Debt Fund Double Hit – Private credit prepares for rate cuts & missed payments

6 September 2023

Chinese Property: the problem which will not disappear

18 September 2023RISK INSIGHT • 13 SEPTEMBER 2023

The Fall of Uncertainty

Kambiz Kazemi, Chief Investment Officer

As we enter the last act of the inflation fighting tragedy, the picture the Fed and investors face this fall is filled with complexity and uncertainty.

As it stands the market is pricing around 50% of an additional 0.25% rate hike sometime this fall, followed by rate cuts less than two quarters later in spring 2024!

In the months ahead, contradictory forces will be at play in a complex and interconnected economic web.

Inflation has not yet been tamed

In recent months, inflation figures have somewhat stubbornly remained above the sacrosanct 2% Fed target. This has driven the Fed to adopt messaging that keeps the door open to potential hikes should these be necessary and might explain why the market is uncertain about prospects of further hikes this fall.

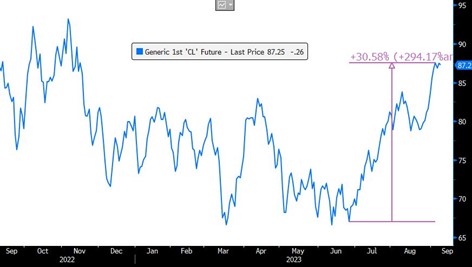

Additionally, just at this critical juncture, energy prices are on the run again with crude oil rallying nearly 30% in the last two months. The effect of this increase will likely be reflected to some extent in upcoming core inflation figures this fall.

Chart 1: WTI Crude front month contract price

Source: Bloomberg

With OPEC+ continuing to indicate its intention to keep production near present levels and US strategic reserves at multi-decade lows not seen since 1980s, any increase in demand or the slightest supply shock (for instance due to geopolitical factors) will likely drive crude prices further up, in turn affecting inflation by, at a minimum, keeping it above the 3-4% level.

In such a scenario, the Fed will be faced with holding rates high while the lagged effects of a restrictive rate environment further erode economic activity.

Effects of aggressive rate hikes are quite uncertain

On the other hand, even if some disinflationary forces were somehow to balance the impact of energy and food prices, the potentially lagged effects of one of the most aggressive interest rate hiking cycles in history might yet to flow through and be seen across the economy.

Fed Chair Jerome Powell has, on multiple occasions, referred to this very difficult task of evaluating these effects in recent months: “let’s wait and see how these aggressive hikes over the last year and half play out” was one of the main reasons behind the Fed’s change of tone at their July 2023 meeting.

In sum, a scenario combining a deteriorating economy with inflation that is floored stubbornly to 3-4% would be a “nightmare scenario” for the Fed as it would put it in a situation to choose between its credibility on the inflation discourse front and deepening a potential economic downturn.

What could this entail?

Uncertainty in financial markets is often synonymous with volatility as market participants shift and change their expectations in light of new developments and data. If any of the above materializes one could expect more volatility in the coming months across rates and by corollary in FX and equities as well.

Additionally, as we enter this last phase of the fight against inflation, we can also expect a desynchronization across different jurisdictions. In fact, the inflation picture can evolve and is evolving differently in different countries – meaning that currency volatility can be even further accentuated by this desynchronization.

On the bright side, currency implied volatilities (a proxy for option prices) have reverted to very low levels (around 7%, the lowest percentile of the last two decades, for USDCAD for instance) offering very interesting positionings going into this foggy fall.

Chart 2: USDCAD 1-year implied volatility at very low multi-decade levels

Source: Bloomberg

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.