Stepping into the strategic spotlight

7 August 2025RISK INSIGHT • 13 August 2025

Artificially Intelligent Markets

Kambiz Kazemi, Chief Investment Officer

“Markets can remain irrational longer than you can remain solvent.”

John Maynard Keynes

US equities continue their relentless ascent, making successive all-time highs this week. It seems we have re-entered a world where “good news is good news, and bad news is good news” for the stock market. After months of lingering uncertainty and flip-flops around both tariffs, rates and rules, investors appear desensitised and remain unfazed by the never-ending saga of tariffs.

More importantly, the markets seem oblivious to the many signs of economic weakness and slowdown flagged by recent data and on-the-ground observations: a weakening US jobs market, a stagnant housing market with new-home sales at multi-decade lows, and inflation that remains sticky around 3%, etc. Admittedly, over the last few decades the stock market has not necessarily reflected the state of the economy or maintained a close relationship with it. Yet the level of divergence between ever-increasing prices of risk assets and a weakening economy is impressive and noteworthy.

Artificial vs Traditional

A closer look at US equity indices highlights that the main engine of their sustained performance is the tech sector. By tech sector we mean the wide net that encompasses not only the Magnificent Seven extensively discussed post-Covid, but also firms across AI and the crypto ecosystem.

As a reminder, the construction of equity indices favours the contribution of stocks that have the highest weights - and those weights go to companies with the largest market capitalisations. As specific stock prices rise to the point where market capitalisation becomes dominant, index performance is in large part driven by a limited number of stocks.

