Validus Achieves ISO 27001 Certification

25 January 2021

Inflation: Gone but not forgotten

9 February 2021INSIGHT • 2 February 2021

What can we learn from GameStop?

Ali Jaffari and Marc Cogliatti

Markets last week were largely focused on a select few events (from the Fed meeting, global vaccine rollout and the annual World Economic Forum conference), but undoubtedly so it was the GameStop phenomenon that dominated the news, creating significant headline risk for markets.

Wall Street was consumed by the actions of a group of day traders, bidding up a handful of stocks, leading to bludgeoning losses for hedge funds. These traders, notably small investors, have emerged as a new risk factor in this digital age for large hedge funds that bet against companies. It makes you wonder if the “hedge” in hedge funds should become a growing area of importance for some of these funds taking on large short positions, where losses are potentially limitless.

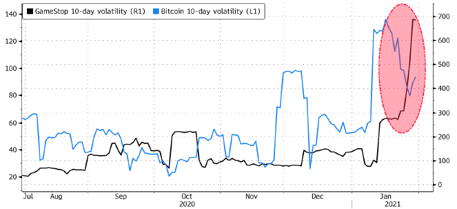

Short sellers in GameStop are reported to have losses over $14 billion, marking one of the worst days on the short side for one stock. What is interesting to note is that the aggregate short position of GameStop shares exceeded its total shares outstanding for GameStop (by ~30%). It is no surprise that active traders love volatility, but perhaps not during this one-way fuelled rally where short-term volatility on GameStop surpassed that of Bitcoin by 6 times (see Chart 1).

Chart 1: GameStop rolling 10-day volatility (black), Bitcoin rolling 10-day volatility (blue)

Source: Bloomberg

While the world of short selling is a far cry from the activities our typical client engages in, there are five valuable lessons we can take away from recent events:

Markets often deviate from their fundamentals – in a world where almost anything can be bought online and delivered to your door, stores like GameStop selling commodity products look set to become an endangered species. I am no retail analyst, but the rationale for shorting a stock like GameStop seems relatively obvious, even for a layman like me. But then the shares go and rally 1,600%! Granted we do not see moves of this magnitude in currencies (thankfully!), but the same principle applies. A currency can be overvalued on every PPP measure, yet still rally (e.g., JPY post 2008).

Momentum is a powerful force (at least in the short-term) – regardless of the rationale behind a move, traders like to follow a trend. This creates as snowball effect whereby a move gains in popularity as it gathers pace. This behavior was also exhibited in currencies in recent months; the dollar’s steady decline has picked up steam and is forecast to continue its downward spiral (consensus among the vast majority of investment banks).

Stay vigilant when positioning becomes extreme – a reversal can be swift. We see this time and again in FX markets (e.g., sterling in 2007, euro in 2012) and regularly highlight it in our reports. Extreme long positioning is building up once again in the euro, as shown by CFTC futures data.

Be aware of the frequency of tail risk events – maybe it is just me, but so called ‘Black Swan’ events seem to be a recurring theme (e.g., Global Financial Crisis, Eurozone Crisis, Brexit, COVID).

Liquidity risk trumps everything – clients often face liquidity risk challenges in managing collateral requirements on hedges which are out of the money (negative mark-to-market valuations). Although an underlying asset may have gone up in value, the underlying does not generate the cash required to collateralize its corresponding hedge. The hedge funds shorting GameStop face a very different set of circumstances (primarily in that they do not have an offsetting position) but my point is that whilst they may be right in the long-term, they cannot fund further losses in the short-term.

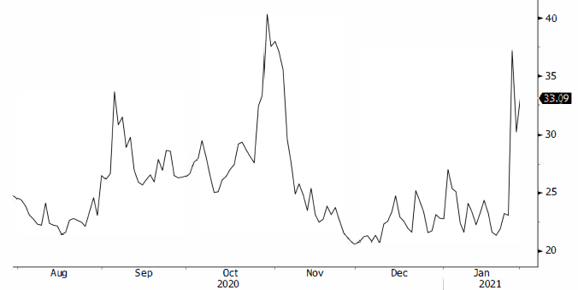

Given the unfolding of events, it both highlights and reinforces the growing importance of risk management practices. Last week’s activity impacted the broader capital markets, as evident by an increased risk-off sentiment that was also priced into the Volatility Index (VIX). The VIX, a ‘fear gauge’ for the level of risk in the market, increased over 50% in the last week amid surging market volatility (see Chart 2) and had the largest single day increase in almost 3 years.

Chart 2: Volatility Index (VIX)

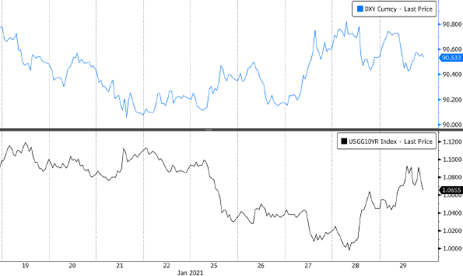

Contrary to the weak USD theme taking hold for the better part of the last 10 months, increased market volatility last week led to a slight appreciation in USD, driven by safe haven flows (see Chart 3). US Treasuries, being the common choice of haven assets, experienced downward pressure on yields back to the 1% level before slowly rising on the back off a dovish Fed. This reinforced its accommodative policy, with no indication on tapering of asset purchases.

Chart 3: USD Index (blue), US 10Y Treasury Yields (black)

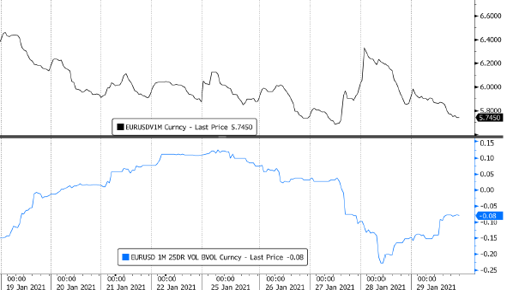

The trading events of last week, specifically the “short-squeezing” activity undergone by hedge funds, largely contributed to the downturn in market sentiment. USD pairs faced increased volatility and rose intra-week. For example, the 1-month implied volatility on EURUSD increased by 0.6% as part of the broader risk-off behaviour (See chart 4). Meanwhile, risk reversal on EURUSD turned negative, indicating that the demand or the implied volatility premium for EUR put options (bearish bets) is higher than that for calls (bullish bets). This is expected, given the recent strength in the US dollar. For further context on a weak euro, please view last weeks article which highlights seven reasons that could lead to the euro’s underperformance in 2021.

Chart 4: EURUSD 1-Month Implied Volatility (black), EURUSD 1-Month 25 Delta Risk Reversal (blue)

In the coming weeks, it may be worthwhile keeping an eye on boisterous moves on certain equities, more so to understand the broader impact on investor confidence and the overall attitude to risk sentiment in the market. It is important to be dynamic in how we view and price risk, especially when dealing with non-fundamental factors. If the large, deviant market swings coming out of the last trading week have taught us anything, it is the importance of maintaining a prudent risk management approach.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.