Cboe® Validus® S&P 500® Dynamic BuyWrite Index

29 July 2025Real Yield Protection Strategy (RYPS)

7 August 2025Hedging Inflation Risk: Beyond Real Return Bonds

Kambiz Kazemi, Chief Investment Officer

With inflation protection becoming a top priority for Canadian pension plans, identifying suitable alternatives to Real Return Bonds (RRBs) is critical. This article, originally co-authored by Validus Risk Management and published in collaboration with ACPM, outlines practical strategies beyond RRBs for navigating the current landscape.

Inflation has re-emerged as a major concern for the retirement well-being of Canadians. From 1991 to 2021, inflation in Canada averaged only 1.81% annually. But between 2022 and 2024, inflation rate more than doubled to 4.37% annually, driven by post-pandemic supply chain disruptions and expansive monetary and fiscal policies. Higher than expected inflation can strain the funding of defined benefit plans. It may also make it harder for savings in capital accumulation plans to meet retirement needs.

Real Return Bonds (RRBs) have long been the go-to tool for inflation protection, offering interest and capital payments indexed to the Consumer Price Index (CPI), though often at the cost of low real yields. Today, their usefulness is somewhat curtailed due to:

- a shrinking and illiquid market

- limited supply on the secondary market as holders rarely sell

- their lower yield given they offer no credit premium; and

- the federal government halting new issuances of RRBs in 2022.

Alternatives to Real Return Bonds

With the limitations of RRBs, investors have increasingly turned to alternative strategies to manage inflation risk while seeking more attractive returns. Over the past decade, many pension plans have diversified into alternative investments such as real estate, infrastructure, commodities, and private equities with inflation-sensitive characteristics. Some have even looked beyond Canadian borders, incorporating U.S. Treasury Inflation Protected Securities (TIPS) into their portfolios.

However, not all of these alternatives offer a robust inflation protection. Real assets can be subject to liquidity constraints, accessibility issues, and market volatility, which may limit their effectiveness depending on the economic environment. TIPS, while structurally similar to RRBs, are tied to the U.S. Consumer Price Index. Although the U.S. and Canadian CPIs have shown about 80% correlation since 1982, annual variations can differ by up to ±3%, and the U.S. CPI has generally grown faster, potentially reducing the precision of inflation hedging for Canadian investors.

An Innovative Take on Inflation Resilience

Since the federal government ceased issuing Real Return Bonds in 2022, there has been widespread discussions about finding effective substitutes for inflation protection. Ideally, these solutions should work in tandem to manage both inflation and interest rate (duration) risks.

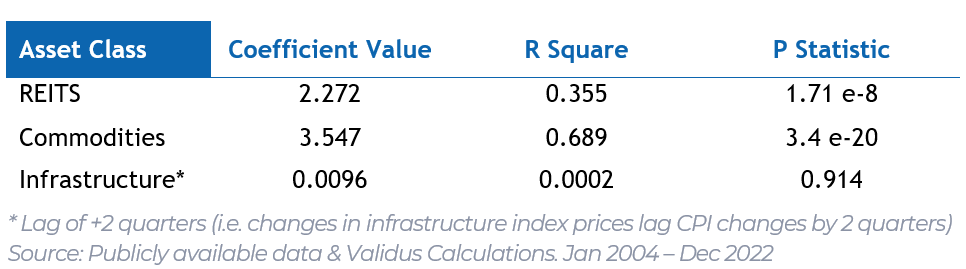

To evaluate the relative attractiveness of these inflation protection substitutes, we looked at their excess returns relative to the excess returns of TIPS versus nominal bonds, a proxy for breakeven rates. We used TIPS because of the availability of the data and liquidity of U.S. alternative assets and indices. The conclusion holds for the Canadian environment. The results, summarized in Table 1, highlight the potential of selected alternative asset indices, to deliver inflation protection based on the regression of their excess return versus that of TIPS. A higher R-squared coefficient indicates a stronger relationship between the alternative asset and the TIPS.

Table 1: Performance of Inflation Hedge Assets Excess Return (ER) Relative to TIPS ER

While infrastructure has often been promoted as an inflation hedge, its effectiveness has weakened over time and proven inconsistent. The analysis shows that infrastructure returns lag inflation by about two quarters, and the relationship is weak in both magnitude and timing. In contrast, commodities and REITs (proxy for real estate) demonstrated stronger and more immediate inflation sensitivity, with commodities showing the highest correlation to inflation-linked excess returns.

Finally, while real estate can offer inflation protection—particularly to the extent that prices are driven by real interest rates—its performance during inflationary periods can be uncertain. Rising nominal rates tend to put downward pressure on property values, while broader economic conditions (e.g., recession vs. growth) also influence outcomes. As a result, on a mark-to-market basis, real estate’s inflation protection can be volatile and imprecise, making it less dependable in the short term despite its long-term potential.