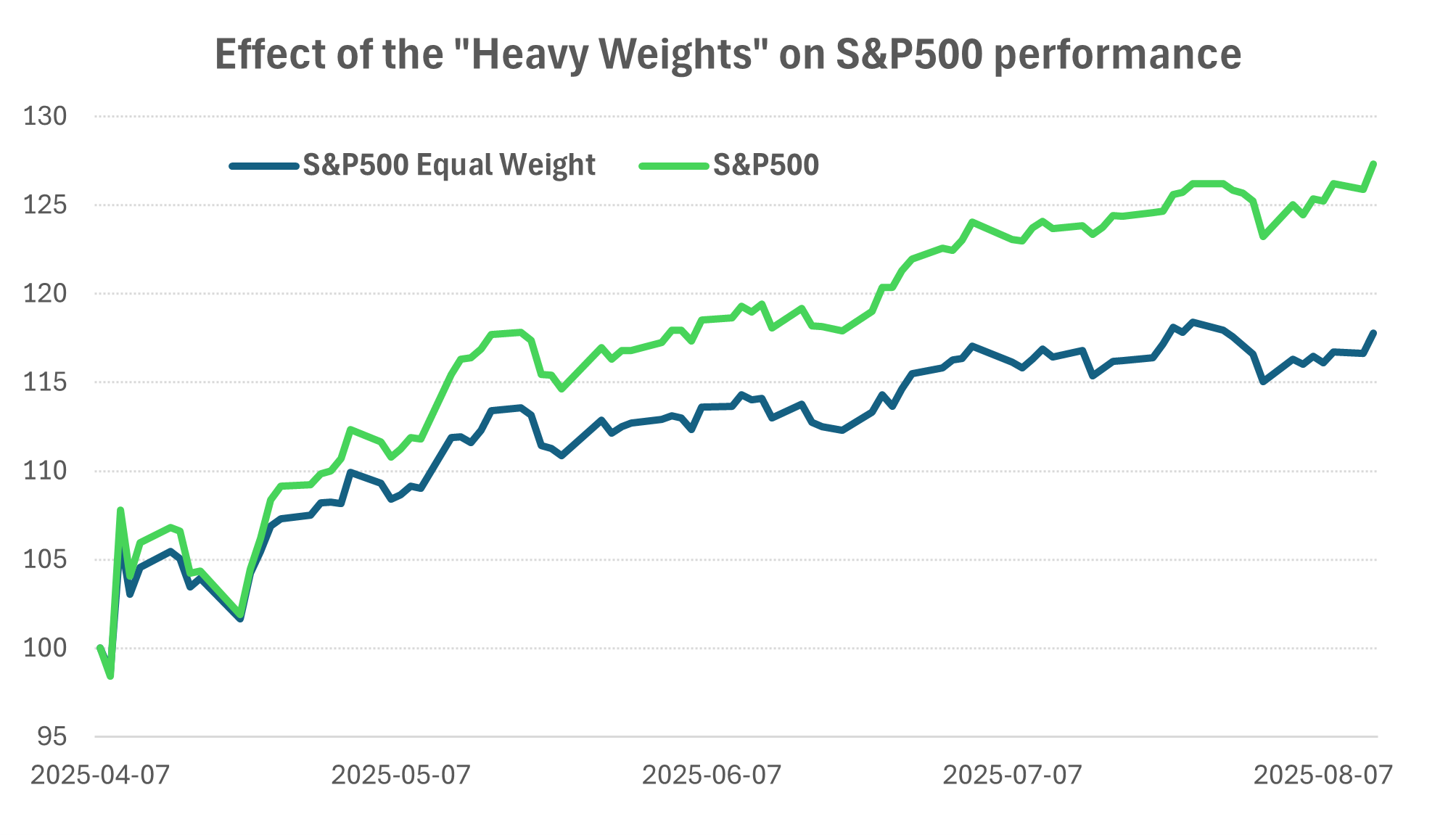

There are a few ways to see the effect of the AI/Tech/Crypto (let’s call it AITC) family on the main US stock indices. For instance, we can look at the S&P500 index versus the S&P500 Equal Weight Index. (see chart 1)

Chart 1: S&P500 Index versus S&P500 Equal Weight Index post-Liberation Day

Nearly one-third of the performance (9% out of 27%) since the Liberation Day is due to the combination of the AITC stocks outperforming “traditional” sectors and the construction of the index. In the past - until the mid-2010s - when AITC stocks had smaller or comparable market capitalisation to traditional stocks, this effect was much more muted. Now there is an argument to be made that investors should look beyond the optics of the main equity indices to get a “balanced” sense of stock-market performance.

The Reality of Artificial Markets

Notwithstanding the fact that index price performance can be skewed by their construction, due the prominence of AITC stocks, the fact remains that we are very much in the midst – some would argue closer to the beginning – of an AI Boom. Much like the Tech Boom of late 1990s, AI related technology is evolving at an impressive pace, generating much enthusiasm among investors of all kinds that directs impressive amounts of capital into the sector.

As it happens, booms can last a while, and it is often a fool’s game to try to predict an end to a cycle that is driven by so many unknowns. Where will AI innovation lead us? How will it reshape our daily lives and societies? Etc. In the meantime, the excitement is not likely to abate soon, which means:

- The traditional (i.e. “real”) economy can very well slowdown and even suffer a recession, but AITC stocks could continue to be in demand and help sustain equity-index performance.

- As AITC becomes increasingly an integral part of the “real” economy, investors will start looking at them from the “traditional” valuation perspective of profitability.

Reality and Fiction Will Meet Again

Historically, (in the US) new technological breakthroughs have often, if not always, been accompanied by periods of excitement and euphoria as investors pour capital into these technologies and sectors. One could argue this process has been at the heart of making the US a bedrock of sustained innovation over the last century and a half.

However, within a capitalist system, all private endeavours and investments are made on the premise of profitability. One can expect the AITC excitement to follow a similar path to the railway mania of the mid 1800s, the Tech Boom of 1990s or, more recently, the boom in renewables that is coming to a screeching halt. Once massive amounts of capital have been directed and invested in the sector, investors and markets’ focus will start shifting to profitability and viability of the business models. How AI firms will generate viable and sustained profits is yet to be seen: - subscription services, humanoid robots, full or partial replacement of service sectors, etc.

At that point, reality will meet AI, as investors’ demand for profitability will drive their (rational) decisions. Until then, in the eyes of the rational investor, markets can remain irrational - but the markets will be “right” in their own way, nonetheless.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.