Macro themes in 2023: A look at the UK, US, and EU landscapes

11 January 2023

The fate of the dollar, rates and inflation: Validus Risk Management outlines macro key risks for 2023

26 January 2023RISK INSIGHT • 17 JANUARY 2023

Is the downtrend in inflation enough for the Fed?

Ali Jaffari, Head of Capital Markets NA

Global inflation prints continue to make headlines as consumers and market participants closely follow the data in anticipation of 2023’s roadmap. Last week’s US inflation print of 6.5% (as measured by CPI YoY) came as no surprise to the market, with the figure in line with consensus—a positive signal indicating signs of easing. While current figures remain far from the Fed’s inflation target, investors will keep close watch as this pace of disinflationary moves—especially on services—could contemplate a shift in Fed policy.

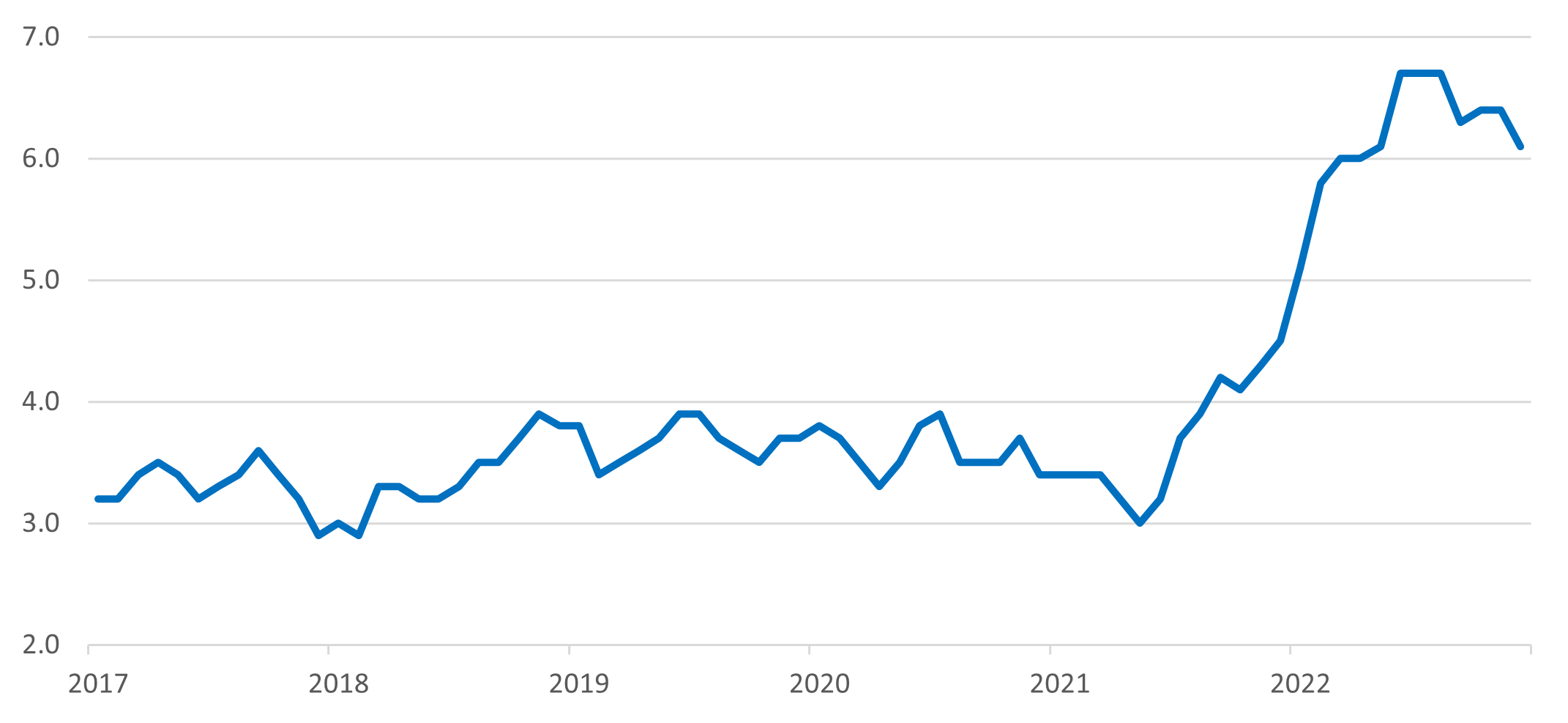

Following the Fed’s aggressive hiking cycle in 2022 to combat inflation, the data is starting to reflect some resolve as price pressures alleviate. Outside of core inflation metrics, a survey from the University of Michigan providing insight into household inflation expectations came in significantly lower than expected, with the 1Y forward looking view at 4% in January, down from 4.4% the month prior—its lowest since April 2021. Furthermore, the Atlanta Fed’s wage tracker, despite being elevated, shows consecutive prints of diminishing wage inflation (see Chart 1).

Chart 1: 3-Month Moving Average of Median US Wage Growth

Source: Federal Reserve Bank of Atlanta

With clear signs of moderating wage and consumer price pressures, the lagged effect of monetary policy is starting to surface. The market is now pricing in a lower magnitude hike of 25 bps—down from 50 bps—at the upcoming February 1st meeting, followed by an additional one or two hikes of 25 bps at subsequent meetings. Regardless of the quantum at the upcoming meeting, expect tightening measures to persist until inflation, wage growth and employment figures move closer to the Fed’s target.

Moderation of the recent inflation print was partly driven by a sharp reduction in energy, and particularly gas prices, followed by a slowdown in food prices. Shelter costs continue to remain elevated, placing upward pressure on inflation figures. Looking forward, it is unlikely that we will continue to get support from an outsized move in gas prices, meaning other categories will need to normalize for the downward trend in inflation to continue. Shelter costs and the services sector—which continues to rise monthly—are key areas to watch out for. A reversal could move the overall figure closer to the Fed’s goals.

The messaging from Fed speakers over the last week seems relatively in line with market expectations, with rate hikes persisting, albeit at a lower magnitude than previously predicted. Currently, the market is pricing in a terminal rate of 4.9% which implies approximately 60 bps of additional tightening. The key risk, however, is if rates surpass that range and continue trending higher on the back of a slower pace of declining inflation. As we get closer to the spring season, further data on services inflation, shelter costs and wage growth will highlight whether we’ve surpassed the peak and provide color on trend expectations.

Repricing the terminal rate higher will shift market dynamics and place upward pressure on front-end rates. The USD has been on a weakening trend since November 2022, with the broader trade weighted dollar index down over 9%. Having been less sensitive to shifts in near-term policy in recent months (and more so driven by market expectations of the neutral rate), support for the USD could emerge if the Fed maintains higher rates for longer and front-end yields surge.

Stay tuned for wage and inflation data along with relevant inflation components over the coming quarter. The end of the Fed’s hiking cycle will partly depend on the pace of moderation depicted in the data. Sound risk management practices are paramount in the face of the continued uncertainty and ensuing volatility.

Be the first to know

Subscribe to our newsletter to receive exclusive Validus Insights and industry updates.