To cut, to hike or to hold? 2024 rates outlook and implications for FX markets

29 February 2024

What’s in store for the US Dollar under Trump?

13 March 2024INSIGHTS • 6 MARCH 2024

Will the UK Government make the same mistake again?

Marc Cogliatti, Head of Capital Markets EMEA

Do you remember September 2022? To some, it might seem like a long time ago, but many of you will remember it like it was yesterday. Even if you’re not bothered about UK politics, if you’re reading this, you have an interest in FX and interest rates.

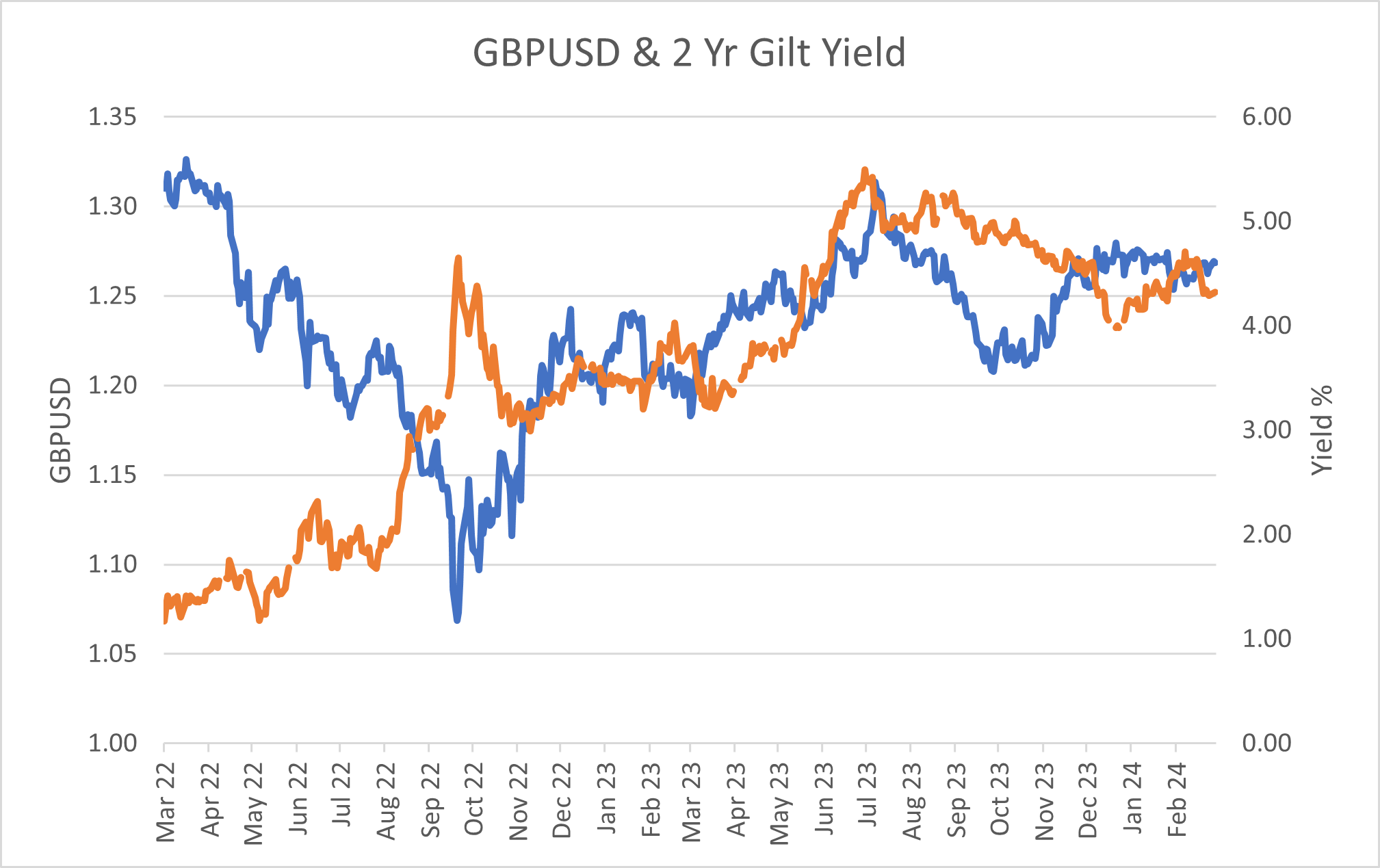

In case you don’t recall, Liz Truss and Kwasi Kwarteng’s mini budget sent sterling markets into a tailspin after the pair announced a raft of tax cuts: removing the top rate of tax altogether, reducing stamp duty and freezing corporation tax, amongst others. When it became clear that these were to be unfunded (and with no associated spending cuts forthcoming) the markets entered panic mode. The potential deluge of additional gilt supply caused yields to climb around 100 bps in the days that followed. The scale of the move was historic, we saw the largest one-day move since 1985 and the rolling five-day move was the largest seen since 1976. Hike pricing changed dramatically, with a non-zero probability of an inter-meeting emergency hike being priced in on Friday and base rates reaching >6% by May 2023. At the same time, we saw the pound tumble against the dollar, falling to all-time lows of under $1.04 (see chart below).

Chart 1: GBPUSD and 2 Year Gilt Yield

Source: Bloomberg

This week, Chancellor Jeremy Hunt will deliver his Spring Budget in what could be a final roll of the dice before the election later this year. Last week, numerous institutions, from banks to economic think tanks, warned against making the same mistake again. Obviously, the Chancellor is eager to offer some pre-election tax cuts to close the gap in the polls with Labour, but given the precarious state of the nation’s finances, the scope to do so is very small. Economists’ estimates range from £6bn - £18bn of room for giveaways which is relatively small in the grand scheme of things. To put it into perspective, a 1p cut in income tax would cost ~£7bn so it is fair to say that the Chancellor has very little wiggle room.

Unsurprisingly, the question posed to us by many clients is what would happen to UK rates and the pound if Hunt were to follow in the steps of his predecessor? Is it possible that the markets could react in the same way as they did in September 2022?

The simple answer is, of course they could. Intuitively, it feels like a highly unlikely scenario given the lessons of less than two years ago, but anything is possible. According to dealers polled by Bloomberg, the Debt Management Office (the department responsible to issuing gilts) is expected to need to raise £258bn next year, up from £237bn this year. When added to the BoE’s quantitative tightening plan, the market will need to absorb ~£358bn of UK government debt next year.

One thing is for sure, markets don’t appear to be pricing in any significant probability of lightning striking twice. The UK rate curve continues to point to lower rates in the second half of 2024 and when coupled with low volatility in the options market, purchasing caps is a relatively cheap strategy for borrowers. Meanwhile in FX, sterling puts are as cheap (relative to calls) as they have been since H2 2020, signalling demand for protection against a lower pound remains low.

Maybe this week’s Budget turns out to be a non-event given that the Chancellor’s hands are tied and thus scope for him to pull something out the bag remains low. However, risks to the pound and UK rates feel very asymmetric – the upside to sterling and UK debt, if Hunt were to produce some magic, feels relatively low, whilst history tells us the downside, should he spook the markets, is huge.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.