How much longer for the US Dollar bull run?

4 October 2022

The Autumn of Dangers

18 October 2022FX INSIGHT • 17 OCTOBER 2022

GBP: the Great British Problem?

Harry Woolman, Global Capital Markets Analyst

In my last note, I alluded to increasing volatility as it was, at the time, more pertinent to the eurozone (Certainly Uncertain: Factors Driving the Euro in the Coming Months). However, what I did not foresee was quite the rapidity at which volatility has climbed for GBP-denominated assets. We are all aware by now of the fiscal and monetary situation unfolding in the UK, but what is not so clear, is what the winter months hold for UK consumers and the possible impact on the pound.

Until now, more has been made of – and arguably rightly so – the energy outlook in mainland Europe, in large part due to the proximity of key stakeholders to the ongoing conflict in Ukraine. However, outperformance in its storage capacity, as well as the pivoting of supply chains away from Russia, stands the euro area in good stead for the winter, all things considered, and assuming no further deterioration.

Conversely, the UK’s situation is vastly more precarious; with gas storage capacity equating to just 1% of that of the EU – enough for four of five typical winter days’ demand. Furthermore, events on 20th July 2022, when the UK had to pay a 5000% premium for electricity from Belgium, suggest that British supply lines are largely beholden to robust energy flows with the continent. Cognisant of the upside risks posed to energy prices, Liz Truss spoke publicly on 6th October urging her European counterparts to “keep the lights on”. These concerns may go some way to explaining why the UK was one of the first major governments in Europe to introduce an energy price cap at £2500 annually, effectively underwriting an option with unlimited liability, should the winter be exceptionally harsh.

