Validus Risk Management expands APAC presence with new leadership hire and Singapore office

10 June 2025

Could Middle East strife hand the dollar a lifeline?

18 June 2025INSIGHTS • 11 June 2025

Watch the $ step

Kambiz Kazemi, Chief Investment Officer

Since the new US administration came into office in January, the US dollar has fallen by more than 10%. The slide began with the first whispers of tariffs in February and accelerated around 'Liberation Day. Since then, the Dollar Index has repeatedly tested, but not breached, the 98–99 range.

Intriguingly, this weakness has unfolded while long-term US interest rates have been rising. The positive correlation between the 10-year Treasury yield and the dollar - higher yields, stronger dollar - has therefore broken down.

Chart 1: US dollar index (DXY)

What’s sapping the greenback?

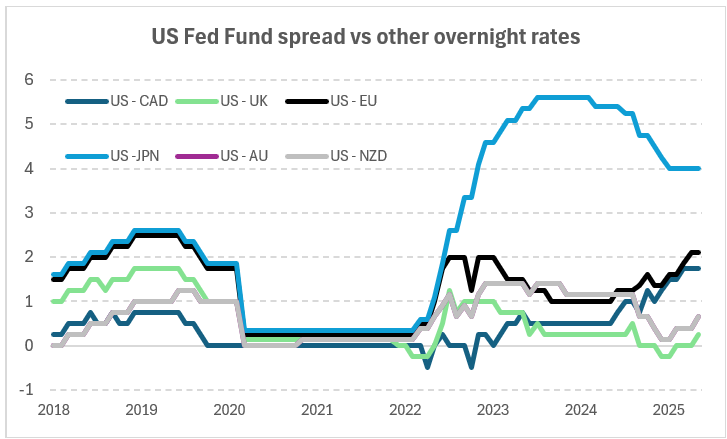

A principal driver appears to be capital outflows, as foreign investors cut their US exposure. The continued outperformance of European equities over American ones, coupled with the dollar’s sharp drop around Liberation Day, supports this view. Although interest-rate differentials have generally widened in the dollar’s favour - Japan is the lone exception - this tail-wind has only partially offset the negative pressures on the currency.

Chart 2: Relative spread of overnight rates between major central banks

What lies ahead?

For the first time in many years, monetary cycles are de-synchronised. The Bank of Japan began raising rates only in 2024, well after other central banks and the Federal Reserve. Meanwhile, the United States and Australia have so far had the least aggressive cutting cycles among developed economies; the Reserve Bank of Australia even held rates steady throughout 2024. By contrast, the Reserve Bank of New Zealand, one of the last to ease, has already cut by 2 percentage points since mid-2024. In the United Kingdom, sticky inflation restrained the Bank of England, while both Canada and the euro area pressed ahead with successive reductions, widening their spreads over the United States to about 2 percentage points.

Against this backdrop two broad and likely scenarios could emerge:

- Scenario One: Inflation persists and central banks are compelled to lift rates again, narrowing spreads over the US. The likely impact on the dollar would not be supportive.

- Scenario Two: Growth falters as trade-war uncertainty delays investment and hiring; if inflation eases, the Fed may resume cuts, again narrowing spreads. The likely impact on the dollar would also not be supportive.

Neither scenario favours the dollar. Should capital outflows from the United States also resume, further weakness against the euro and the Canadian dollar is likely. With the euro comprising nearly 60 per cent of the Dollar Index, the 98-99 band warrants close attention - a sustained break could signal a medium-term decline in the greenback.

Time, therefore, to scrutinise exposures and refresh hedges.