It’s a deal!

5 January 2021

2021 Global Macro Outlook – Part Two: Where we might go

19 January 2021INSIGHTS • 12 January 2021

2021 Global Macro Outlook -Part One: Where we are

Validus Risk Management

While we never know where we’re going, we ought to know where we are…

Howard Marks, ‘The Most Important Thing: Uncommon Sense for the Thoughtful Investor’, 2011

In this first part of a two-part overview of the 2021 macro environment, we will take stock of the major market factors that we feel deserve particular attention.

As Howard Marks implies above, predicting financial markets is a notoriously difficult task at the best of times. With global economic activity crushed by a pandemic and financial markets dominated by central banks and appearing to be increasingly disconnected from the ‘real economy’, Mr. Marks’ words resonate particularly powerfully today.

However, as a starting point, the Risk Insight team met (virtually) last week to discuss the major macro factors to consider as we think about the hedging environment for 2021.

Here are the highlights.

Fed Policy Kambiz Kazemi, Chief Investment Officer

The pandemic crisis of 2020 took the Fed’s monetary policy into new and uncharted territory in March. After bringing down the overnight rates to zero in two emergency cuts, it not only deployed its traditional QE tools but launched a number of new asset buying and lending programs.

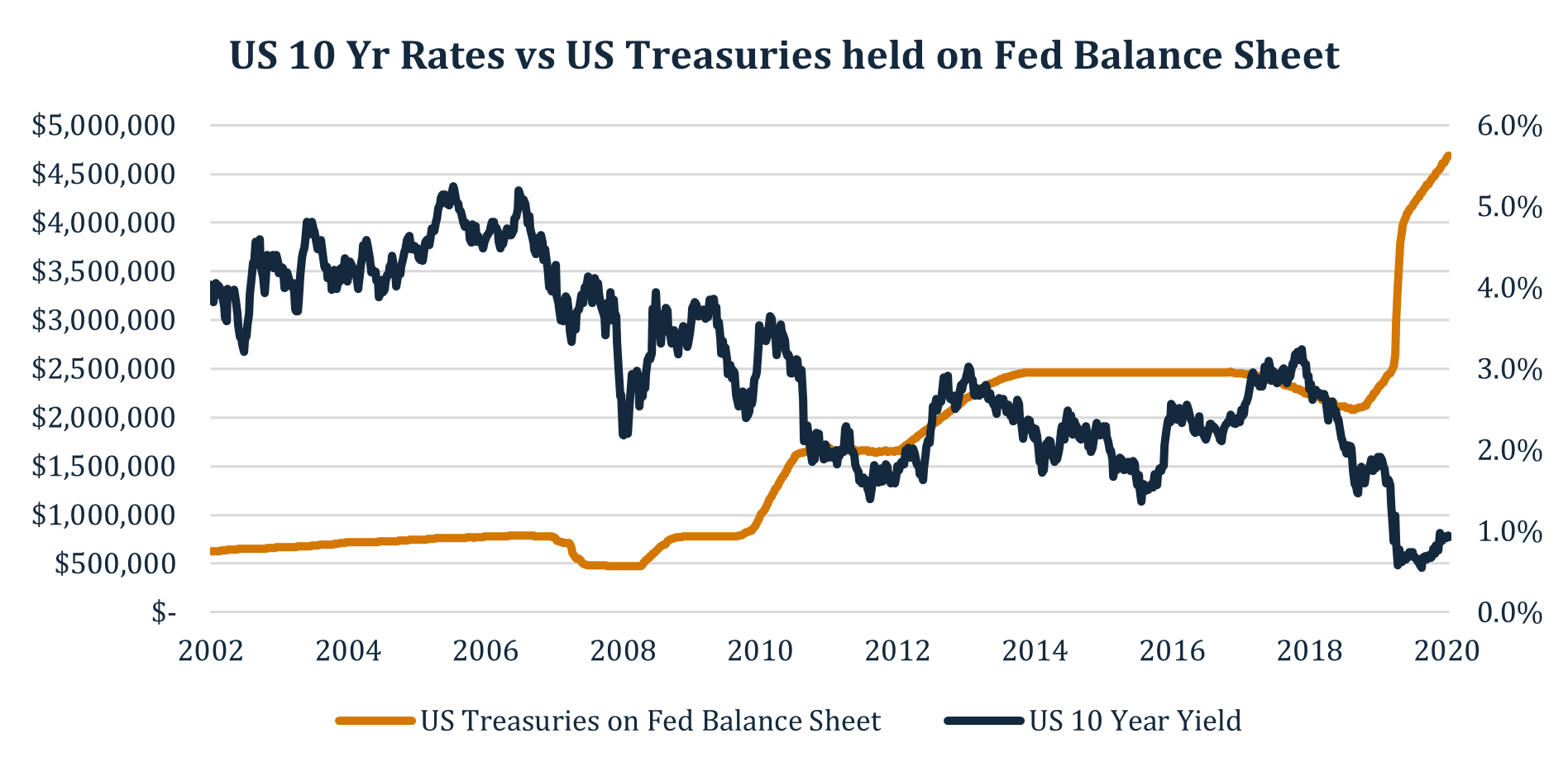

These actions nearly doubled the amount of Treasury securities held on the Fed balance sheet in 2020, a staggering increase of $2.4 trillion. Not surprisingly this new arsenal of programs drove longer dated rates to their all-time lows, around 0.50% for the 10-year Treasuries.

This drop in the nominal rates was naturally accompanied by a weakening of the USD against most currencies. The sustained rise in risk assets and increased economic activity in Q3 comforted the Fed as it signaled no immediate change in its asset buying programs. At the last Fed meeting in Dec 2020 members projected the Fed Fund rate being held at near 0% until the end of 2023.

Yet, the rising expectations of inflation – as measured by breakeven yield – and the prospects of a steady economic recovery under the new US administration, helped by vaccinations campaigns, have some market participants watching closely for any signal from the Fed with regards to modifications to their asset purchase program.

In the last few weeks, statements by Philly Fed President Mr. Harker – who sees a case for reducing asset purchases by year end – followed most recently Fed Vice Chair Clarida’s optimistic view on economic recovery, are worth monitoring very closely. These statements signal Fed’s willingness to continue monetary easing as far as the short end of the curve is concerned, all the while contemplating the prospects of a progressive steepening of the curve at some point in the future, via reduction of asset purchases.

The rapid rise of long end rates in the last few weeks might reflect the fact that market participants are awakening to this scenario. (see below)

Source: Bloomberg

For 2021, Fed’s asset purchase program and the extent to which it affects the behavior of long term US interest rate is a key factor not only for price action of risk assets at large but in particular for that of US dollar.