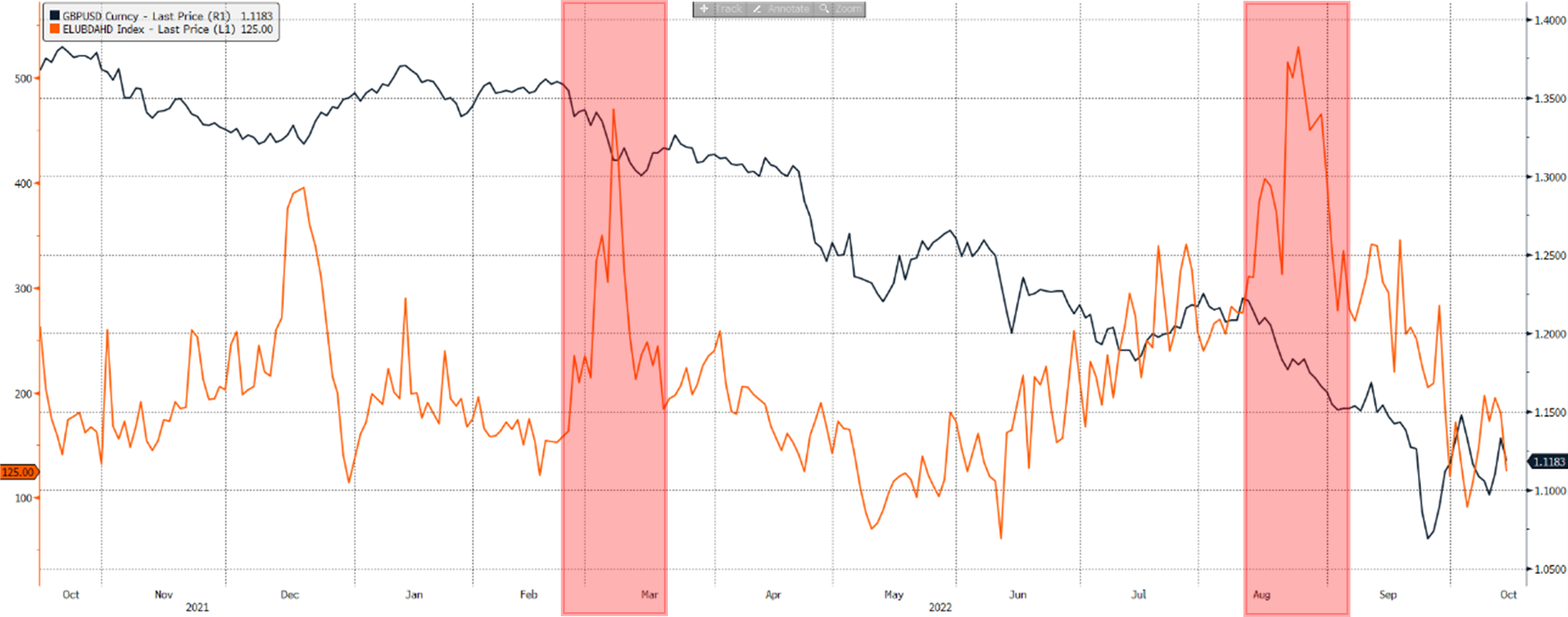

The pound has also fared badly commensurate with two energy shocks in the last year, as highlighted in the red bars below – Russia’s initial invasion of Ukraine at the end of February, and the ceasing of supply in Nord Stream 1 at the end of August. It was the former, initial shock, that ignited the fall is risk assets globally, with GBP one of the many victims against the dollar.

Chart 1: 1Y GBPUSD vs. UK day-ahead power prices

Source: Bloomberg

Adding fuel to the fire – pardon the pun – the ill-timed ‘mini-budget’ on 23rd September exacerbated the apprehension markets were clearly harbouring towards pro-risk assets, with myriad unfunded easing measures announced (although some have since been unwound). Consequently, volatility for GBP crosses has spiked; GBPUSD 12-month volatility has surpassed that seen at the onset of the pandemic, to highs last seen during the global financial crisis. Thus, capping liquidity risks for investors via optionality is that much more expensive. Notably, the pair also bottomed out at historic lows, just above 1.0300.

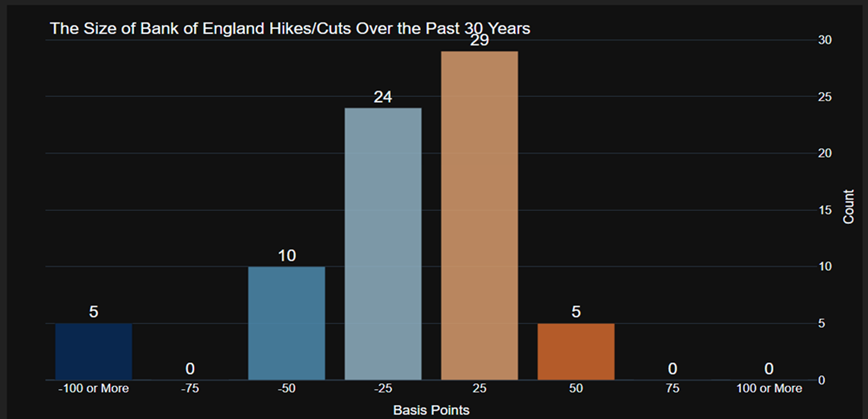

Conflicting fiscal and monetary policy has only aided these profound swings, which in turn have caused money markets to reprice their expectations of the Bank of England; a 100bps hike is fully priced-in for the MPC’s meeting on 3rd November, with the peak rate hovering just above 5.50% in Q2 2023. Such a move cannot be understated; in the last 30 years, the MPC has never hiked by more than 50bps – doing so on only five occasions.

Chart 2: The size of BoE hikes/ cuts over the past 30 years

Source: Bloomberg

In spite of the above, it’s not all bad news. We’ve long been proponents of traditional PPP theory, and current valuations for GBPUSD (-20.93% undervalued) suggest there is a long way for the pair to move higher – although the move will be far from linear. Equally, exogenous shock factors should not be ignored. Whilst unlikely at this stage, easing geopolitical tensions in Eastern Europe will provide a boon for risk assets via positive sentiment shifts, as well as more accessible supply chains.

Markets have clearly seen current pricing as a significant opportunity, either for heavily discounted GBP-denominated assets, or positioning accordingly for a strong move in either direction for the pound. In any case, CFTC data shows net GBP-long positions at their highest in a decade, with the bulk of that number driven by hedgers and reporting firms.

As risk managers, it is precisely times like these – when momentum appears to be moving in only one direction – when we need to be prepared for sudden and sizeable moves to the contrary. Ensuring adequate credit capacity with trading counterparties will be vital to avoid margin calls in the event of a notable bounce in GBP. Equally, having an expert advisor on hand to siphon through the noise at a time of extreme volatility, will no doubt pay dividends longer term.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.