Head of Global Capital Markets, North America

On July 26th, the FOMC hiked interest rates another 0.25% to bring the Fed Funds rate to its current level of 5.25-5.5%. Fed Chair Jerome Powell highlighted vigilance against inflation, and again emphasized data dependence in terms of whether additional hikes would be needed as they near the end of the tightening cycle. Specifically, he explained that with a relatively long break until the next FOMC meeting on September 20th, they would have a significant amount of data (two inflation releases and two employment reports) to inform their understanding of the direction of both inflation and the labour market – the two pieces of their dual mandate. We are almost exactly halfway through this period, so let’s evaluate where things stand currently.

Powell’s press conference contained some upbeat notes, even if it was interpreted as hawkish. For one, the Fed is no longer forecasting a recession as they continue the fight to bring inflation under control – indeed, a soft landing appears to be more likely than earlier this year when most market prognosticators were forecasting a recession. Second, Powell clarified that he felt the current level of Fed Funds was in restrictive territory, and that as long as they felt inflation was coming down to a sustainable level, “you’d stop raising rates long before you got to 2% inflation, and you’d start cutting before you got to 2% inflation, too” which seemed to validate a US rates market that has priced cuts aggressively below the FOMC dot plot for most of the year to date.

Evolution of US Data Releases

On August 4th, the Non-Farm Employment Report for the month of July was released. Markets cheered at the 187k figure – below an expected 200k – thinking this meant the peak in the US rate hike cycle had been reached. However, the unemployment rate came in at 3.5%, below expectations of 3.6%, which historically is a very low level. Powell himself said at the FOMC press conference on July 26th that “the unemployment rate is the same as it was when we lifted off in March of 2022, at 3.6%”. Digging a little further, it is hard to find a time in the last 50-75 years where the US unemployment rate was lower for any kind of sustained period. The resilience and tightness of the US labour market continues to surprise. Powell said the same day that “the historical record does suggest that when central banks go in and slow the economy to bring down inflation, the result tends to be some softening in labour market conditions.” Can we rest assured the battle against inflation has been won?

