US rates markets weigh how much Trump will deliver

20 November 2024

Populist Economics in 2025

4 December 2024INSIGHTS • 28 NOVEMBER 2024

US Elections: The European Story

Shane O'Neill, Head of Interest Rate Trading

In the aftermath of the US election, dollar rates, assets and the currency itself all jumped higher. The focus has begun to spread wider, as the markets start to digest the effects of Trumpian tariffs on the rest of the world. European economies look unlikely to escape this presidency without significant bruising, but there may be some green shoots and opportunities appearing for the continent as an indirect result of the new administration.

A Powerhouse in Decline

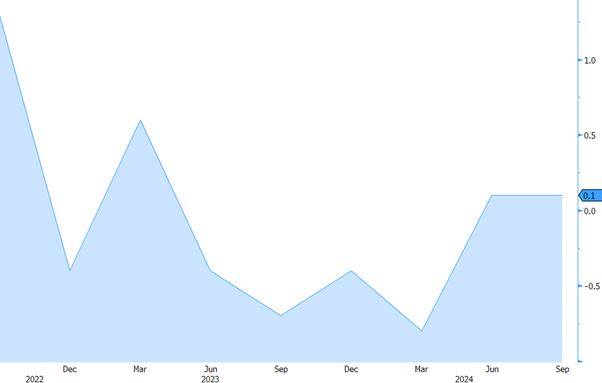

The recent strength in the dollar has coincided with a period of worrying weakness out of Europe. Last week’s PMIs, a forward-looking measure of growth, came in weaker than expected and significantly below 50, the demarcation between growth and contraction. Of particular concern is the German economy – once the powerhouse of Europe, the economy is now reeling. Germany has long been considered a manufacturing driven economy, but the manufacturing PMIs have been in contractionary territory for some years now. The services side of the economy has helped to soften the blow, but the most recent PMI data showed services contracting for the first time in 9 months. The net effect has been GDP growth figures languishing around 0% since late 2022. Undoubtedly, the expectations of Trump tariffs on German cars are adding to the dark cloud hanging over Germany.

Chart 1: For two years now, German growth figures have been hovering around 0%

Source: Bloomberg

Political Stability

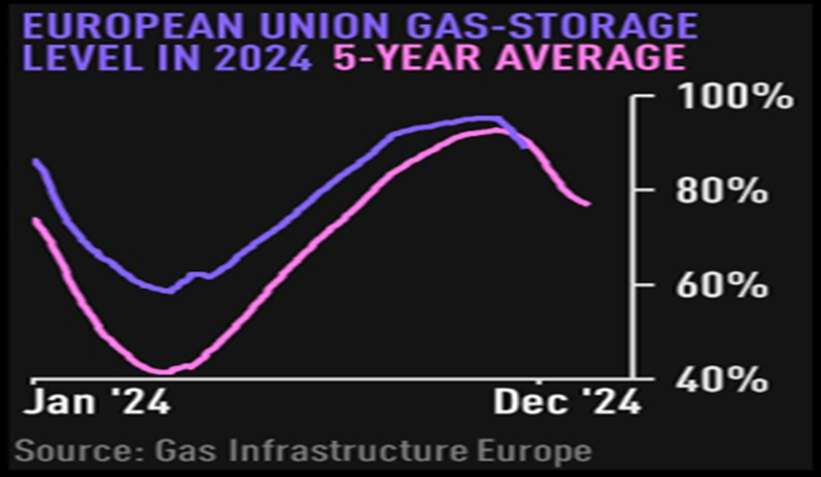

One never has long to wait after economic woes for political instability, and sure enough, the day after Trump powered to victory, Olaf Scholz’s coalition government collapsed. Adding to the social unrest was the decision instigated as far back as 2011 to shut down Germany’s nuclear power stations. This decision has exacerbated the nation’s dependence on Russian gas, leaving the health of the country’s economy – and, by extension, the entire EU economy – tied to the unpredictable developments surrounding Ukraine. Recent data from Gas Infrastructure Europe shows that winter gas stores in the EU are below the 5-year average. A cold winter and a worsening of the situation in Ukraine could squeeze the pockets of European consumers at the most inopportune time.

Chart 2: Gas storage levels fall below 5-year average, intensifying focus on developments in Ukraine

Source: Gas Infrastructure Eruope

Market Reactions Don’t Surprise

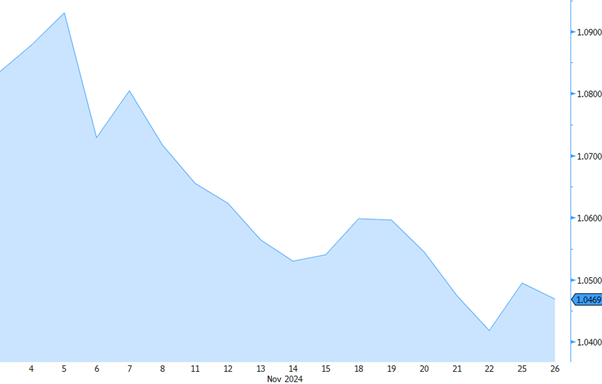

With this confluence of events, it is hardly surprising that markets haven’t reacted kindly. The euro has fallen more than 4% versus the dollar since Trump won and additional interest rate cuts have been priced into the curve. Markets are pricing a 60% chance of a 50bps cut by the ECB in December and a total of almost 150bps of cuts by this time next year. Unlike in the past, ECB officials are far from trying to dampen the repricing. Prominent members Lane, Villeroy, and Guindos have stressed the necessity of moving rates into non-restrictive territory in short order, lest they weigh even further on growth.

Chart 3: Since the Trump victory we have seen EURUSD fall to levels not seen since late 2022

Source: Bloomberg

Green Shoots and Opportunities

Given the current challenges, it’s easy adopt a fervent Euro-skeptic outlook. Whilst this may be justified, there are reasons to believe the currency could rebound. Unfortunately for the Eurozone, many of the reasons are out of their hands. The Trump tariffs which immediately weighed so heavy on the Euro are far from set in stone. Trump’s initial concern is with China and depending on how events unfold, the EU may manage to avoid tariffs altogether. Additionally, Trump continues to be vocal about finding a peaceful resolution to the issues in Ukraine. Whilst relying on Trump’s diplomacy skills is risky, actively working toward a solution could instill calm in the region and create positive pressure on the single currency.

Recent moves have also created a market opportunity for euro hedgers and those looking to raise cash. EURUSD basis, a market measure of the demand for one currency over the other, has moved back toward positive territory. Conversely, given the above commentary, this is indicative of an increasing demand for EUR over USD, the last time the basis was in positive territory was before the GFC. Technical market pressures – including stress in euro funding markets and gamma positions on bank trading desks – have moved the basis this direction but more important than the reason is the potential opportunity. Euro funds hedging dollars will still face the bulk cost of the interest rate differential, but the usually additive cost of basis has reduced dramatically and may be worth locking in for hedgers looking further out the curve. Similarly good news for European entities looking to raise debt domestically – negative basis led to it being advantageous to raise money in the US and swap it back to euros. With the recent move both markets are essentially equivalent from a cost basis – levelling the playing field for those who only have access to euro markets and removing the operational burden of a cross-currency swap from those who had traditionally looked stateside.

Chart 4: EURUSD basis briefly reached positive territory and remains at elevated levels last seen pre-GFC. Red – 2y basis, blue 5y basis, orange – 10y basis

Source: Bloomberg