Energy crisis lays bare the importance of effective risk management

28 September 2021

FX Hedging in China – Risks are Rising for Private Equity Investors

12 October 2021INSIGHT • 5 OCT 2021

Transitory inflation that might last forever

Kambiz Kazemi, Chief Investment Officer

“The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.”

In our February 9th note: “Inflation: Gone but not forgotten”, we highlighted that continued supply chain disruptions and a likely early summer pickup in demand due to progress in the vaccination rollout could bring about inflationary pressures.

The Personal Consumption Expenditure – Fed’s preferred gauge of inflation – released last Friday hit a 30-year high of 4.3%.

The main debate among pundits is whether these inflationary pressures are transitory or permanent. Mr. Powell and Ms. Lagarde so far keep asserting their belief that these are transitory shocks. The market, however, increasingly seems to doubt them.

In our view, “the answer might not lie in one (inflation is transitory) or the other (tapering) but a bit of both” (Two and Half Century of (real) Interest Rates).

Why? We suggest, observed inflation can be explained by elements that fall into two main categories.

Cause 1: Disruption in supply chains while demand normalizes

This view has been widely discussed and the main explanatory factor put forward by the Fed and the ECB. The idea is that the pandemic-induced disruptions and inefficiencies coupled with a resurging demand, close to pre-pandemic levels, have driven prices higher, and as these disruptions subside, we will witness some pressure coming off prices.

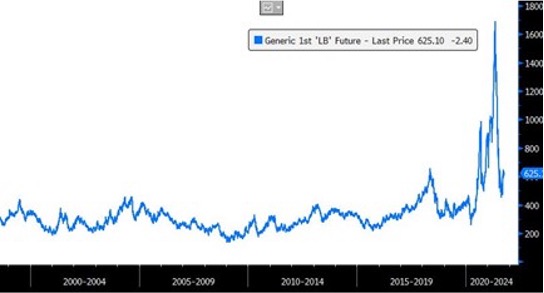

Lumber prices in US are a notable example. As supplies were scarce their prices quadrupled this year into the summer, only to drop by 60% since then. Yet today the price of lumber remains 50% higher than pre-pandemic levels.

Chart 1: Lumber, the tale of a supply chain disruption

Source: Bloomberg

Cause 2: Decarbonization & climate change (direct and indirect costs)

Decarbonization has proven to be a tricky affair. Renewable energy was touted as the main substitute for fossil fuels. But what does happen when the wind stops blowing, and UK wind production drops by 80%? Or a cold spell stops wind turbines in Texas? Or even when the sun stops shining at the same time as electricity grids are at peak demand?

In these situations, we are back to firing up gas or coal plants many of which happen to be closed or out of commission. What if, on top of that, the natural gas arrangements that ensured their smooth functioning for decades, have been also discarded or disrupted?

Impact on the developed “carbon-conscience’ world

Natural gas prices in Europe have simply exploded, a 5-fold increase in less than a year. In addition, spot and forward electricity prices are up 3-fold in France and Germany this year, in particular.

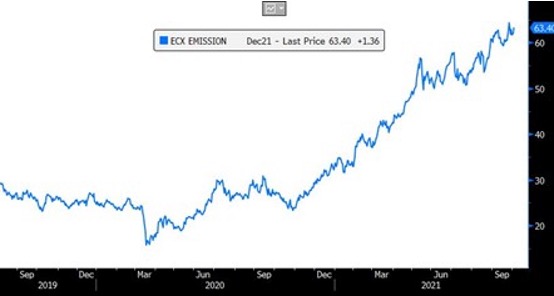

As fossil fuel-based energy comes back online in the developed world carbon emission prices go up, given that polluters need those credits, further bringing up their cost of doing business.

This has put in motion a feedback loop that ultimately flows through every single industrial and consumer item: from aluminium, whose production is extremely electricity intensive, to solar panels produced by relying heavily on coal generated power to any type of processed food.

Chart 2: Decarbonization has a cost: price of carbon emission in EU

Source: Bloomberg

Impact on China & India

With nearly 40% of world population, the economies of China and India rank respectively 2nd and 6th globally by GDP and are the top consumers of coal in the world. Their efforts towards carbon-efficiency are proving to have an important impact, in particular on natural gas. Most recently, in light of increased demand and cold weather, China has started to secure natural gas supplies at any price.

This means the energy price crunch in UK and EU will likely be further exacerbated. India, on the other hand, is on the verge of a power crisis as coal stocks have dropped to only 4 days of supply vs. two weeks of supply back in August.

Further pressure on energy prices globally makes any short or medium-term normalization of prices very unlikely. Adding to the turmoil is the risk of important industrial disruptions, particularly in the manufacturing sector. Last month, manufacturing suffered its first contraction in China since the start of the pandemic and the government has mobilized massive resources to avoid any further slowdown.

Transitory inflation that’s here to stay

In our view, while these can look a lot like supply chain disruptions, their drivers are not temporary, but the result of policy choices made to achieve a more carbon-efficient economy. It is wishful thinking to see them dissipate and revert to pre-pandemic price levels for energy and commodities.

Put differently, decarbonizing our economies has a cost, the reason why this process was often pushed out (into the future?). The pandemic and an over-optimized inventory system have simply brought into light in an abrupt manner the reality of higher cost for living in a “greener” world and this is not a transitory phenomenon, unless governments walk away from their carbon commitments in response to the massive social costs.

While some of the price shock and pressure will likely subside, price increases are – at least in part -systemic. It is wise to be ready for a scenario of sustained inflation and possibly higher interest rates.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.