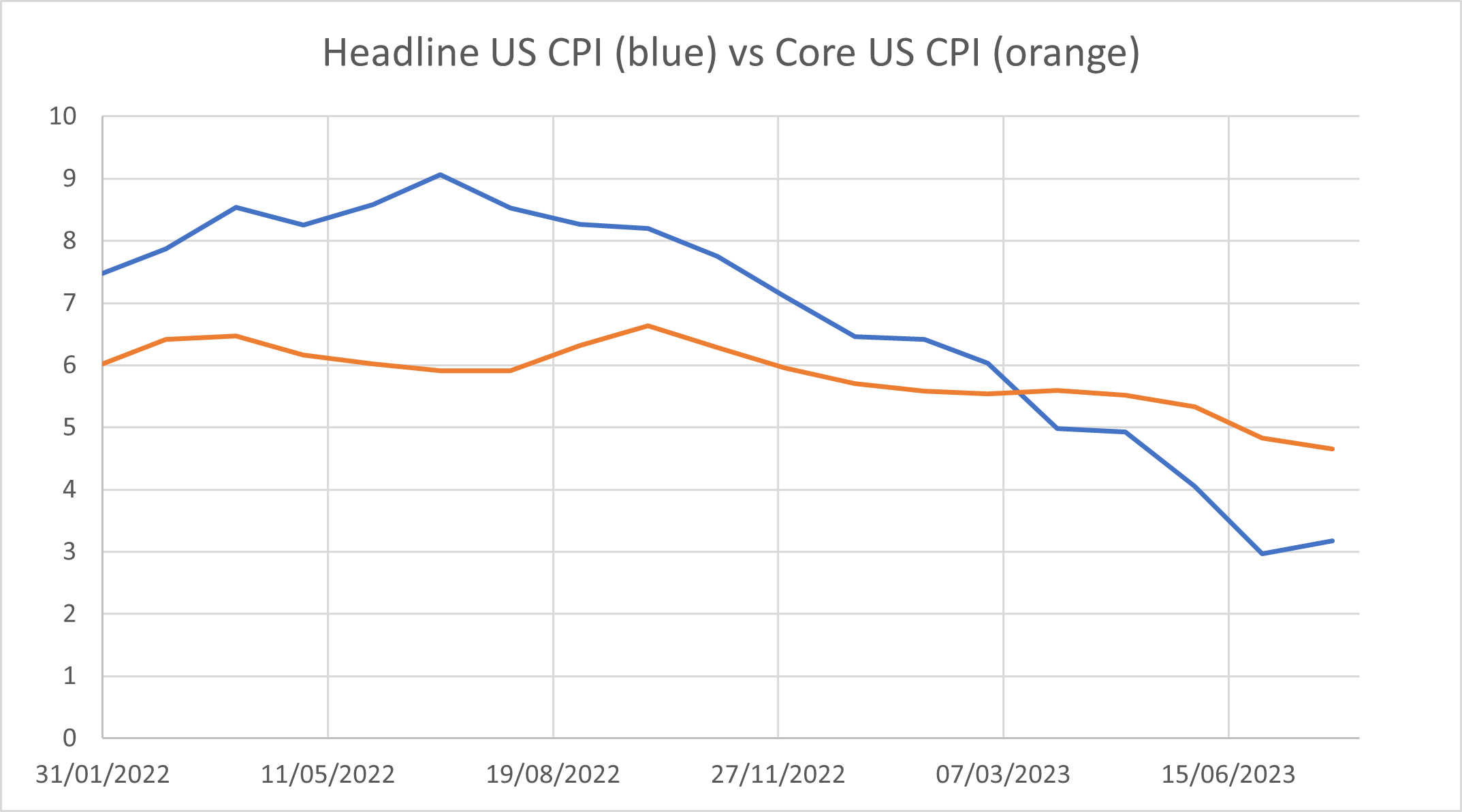

CPI readings for the month of July were released on August 10th, coming in at 3.2% versus an expected 3.3%. However, what many may not have considered is that, as the chart below shows, this was the first uptick in inflation since the peak at 9.1% in June 2022. Indeed, base effects mean that the last mile on inflation might be harder than anticipated to achieve, and may indeed require further rate hikes. Core inflation continues to make progress, and printed a new low from the September 2022 peak, but it is still tracking at 4.7%....is that consistent with achieving 2% headline inflation without further hikes?

Chart 1: Headline US CPI (blue) vs Core US CPI (orange)