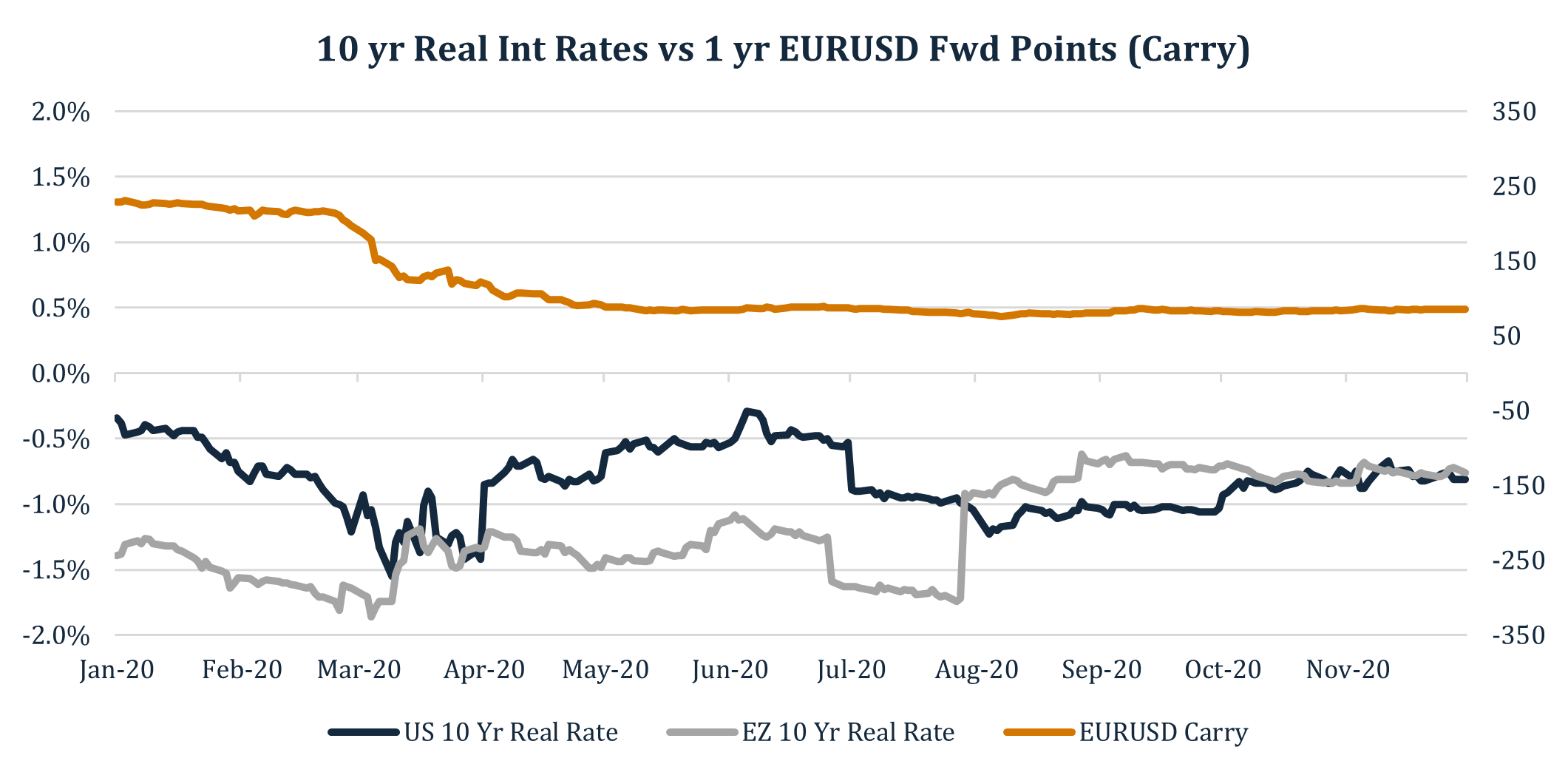

Real Interest Rates and Carry Richard Hall, CFA Co-Head of European Risk Advisory

In theory, real interest rates (adjusted to remove the effects of inflation) are driven by changes in the economy / business cycle, which can be heightened by the intensity of economic activity and the pressures that this intensity puts on productive capacity, as well as the labour and commodity markets. In practice, 2020 gave the stage to central banks around the world implementing emergency rate cuts in hopes of buoying the global economy.What is important to note here, is the magnitude of the emergency rate cuts, of which the US was certainly the greatest, pushing down real rates by about 50 basis points. In addition, Eurozone disinflation / deflation actually pushed up real rates by about 60 basis points. (UK real rates were broadly flat). This may be one reason why EURUSD rose by about 10 big figures in 2020, whereas GBPUSD ‘only’ rose by 5.

Furthermore, the generous carry (a function of nominal, rather than real, rates) experienced by USD investors hedging EUR exposures in particular began to decline. In effect, a double whammy for USD-based hedgers and a boon to EUR-based investors hedging USD exposures.

Geopolitics / China

Bill Manahan, Associate, Strategy and Business Development

Trump cast China as the bogeyman for much of his term, engaging in incendiary rhetoric and tit for tat tariff spats. After some initial concern about this adversarial approach, the USDCNY relationship tilted bullish dollar.

The Trump administration focused almost entirely on trade when it came to China, paying little attention to anything else (the Uighurs, Hong Kong, Taiwan, South China Sea).

This stood in stark contrast to the multi-layered, multi-lateral Obama administration approach. Through various organisations and international coalitions, Obama sought to force China onto a level playing field. Obama famously pivoted to Asia in an effort to exert the necessary pressure/ influence to achieve this goal. Throughout this period, a weaker dollar was a consistent pattern.

While nothing about the Biden administration is set in stone as of yet, it is clear from the nominations to date (Anthony Blinken as Sec State, Jake Sullivan as NSA) as well as the type of vice president he was, that Biden will seek to reengage with the world at large. It would be a fairly safe bet that Biden seeks to re-commit to many of the deals Trump left as well as foster stronger relations with America's traditional allies.