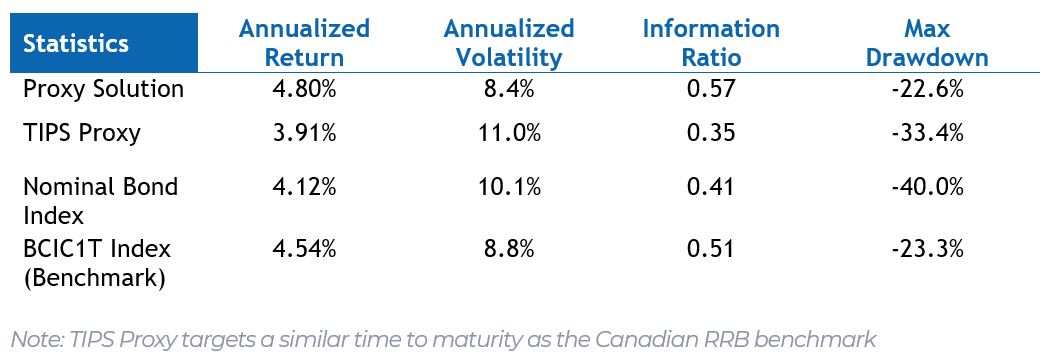

This suggests that a targeted, liquid and scalable approach using nominal bonds and commodities could offer superior inflation resilience without the limitations of RRBs or the volatility of real asset exposures.

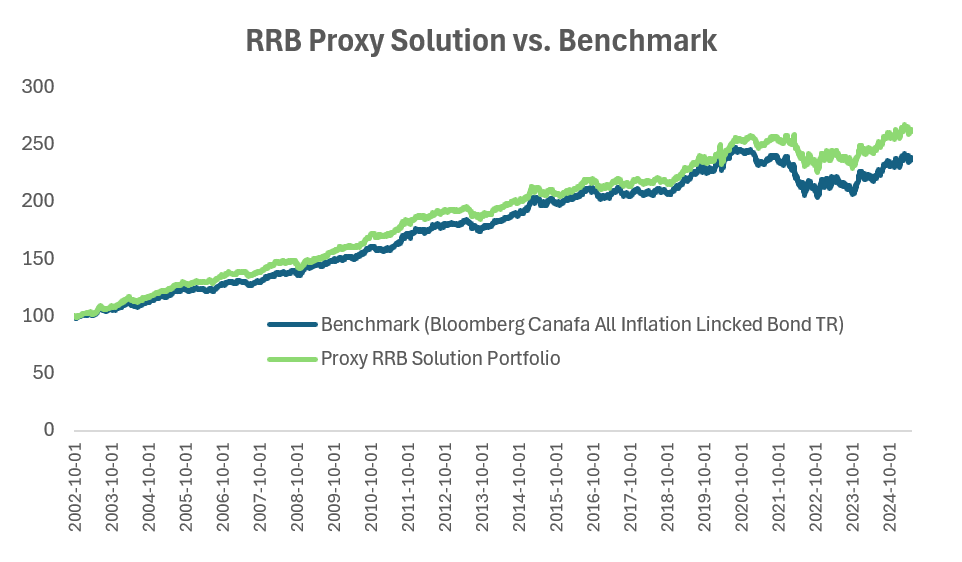

In fact, recent work based on this approach has shown that such a solution of a combination of nominal bonds and carefully selected commodity sensitive securities can outperform traditional inflation-indexed benchmark and real asset-based strategies.

Chart 1 – Historical Performance of the RRB Proxy Solution Strategy (CAD) – value of $100 invested

Table 2: Returns and Risk Measures of Various Inflation-Linked Approaches.

Synthesis

The proposed inflation-hedging strategy—combining nominal bonds with carefully selected commodity-sensitive assets—offers a compelling alternative to traditional Real Return Bonds (RRBs). With a correlation of nearly 90% to the RRB benchmark, this approach delivers comparable inflation protection while offering greater flexibility, liquidity, and scalability.

Even if RRBs were still available, this solution would remain highly relevant due to its strong performance characteristics and adaptability to various benchmarks. It fits within the fixed income universe while also functioning as an inflation-sensitive asset, outperforming many conventional tools in both categories.

Importantly, this strategy is not limited to defined-benefit pension plans. Its modular structure allows for the use of different types of bonds as the nominal component, making it well suited for capital accumulation plans. This enables individuals to better preserve the purchasing power of their retirement savings—both at and beyond retirement.

As RRBs are gradually phased out, the existing benchmark becomes less relevant, particularly as its duration sensitivity diverges from the typical liability profile of most plans. This proxy solution is not just a replacement—it has the potential to become a new benchmark in its own right, offering a standalone, scalable, and efficient framework for inflation protection without introducing tracking error.

1 See “Inflation Protection: Do Alternative Assets Work”, May 2024, Validus Risk Management

2 The study uses the Real Estate NAREIT index, the Rogers International Commodity Index and the INFRA300 Index as proxies for each alternative asset type.

This article was originally published by the Association of Canadian Pension Management (ACPM) in its Observer newsletter.

Co-written by Christian Robert, Vice-President, Investment Solutions and Product Management, Addenda Capital