The Treasury’s Yield Curve Play: the 2025 Maturity Wall

9 July 2025

UK Macro Update: Sticky Prices, Sluggish Growth

23 July 2025RISK INSIGHT • 16 July 2025

Trump turns up the tariff temperature

Marc Cogliatti, Global Capital Markets Director

After two months of trade negotiations and relative calm in the markets, Donald Trump turned up the heat again on Saturday by announcing that goods imported into the US from the European Union and Mexico will be subject to a 30% tariff rate starting on 1st August. The news comes as a nasty surprise to European leaders who have been busy negotiating a trade deal that they thought was nearing a conclusion that was acceptable to both sides. Consequently, EU trade ministers find themselves reconvening for a pre-arranged summit with an unexpected item at the top of the agenda.

Without doubt, there will be pressure from certain quarters to announce retaliative measures and avoid showing any sign of weakness. For now though, the EU has elected to postpone retaliation and instead delay tariffs on €21bn of goods that had been due to kick in at midnight tonight while additional discussions take place. Unsurprisingly, there is clear desire from the EU side to reach a resolution. Denmark’s Foreign Minister, Lars Lokke Rasmussen, who will chair talks, said Europe doesn’t want to a trade war that would be “devastating” for both sides. However, he also suggested that the EU won’t be bullied by Trump. Ministers from Germany, France, Italy and Lithuania also expressed the need for avoiding a trade war citing both economic and security concerns.

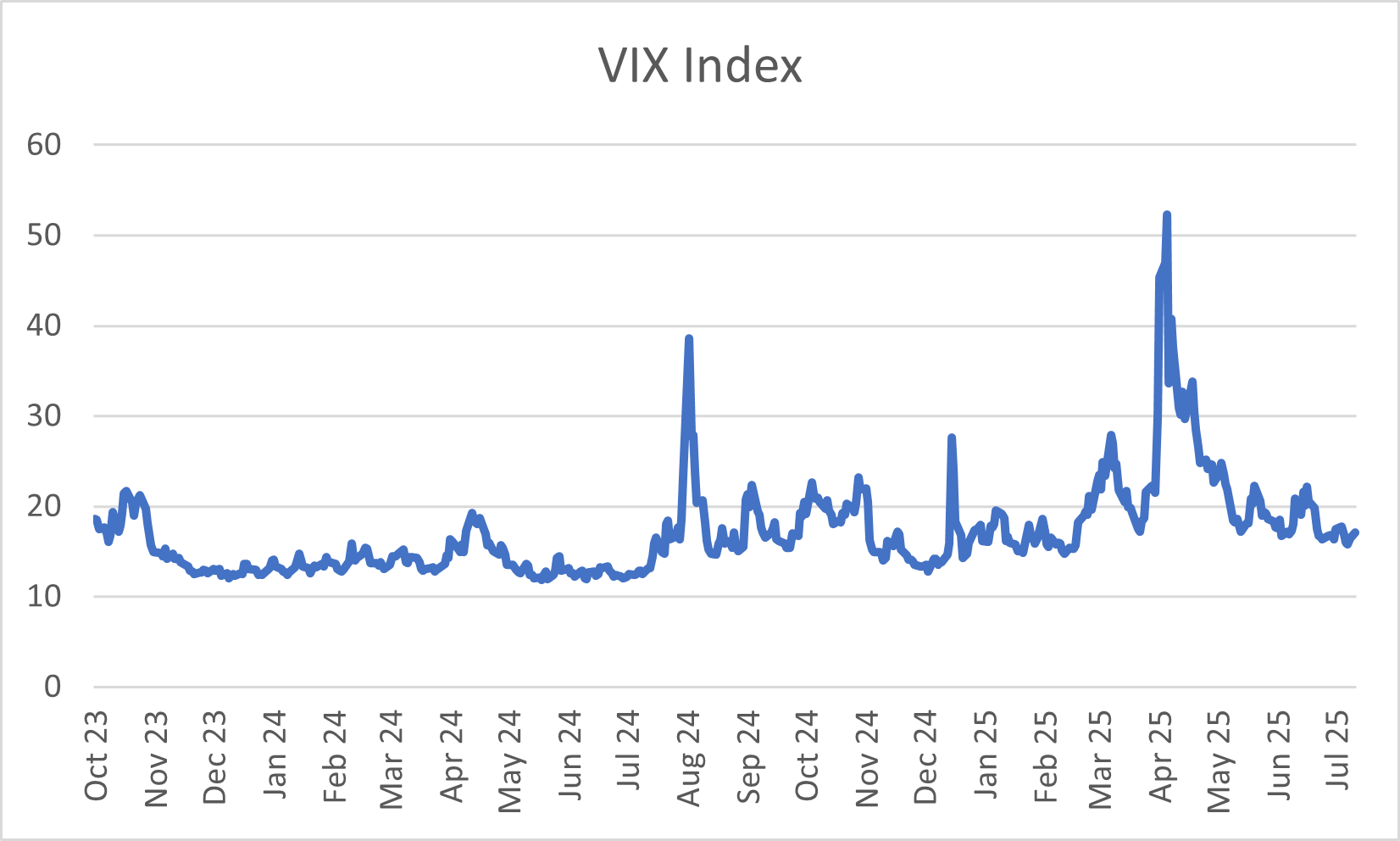

Judging by market reaction, there is still a firm expectation that the worst-case scenario will be avoided. European bourses opened the week down ~0.5% which while not insignificant, is a far cry from the volatility seen back in March / early April (see VIX index chart below). The response in the FX market is interesting with the dollar stronger across the board. Whilst a weaker euro might not be that surprising given the impact tariffs would have on the European economy, the single currency is trading higher against both the pound and the yen, implying the move in EURUSD is more about dollar strength than euro weakness.

Figure 1: VIX Index

Source: Validus / Bloomberg

A couple of points worth considering:

- Don’t rely on correlations – we’ve written numerous articles in recent months about the breakdown of traditional correlations between equity markets, interest rates and exchange rates. For the past couple of months, talk of tariffs has been met by weaker equity markets and a softer dollar. Maybe we shouldn’t read too much into a one day move, but it’s notable that we’re seeing more of a ‘traditional’ risk off reaction in the markets today.

- The dangers of complacency - Whilst there is clear desire to reach an agreement, particularly from the European side, it feels like markets are somewhat complacent about the risks of this not happening. Global equity indices remain close to record highs while volatility in both FX and interest rates remain surprisingly subdued. As the next two weeks unfold, if there aren’t signs of progress being made, there is a clear risk of markets becoming increasingly volatile.

- Negotiation tactics – Trump has shown that he’s not adverse to extreme demands followed by small, slow concessions. The problem with this strategy is that it can result in negotiations being drawn out, even to the extent that a deadline is allowed to pass before a resolution is found later. That may be all well and good, but the market volatility caused in the interim is particularly difficult to manage.

What does it mean for our IR and FX views?

In short, we see no reason to change our long-term bearish view on the dollar. Given the uncertainty created by Trump and his policies, we continue to expect foreign investors to diversify their holdings away from the US (which in turn should weigh on the dollar). That said, we’ve already seen the dollar depreciate >15% since the beginning of the year and knowing markets rarely move in straight lines, a correction, or even just a period of consolidation, would not be untoward in the near term and wouldn’t change our long-term bias.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.