China will be close to the top of his foreign policy. While there might be an easing (of sorts) relating to the trade tension between the countries, the topic of human rights may become (again) the point of maximum friction. Were he to tow a similar line to his former boss – engage on multiple fronts to achieve a set of highly integrated goals – we might see the dollar weaken again? It is highly unlikely he will maintain the current administrations set of foreign policy objectives as it relates to China (even as they helped achieve a stronger dollar against the Yuan).

FX Valuation

Ali Jaffari and Caleb Thibodeau, Global Capital Markets (North America)

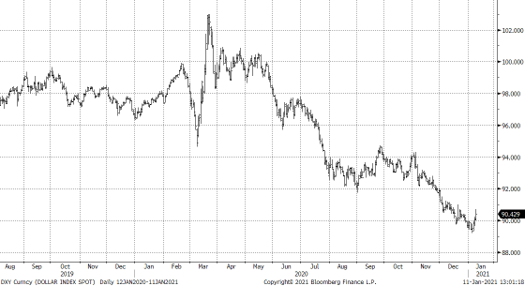

The greenback has been on the decline this year. The US dollar index, which measures the currency against a basket of foreign currencies, has tumbled around 14% since its March highs.

In addition, to the aforementioned decline in real interest rates (particularly against the euro) the headwinds facing the dollar also include:

- An increase in the U.S. trade deficit. U.S. trade deficit hit its highest level in 14 years, as exports of goods and services remain well below levels seen in 2019 (down 12.5% since November 2019), while imports have picked up pace.

- A decline in the global share of USD reserves. The dollar’s share of reserves fell by 1.3% in the third quarter, as reported by the IMF, while EUR and JPY’s share of reserves increased in the same period by 1.9% as they benefitted from diversification flows away from the USD. Third quarter data represented the lowest proportion of allocated reserves held in USD since 1996 (60.5%).