Source: Bloomberg

Evolution of Market Pricing

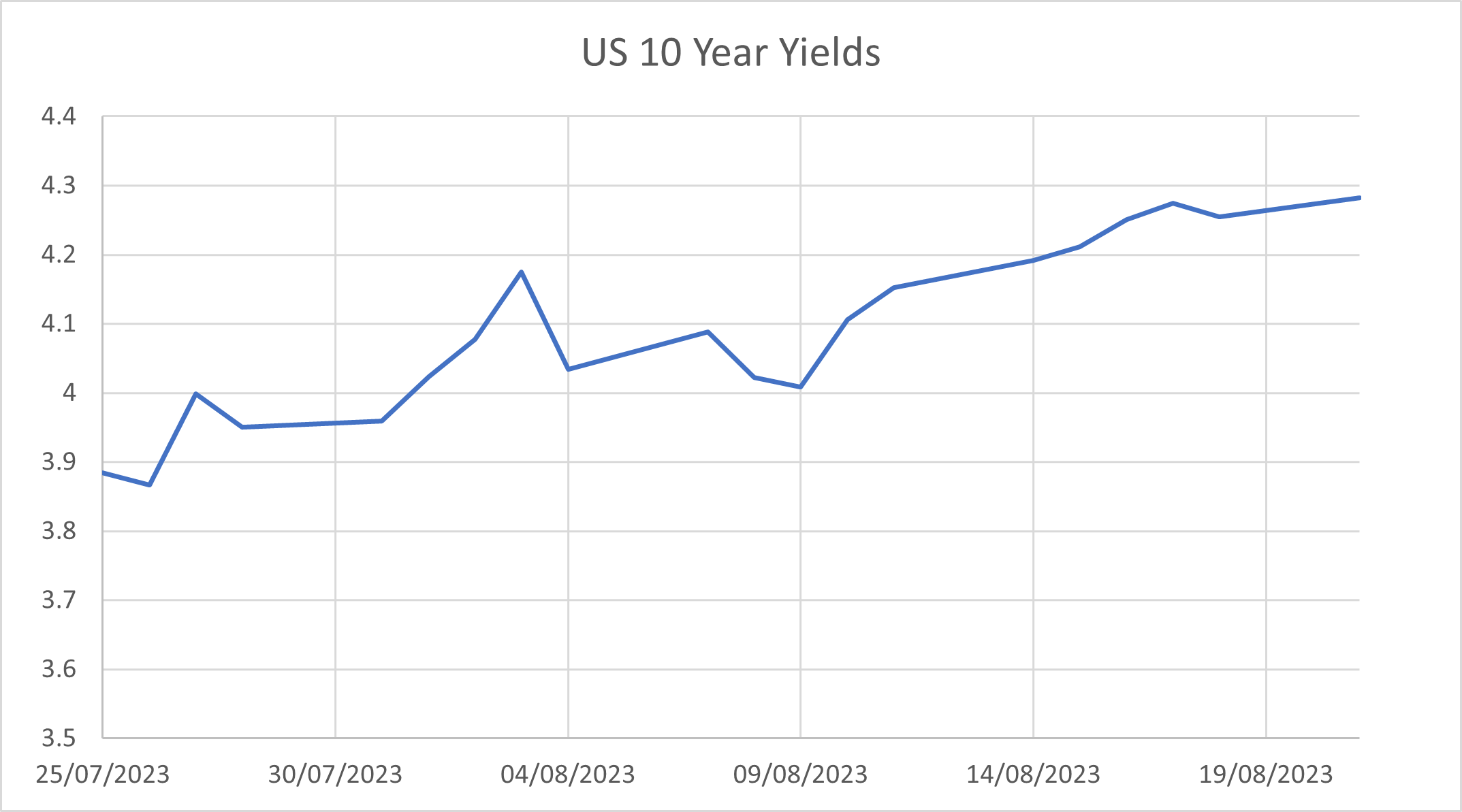

While short-dated US interest rates have seen two way moves in reaction to the data, the 10-year yield has broken out to the topside as markets adjust to the likelihood that rates will have to stay higher for longer in order to tame inflation.

