Validus upgrades signature TradeView platform with automated pre-trade check functionality

18 June 2024

Closing the Gap: Can the US Avoid a Debt Crisis?

25 June 2024INSIGHT • 19 JUNE 2024

The Fed vs. Inflation: The Battle Continues

Shane O'Neill, Head of Interest Rates Trading

Earlier this year, US rates markets were overly aggressive in pricing in a rate-cutting cycle. Since then, we’ve witnessed a steady stream of cuts being priced out. Now, halfway through the year, with key data points like the latest CPI and the Fed meeting, it’s crucial to analyze the current state of US rates markets and identify key factors for hedgers to navigate in the second half of 2024.

Time to declare victory in the fight against inflation?

Last week’s US inflation report offered welcome news for the Fed. Both headline and core inflation came in lower than expected, at 3.3% and 3.4% respectively. This marks the first time since October 2023 that either figure has undershot economists’ predictions. While still notably above the Fed’s target, it’s a clear step in the right direction.

A deeper dive into the numbers reveals even more promising signs. Core CPI’s monthly change hit its lowest level since 2021, and core goods fell for a fifth month, coming in at -1.7% YoY. Fueled by this optimism, markets immediately priced in another 0.15% of cuts by year-end.

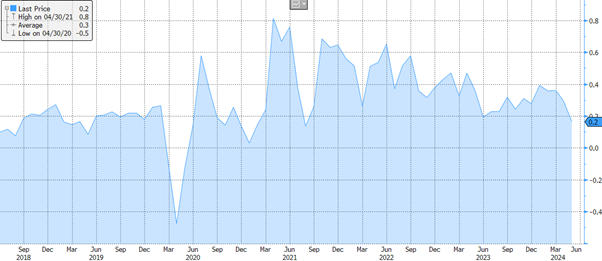

Chart 1: Core CPI MoM figures fell to their lowest levels since 2021

The Fed ruins the party

Market volatility subsided after the Fed released its latest economic predictions. The Fed meeting contained the most up-to-date dot plot, a graph detailing Fed members’ expectations of future rate moves. This dot-plot confirmed the recent shift in the Fed’s policy stance, with a divided FOMC. By year-end, seven members anticipate one rate cut, eight expect two, and four foresee no cuts at all. This puts current market pricing of 1.8 cuts this year, a little high but broadly in line with FOMC expectations. This is a stark change from the beginning of the year, when there was a huge mismatch between the two, and one of the drivers for our calls of an over-optimistic market rate path.

The Fed’s message beyond the dot plot tempered the optimism sparked by the CPI data. Members upped their inflation forecasts, expecting core CPI to finish the year at 2.8% vs. 2.6% previously. This suggests slower progress in the coming months.

Several Fed members reinforced a hawkish stance. The Dallas President indicated higher rates are not proving to be less of a drag on activity than previously thought, and the New York President commented that current policy is appropriate to bring inflation down to target. The Minneapolis President echoed this cautious approach, emphasizing in an interview “We’re in a very good position right now to take our time, get more inflation data, get more data on the economy, on the labor market, before we make any decisions.”

Despite some moderation in pricing versus earlier this year, we believe interest rates in the US are more likely to rise than fall. Markets are currently pricing 45bps of cuts. We believe that no cuts is a significantly more likely outcome than 90bps. Given this outlook, those exposed to higher rates should consider using hedges – whether a cap or swap, the downward sloping curve represents attractive hedge characteristics, but this trend may not continue.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.