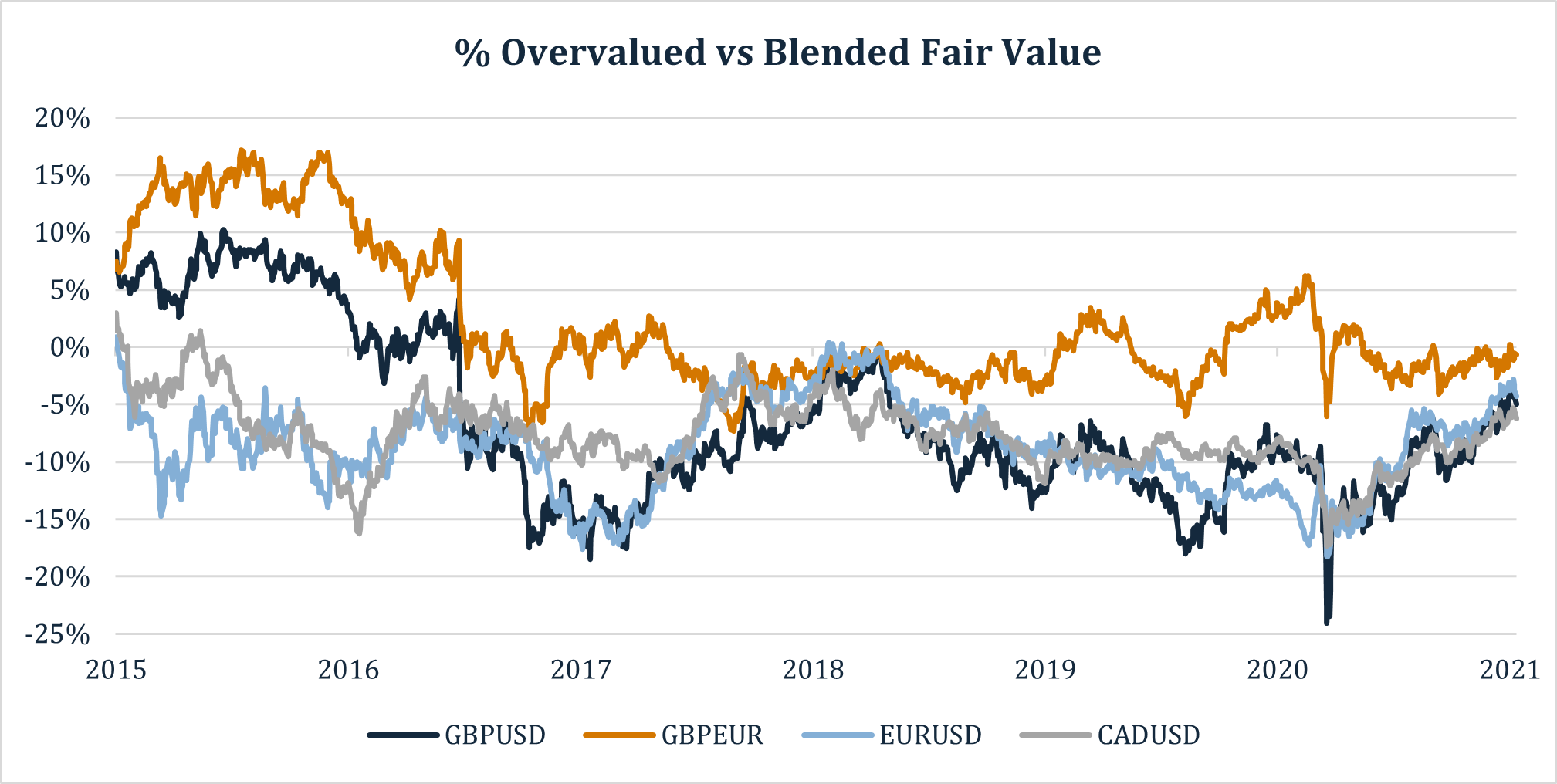

On a purchasing power parity basis, currencies tend to revert to ‘fair value’ on a very long-term scale. While this is no indication in the short-run, extremely under or overvalued currencies typically move back towards an approximate PPP valuation.

The below chart helps position the recent dollar move against a blended fair value measure, consisting of PPP measured on an inflation and producer prices basis from Bloomberg, the OECD and the IMF.

What is clear from the above is that the US dollar’s persistent premium (which peaked at between 15% and 20% depending on the currency pair) was largely eroded in 2020. This is both evidence of the predictive power of FX valuation, and reason to be especially cautious when it comes to FX predictions for 2021!

FX Market Consensus Marc Cogliatti and Harry Woolman, Global Capital Markets (Europe)

At the start of a calendar year, seldom has market sentiment seemed this one-sided in its forecasts, particularly against the dollar. CFTC data ending 5th January shows that speculative bets against the greenback have increased, bringing the aggregate positioning of the USD versus G10 currencies down from -14% to -16% of open interest from the period 15th December to 5th January.

Furthermore, recent analysis from Nordea / Bloomberg has showed that not a single investment bank has published a bullish dollar outlook for 2021, and nine out of ten forecasters expected EURUSD to break above 1.25 in 2021.

It is widely viewed that recovery from the pandemic – driven by vaccination rollouts – is dollar-negative, with investors anticipating a move away from the greenback. However, there is still a strong argument in favour of the dollar: economic disruption caused by Covid-19 will be long lasting and further outbreaks / global lockdowns will favour safer-haven assets. And with market positioning and consensus as skewed as they have ever been in terms of expectations of future USD weakness, a possible move higher in the dollar could be swift and brutal.

This summary of market factors shows that ‘where we are’ is somewhere both familiar and at the same time quite extraordinary. The implications of a global pandemic, and the resulting monetary and fiscal measures deployed to deal help the economy survive, are not something we have had to factor in to our forward-looking risk analyses before. However, factors such as monetary policy activism, geopolitical tension, and lop-sided FX market positioning are certainly nothing new to anyone who has been observing global markets for even a relatively short period.

In his excellent book ‘The Most Important Thing’, Howard Marks writes: ‘The thing I find most interesting about investing is how paradoxical it is: how often the things that seem most obvious - on which everyone agrees – turn out not to be true.’ Next week, in Part II, I will examine the risks to the current consensus macro view (weak US dollar, rates remaining at zero, ‘risk on’) and the implications for hedging programs in 2021. Happy New Year!

Kevin Lester CEO

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.