Chart 2: US 10 Year Yields

Source: Bloomberg

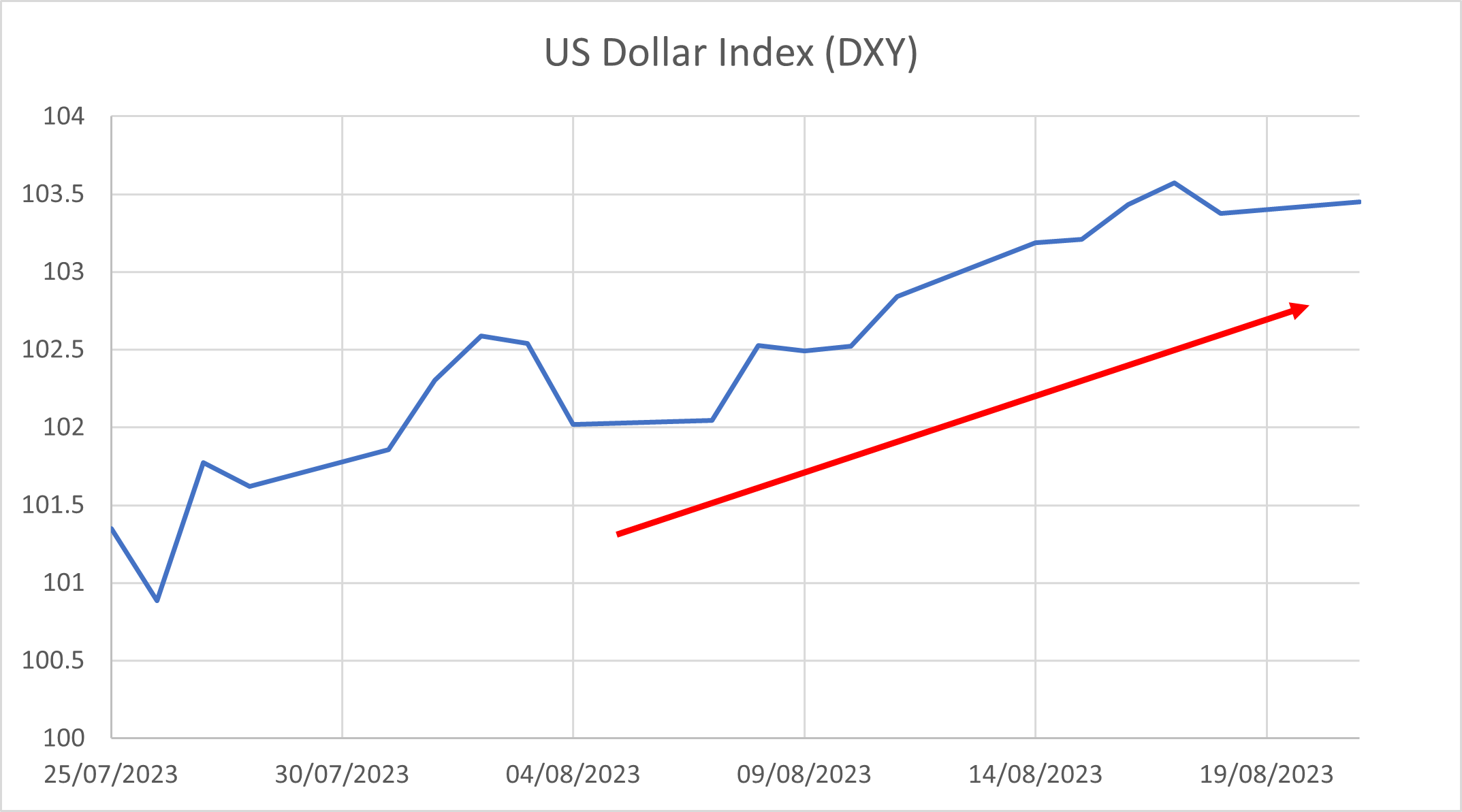

Similarly, after selling off into the July FOMC meeting, the USD has rebounded smartly and has added gains as the previously mentioned data has been released, no doubt supported further by equity markets pulling back and reacting to the same “higher for longer” phenomenon.

Chart 3: US Dollar Index (DXY)

Source: Bloomberg

Implications for the Future

In a previous note titled 'Two Percentism and Its Dangers', we discussed the risks to some countries of dogmatic adherence to a non-scientific 2% inflation target. We have also previously mentioned that the Fed has a tough job trying to manage a very complex and interconnected economy with only a few, blunt, and imprecise tools – interest rates and QE/QT. Its ability to cool things off and bring down inflation using interest rates has arguably been weakened after up to half of outstanding US mortgages refinanced for the very long-term at ultra-low rates in 2020-2021. (Source: NY Fed study)

The Fed has a dual mandate, that of maximum employment and stable prices, and it has to pursue these goals using the few blunt tools at its disposal. It is currently in data-dependent mode as it considers whether further interest rate hikes are necessary in this tightening cycle. Although many feel they have reached the end of the hiking cycle already, can further hikes be ruled out given that (a) unemployment seems to be running below the natural rate and (b) inflation is still well above target? It doesn’t feel like the time to turn dovish with inflation unlikely to break back below 3% any time soon due to base effects. US rates markets currently price no additional full hikes (not even by the November or December meetings), and cuts are priced into the curve for 2024 despite the recent adjustment to “higher for longer”. Powell’s eagerly anticipated address at Jackson Hole this week will be a critical one indeed.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.