Labour’s Historic 2024 Budget: A Bold Plan for Growth Amid Inflation Risks

13 November 2024

Validus named Risk Management Software Provider of the Year 2024

18 November 2024INSIGHTS • 13 NOVEMBER 2024

Germany’s Uncertain Future: Political Instability and a Struggling Economy

Harun Thilak, Global Capital Markets, Senior Associate

While the eyes of the world were transfixed on the election results in the US last week, Germany was plunged into its own political turmoil with the breakdown of the Governing coalition. This political uncertainty will act as a further drag to an already fragile economy. With the prospect of increased tariffs and disruption to established trade flows under Trump, help may be needed from the ECB through sustained dovish policies to support Europe’s largest economy.

Political Uncertainty

Germany’s ruling coalition, led by Chancellor Olaf Scholz, broke down after months of infighting between his center-left Social Democrats, the climate-focused Greens and the pro-business Free Democrats. The final nail in the coffin came last week, when Scholz fired his finance minister Christian Lindner, leader of the Free Democrats, in a dispute about debt-financed government spending, thereby dismantling his three-party coalition. Scholz intends to call for a confidence vote in mid January which would pave the way for an early election in March.

Chart 1: Leadership contenders

Source: Bloomberg

A Struggling Economy

Germany narrowly escaped a technical recession this year with Q3 GDP coming in at +0.2% QoQ, following -0.3% in the previous quarter. The German automotive industry, a cornerstone of the economy, is enduring an extremely challenging year with large scale downsizing of operations to rein in costs amidst sluggish global demand. Heightened tariffs and trade-protectionist measures under Trump’s second term could add fuel to the fire, potentially leading to a stalling of growth in the largest export-oriented economy in Europe. Monetary policy support may be needed from the ECB to help Germany navigate this period of uncertainty and prevent Germany from slipping into a full-blown economic crisis.

ECB’s Dovish Stance and its Impact on EURUSD

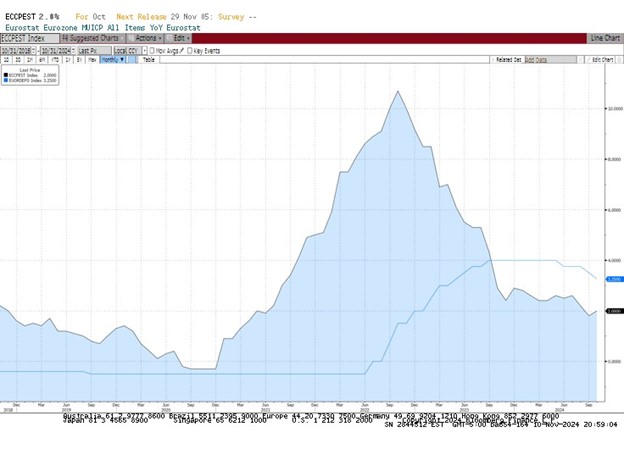

The ECB is approaching a crucial crossroads in setting monetary policy. Eurozone inflation has slowed down faster than expected to the target range of 2%. In response, the ECB has already lowered borrowing costs three times since June and is widely expected to do so again next month.

Chart 2: Euro Zone CPI vs ECB Deposit Rate

Source: Bloomberg

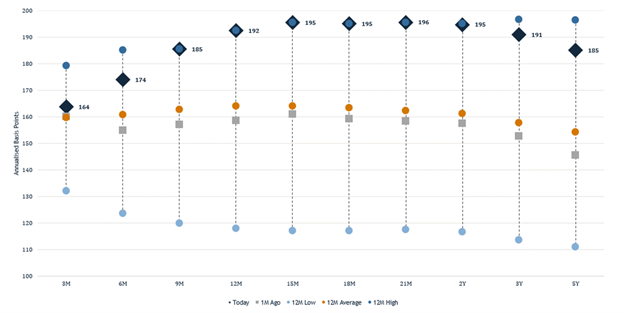

With economic activity expected to remain sluggish in the Eurozone and heightened political uncertainty in Germany, investors expect the ECB to remain on a sustained dovish trend. Markets are pricing in approximately 150bps of cuts from the ECB by the end 2025 (compared to approximately 80bps of cuts from the US Fed). This rate divergence should lead to EURUSD spot struggling to make sustained moves higher. USD-based investors looking to hedge against EUR weakness may consider using FX forwards as they benefit from the recent pickup in EURUSD FX forwards carry seen from the rate divergence.

Chart 3: EURUSD FX Forwards Carry (in annualized bps)

Source: Bloomberg, Validus

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.