Validus appoints new CTO amidst ongoing global expansion

25 June 2025

The Treasury’s Yield Curve Play: the 2025 Maturity Wall

9 July 2025INSIGHTS • 02 July 2025

US Fed's 2025 tightrope: balancing data, mandate and political heat

Harun Thilak, Head of Global Capital Markets NA

The U.S. Federal Reserve, tasked with the dual mandate of maintaining maximum employment and price stability, has spent 202 navigating an economic maze shaped by shifting indicators and intensifying political pressure. Under Chair Jerome Powell, the central bank has stuck to a cautious, data-dependent course, weighing fresh figures against the inflationary pulse that the latest US administration’s trade policies could unleash. Below we review the Fed’s response to the latest data, note recent comments from key policymakers amid White House calls for easier policy, and outline what markets now expect.

Solid jobs, sticky prices - the Fed's high-wire act

The macro picture looks resilient, yet the path ahead is clouded by trade uncertainty.

The labour market - central to the Fed’s mandate - remains firm: the unemployment rate has hovered near 4 per cent for a year, and non-farm payrolls have averaged about 150,000 a month in 2025, a slowdown from 2024 but far from recessionary. Wage growth still outpaces inflation, though it has moderated, hinting that supply and demand for labour are still broadly in balance.

Inflation, however, is proving stickier. The downtrend of 2023-24 has stalled, with headline PCE running at 2.3 per cent and core PCE at roughly 2.7 per cent - both above the Fed’s 2 per cent goal. Short-term inflation expectations have edged higher, largely on the prospect of fresh tariffs that would raise costs for businesses and consumers alike.

Against this backdrop the Fed has kept the funds-rate target at 4.25-4.50 per cent since December 2024, following three cuts earlier that year. Powell frames the stance as a “wait-and-see” pause: policymakers want clearer evidence of how the new tariff regime will play out before acting again. They are acutely aware that tariff-driven price rises could rekindle inflation even as growth cools, reviving the unwelcome spectre of stagflation.

Chart 1: US Fed Funds rate vs core PCE

Source: Bloomberg

Inside the Fed: data first, politics last

Chair Powell continues to champion evidence-based policy and central-bank independence. In his latest appearance before the House Financial Services Committee, he said the Fed is “well positioned to wait to learn more about the likely course of the economy” before shifting rates. He warned that tariffs are “likely to push up on inflation” while denting activity and stressed the need to stop one-off price shocks from becoming lasting inflation - re-anchoring expectations at 2 per cent.

Most voting members - Governors Barr, Barkin and Kugler among them - have echoed Powell’s line. By contrast, Trump-appointees Bowman (Vice-Chair for Supervision) and Waller sound marginally more dovish. Minutes of the May 2025 FOMC meeting record broad worries that tariffs and policy uncertainty could restrain growth while fuelling persistent inflation, justifying the decision to hold rates steady.

Trump vs Powell: the ‘shadow-chair’ standoff

The US administration has kept up vocal pressure for rate cuts, accusing the Fed of excessive caution and claiming high rates handicap the US against trading partners. The Fed has responded by reaffirming its independence and devotion to data.

Powell’s term ends in May 2026, and President Trump has said he will not re-nominate him - though legal opinion suggests the president cannot simply sack a Fed Chair. Media reports now hint that the US administration could name a successor as early as September. Possible nominees include former Fed governor Kevin Warsh, former NEC director Kevin Hassett, and Treasury Secretary Scott Bessent - all perceived as favouring lower rates. Markets and Congress may push back, fearing an overtly politicised Fed.

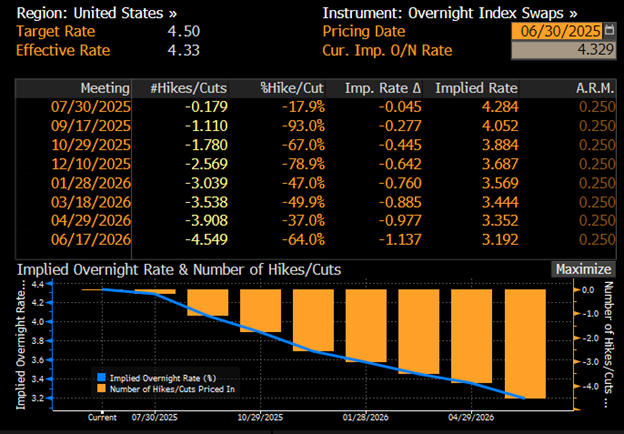

Market pricing the pause – and the cuts

With inflation readings subdued, political noise rising and talk of a dovish ‘shadow chair’ swirling, investors have shifted their rate outlook. Futures now imply roughly 65 basis points of cuts over the rest of 2025 - up from 50 basis points at the start of June.

The dollar has struggled: the DXY index is down about 10 per cent year-to-date. Further softness looks likely, especially if speculation over a dovish successor captures summer headlines and keeps the pressure on yields.

Chart 2: US policy rate trajectory implied from OIS pricing

Chart 3: DXY YTD Chart

Source: Bloomberg